This blog is written for small and medium-sized business owners, company directors, landlords and high earners who work with, or are thinking of working with, Total Books. The aim is straightforward:

- explain what the government is trying to do with this Budget,

- relate it to what happened in Autumn Budget 2024,

- show how it hits real businesses and households in the UK, and

- give you practical ideas for business planning, tax planning and savings strategy.

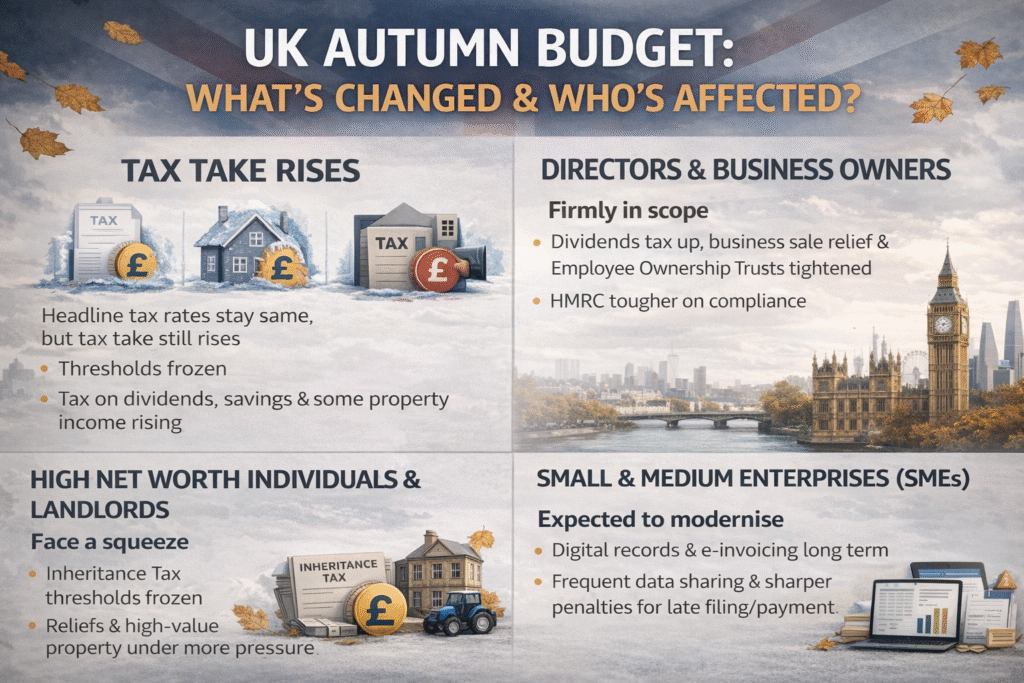

Quick summary: what’s changed and who’s affected?

Here’s the short version in plain English.

- Headline tax rates stay the same, but the tax take still rises. Income Tax, NIC and VAT rates aren’t going up, but thresholds are frozen and tax on dividends, savings and some property income is rising.

- Directors and business owners are firmly in scope. Dividend tax is increasing, reliefs on business sales and Employee Ownership Trusts are being tightened, and HMRC is getting tougher on compliance.

- High net worth individuals and landlords face a squeeze. Inheritance Tax thresholds are frozen, reliefs on business and agricultural assets are changing, and high-value property faces more pressure.

- SMEs are expected to modernise. There’s a long-term push towards digital records, e-invoicing, more frequent data sharing with HMRC and sharper penalties for late filing and payment.

To put this in context, remember that SMEs make up over 99% of businesses in the UK and around half of private sector turnover. For many of those firms, especially in professional services, construction and retail, average profit margins are often in the 10–20% range. A few extra percentage points of tax, or earlier payment dates, can feel like losing a month’s profit each year.

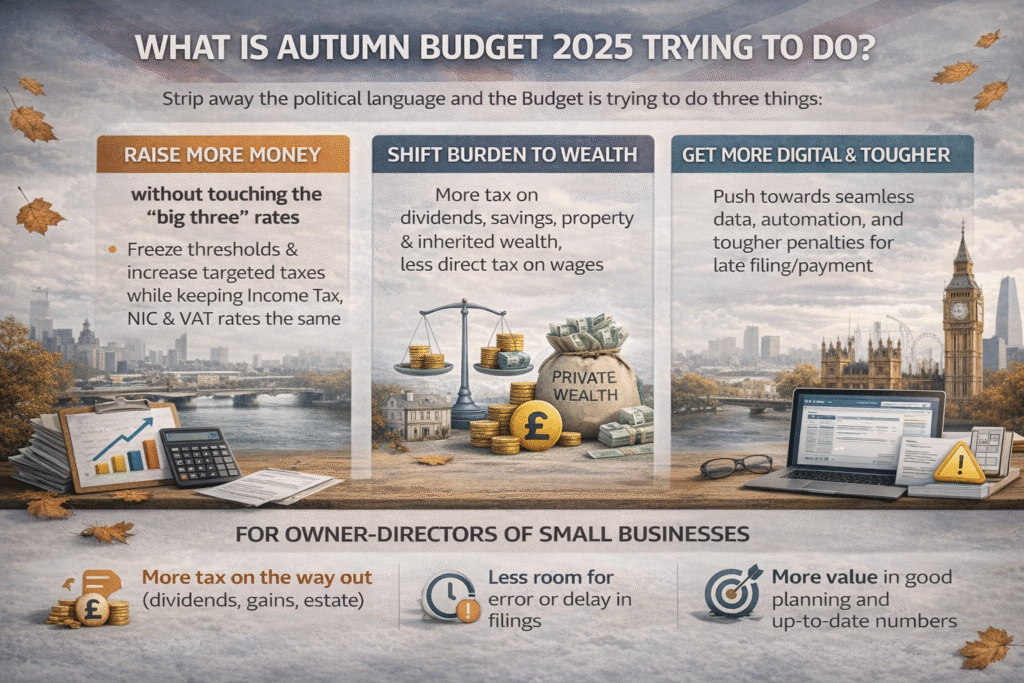

What is Autumn Budget 2025 trying to do?

Strip away the political language and the Budget is trying to do three things:

- Raise more money without touching the “big three” rates. The government has chosen to keep the main Income Tax, NIC and VAT rates where they are, and instead use freezes and targeted increases to draw in more revenue.

- Shift some of the burden from work to wealth. The direction is clear: more tax comes from dividends, savings, property, gains and inherited wealth, and less from direct changes to wages.

- Make the tax system more digital and harder to dodge. HMRC is moving towards more data, more automation and a tougher penalty regime.

For a typical Total Books client – say a limited company with £1–£10 million turnover and a small board of owner-directors – this combination means:

- more tax on the way out (dividends, gains, estate),

- less room for error or delay in filings, and

- more value in good planning and up-to-date numbers.

How does Autumn Budget 2025 fit with Autumn Budget 2024 and earlier policy?

What happened in Autumn Budget 2024?

Autumn Budget 2024 set the tone. It:

- Raised Capital Gains Tax on many assets, including business disposals.

- Announced higher special CGT rates for Business Asset Disposal Relief and Investors’ Relief over time.

- Started to tighten Inheritance Tax, with more focus on pensions, trusts and business/agricultural reliefs.

- Adjusted the employer National Insurance position, making staff costs higher for many larger businesses even as some smaller employers gained from an improved Employment Allowance.

- Began to replace the non-dom regime with a simpler, residence-based approach that brings long-term UK residents more firmly into the net.

For many business owners and high earners, 2024 was the year when the direction of travel became obvious: capital and long-term wealth were firmly under the spotlight.

What’s the big picture strategy now?

Autumn Budget 2025 doesn’t row back on any of that. Instead, it:

- Extends freezes on thresholds, so more income and more estates drift into higher effective tax.

- Increases tax on dividends, savings and some property income, nudging the system towards closer alignment between “work” and “wealth” income.

- Further reshapes reliefs and schemes that were widely used for exits and inheritance planning, such as EOTs and APR/BPR.

- Doubles down on digital compliance and enforcement.

For context, government statistics in recent years show that corporation tax, income tax and NIC from owner-managed businesses and higher earners make up a large and growing share of the tax base. The overall tax burden as a share of GDP has been trending upwards. This Budget continues that pattern.

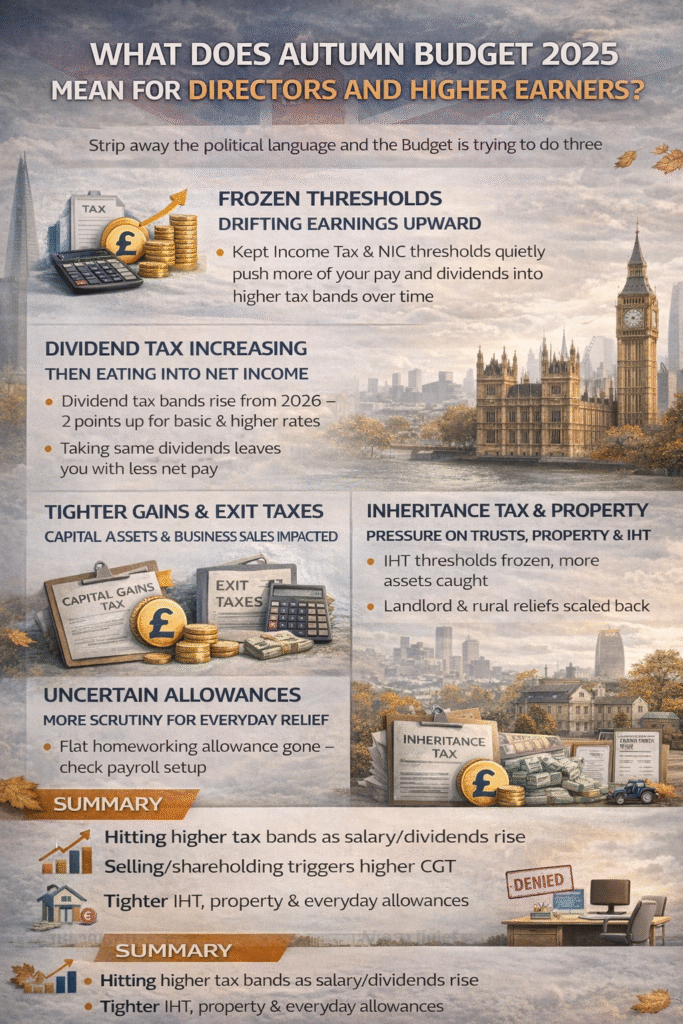

What does Autumn Budget 2025 mean for directors and higher earners?

This is where many of our clients feel the changes most directly.

Why frozen thresholds matter for your pay

Freezing Income Tax and NIC thresholds doesn’t sound dramatic, but it quietly moves more of your income into higher bands over time.

- As director salaries and bonuses rise with inflation, more income falls into the 40% and 45% bands.

- The same applies to dividend income layered on top of PAYE income.

- For households whose income is already in higher bands, the freeze often means a real-terms tax rise even if the headline rates don’t change.

Remember that average weekly earnings in the UK have been rising faster than some tax thresholds in recent years, so many professionals have already seen themselves drift into higher tax bands without feeling much richer. The new Budget continues that story.

What’s changing for dividend tax?

From April 2026, directors who rely on dividends will see rates increase:

- The basic-rate dividend tax band rises by 2 percentage points.

- The higher-rate band also rises by 2 points.

- The additional rate remains high by historic standards.

The dividend allowance itself remains small, so once you are above it the change bites quickly. For owner-managed companies this means:

- Taking the same dividend after 2026 leaves you with less net income.

- The old “minimum salary, everything else as dividends” model is no longer always the most efficient.

Most UK small and medium companies already use a salary-plus-dividends mix. The Budget simply makes it more important to run the numbers for your specific case rather than relying on rules of thumb.

What about savings and property income?

If you have significant savings outside ISAs and pensions, or a portfolio of rental properties, you’ll also see pressure from:

- Higher tax on savings income (interest) over the next few years.

- Higher tax on certain property income, particularly where you are already in higher bands and mortgage interest relief is restricted.

With Bank of England data showing that cash deposits and fixed-income holdings in the UK run into the hundreds of billions of pounds, even small percentage changes in tax rates translate into meaningful extra revenue for HMRC – and lower net returns for savers.

How are Capital Gains Tax and exits affected?

Capital Gains Tax rises from Autumn Budget 2024 are now part of the baseline, and 2025 builds on this by:

- Making Employee Ownership Trust (EOT) disposals less generous, with only part of the gain eligible for relief.

- Tightening anti-avoidance rules on share exchanges and reorganisations, making certain structures harder to use purely for tax advantage.

For directors and shareholders thinking about an exit:

- Selling shares, property or investments generally triggers a higher CGT bill than it would have a few years ago.

- Special reliefs such as BADR and Investors’ Relief still exist but no longer deliver ultra-low effective rates.

- EOTs remain a potential route for succession and staff ownership, but must be weighed against other exit options on a net-of-tax basis rather than assumed to be tax-free.

In the UK, over 99% of high-growth businesses are classed as SMEs, and many of their founders plan to use a future exit to fund retirement or other ventures. Against that backdrop, even a few percentage points of extra CGT can mean tens or hundreds of thousands of pounds less in your pocket on sale.

What’s happening with Inheritance Tax, trusts and property?

The Budget continues a longer trend of tightening Inheritance Tax:

- IHT thresholds are frozen for longer. As UK house prices and investment portfolios have grown over the last decade, more families have slipped into the IHT net. That trend continues.

- Business and agricultural property reliefs are being reshaped, with caps and clearer conditions, which matters for owners of trading companies, farms and rural estates.

- More attention is being paid to trusts and long-term UK residents, reducing the ability to keep large pools of wealth outside the UK system.

- High-value residential property faces extra local levies in future, adding to the existing mix of council tax, stamp duty and IHT.

For families in London and the South East in particular – where average house prices are significantly higher than the UK average – it’s increasingly common for “ordinary” professionals to brush up against IHT thresholds. That becomes even more likely when you add in business interests, pensions and investments.

What’s changing for homeworking and everyday allowances?

On a more day-to-day level:

- The flat-rate homeworking allowance that many employees claimed directly from HMRC is being withdrawn. Going forward, relief will mainly come from employers reimbursing genuine additional costs under the rules.

- Other small clarifications (such as payments for cancelled shifts being taxable income) tidy up the edges of the system.

For directors, it makes sense to make sure any home office arrangements – whether you’re claiming a portion of household costs or charging rent to the company – are structured and documented properly rather than relying on informal claims.

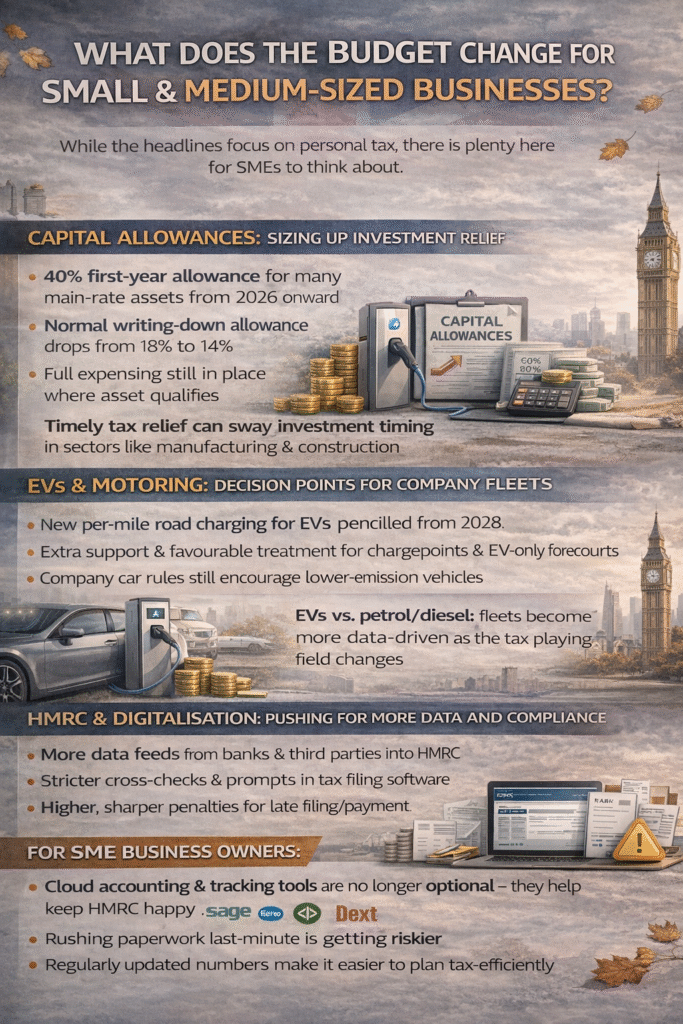

What does the Budget change for small and medium-sized businesses?

While the headlines focus on personal tax, there is plenty here for SMEs to think about.

How do the capital allowances changes affect investment decisions?

The government keeps the main Corporation Tax rate at 25% and continues to support full expensing for certain assets, but tweaks how other investment is relieved through:

- A new 40% first-year allowance (FYA) for many main-rate assets from 2026.

- A lower writing-down allowance (WDA) of 14% instead of 18% for main pool assets.

For a typical mid-sized firm – say, a manufacturing or engineering business in South Wales investing £300,000 in plant and machinery – this can change the timing of tax relief quite noticeably:

- Relying on full expensing still gives 100% in year one where available.

- Using the new 40% FYA plus WDAs gives a large chunk up front and a slower tail.

- Pure WDA at 14% is noticeably slower than the old 18%.

According to UK business population statistics, manufacturing and construction together account for over a million UK employees and a sizeable share of business investment each year. For these sectors in particular, the timing of relief can make the difference between going ahead with a project now or deferring it.

How are electric vehicles and motoring treated?

The Budget sets a clearer path for how electric vehicles (EVs) will be taxed over the rest of the decade:

- A new per-mile road charging system for EVs is pencilled in from 2028.

- There is extra support and favourable treatment for EV chargepoints and EV-only forecourts through business rates and capital allowances.

- Company car rules continue to encourage lower-emission vehicles.

For businesses with fleets – think of trades, logistics and field-based professional services – it’s becoming normal to:

- Run side-by-side comparisons of petrol, diesel and EVs over five to ten years, including purchase cost, fuel/charging, maintenance, and tax.

- Consider installing workplace charging, especially in urban areas where staff and clients increasingly expect it.

UK transport and storage businesses alone employ hundreds of thousands of people, and many are now baking EV decisions into their long-term capital plans. The tax system is clearly nudging in that direction.

What’s changing with HMRC, digitalisation and penalties?

One of the most important themes – especially if your bookkeeping isn’t as tidy as it could be – is the move towards:

- More frequent and detailed data feeds into HMRC from banks, payment providers and other third parties.

- Digital prompts and cross-checks inside tax filing software for VAT and Corporation Tax, designed to catch errors or omissions as you file.

- A future of standard electronic invoicing for VAT invoices, likely applying to millions of UK businesses once fully rolled out.

- Higher penalties for late filing and late payment, including Corporation Tax and VAT.

Given that there are around 5.5 million private sector businesses in the UK, and most of them are small, these changes are clearly aimed at nudging the whole SME base towards better digital records and on-time compliance.

For you, this means:

- Cloud accounting (Xero, QuickBooks, Sage) plus tools like Dext are no longer “nice extras” – they are part of staying on the right side of HMRC.

- Leaving accounts and returns until the last minute is becoming more expensive and riskier.

- There’s real value in monthly or quarterly management accounts rather than just a once-a-year scramble.

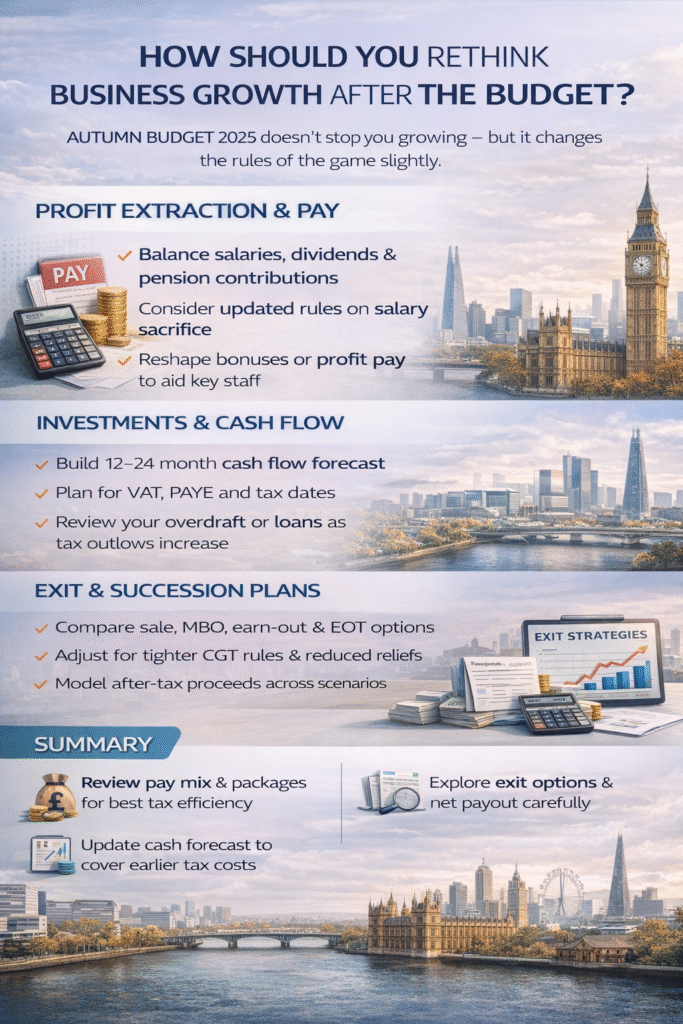

How should you rethink business growth after the Budget?

Autumn Budget 2025 doesn’t stop you growing – but it changes the rules of the game slightly.

How should you approach profit extraction and pay?

With dividend tax rising and thresholds frozen, it’s sensible to:

- Reassess the mix of salary, dividends and pension contributions for you and other directors.

- Factor in the future cap on NIC-efficient salary sacrifice to pensions.

- Consider whether bonuses or profit-related pay should be reshaped, especially if you want to help key staff with their own cost-of-living and tax pressures.

Many UK directors in SMEs have total pay packages in the £60,000–£150,000 range. At those levels, small tweaks in structure can easily save four or five figures a year in tax and NIC without doing anything aggressive – just by being thoughtful.

What about investment, borrowing and working capital?

With changes to capital allowances and a general move towards earlier tax collection, it’s worth:

- Building a rolling 12–24 month cash-flow forecast that includes:

- VAT and Corporation Tax dates

- PAYE payments

- Directors’ personal tax bills

- Planned capital expenditure and loan repayments

- Checking whether your overdrafts, term loans and invoice finance arrangements can comfortably absorb higher or earlier tax outflows.

UK bank lending to SMEs runs into tens of billions of pounds, and lenders are increasingly interested in businesses that can show clear forward projections rather than just historic accounts. A good forecast helps with bank conversations as much as with HMRC.

How does the Budget affect exit and succession planning?

If you’re thinking of selling or stepping back in the next five to ten years:

- Higher CGT and reduced reliefs mean you need to pay more attention to timing, buyer type and deal structure.

- It may be worth comparing:

- a straight trade sale,

- a management buy-out,

- a partial sale with earn-out, and

- an EOT route under the new rules.

- You’ll want to model your net-of-tax position in each scenario, not just look at the headline valuation.

A lot of UK owner-managers hope to use a business sale as their “second pension”. This Budget doesn’t remove that possibility, but it does mean that early planning is key if you want to keep more of the proceeds.

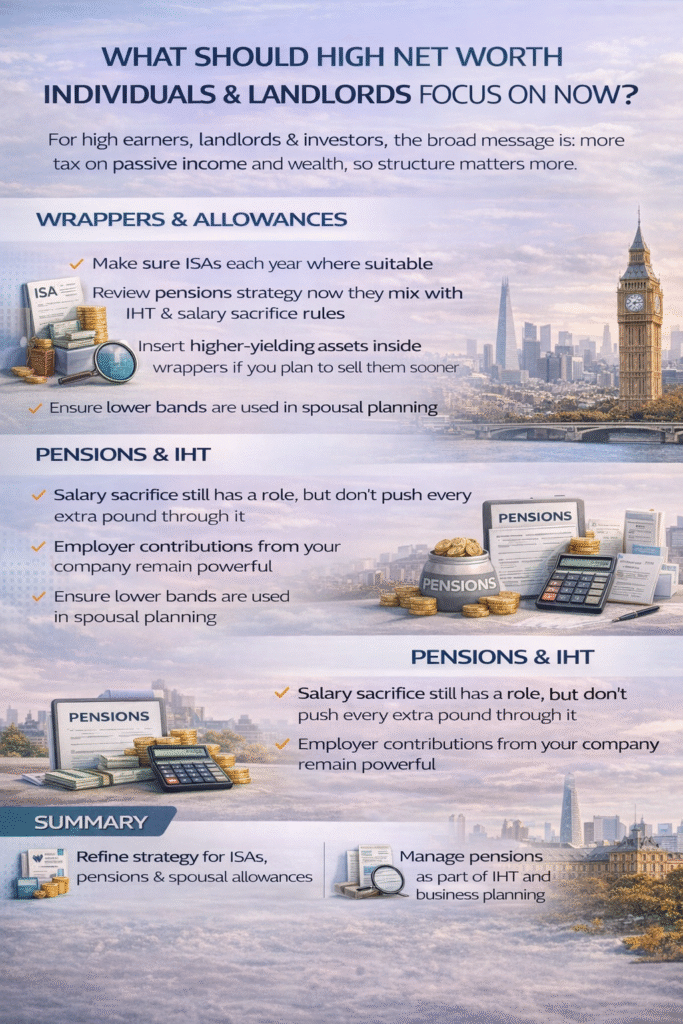

What should high net worth individuals and landlords focus on now?

For high earners, landlords and investors, the broad message is: more tax on passive income and wealth, so structure matters more.

How should you use wrappers and allowances?

With higher tax on dividends and savings income:

- Make sure you’re using ISA allowances fully each year where suitable.

- Review whether your pensions strategy still fits now that pensions are more entwined with IHT and salary sacrifice rules.

- Think carefully about which assets sit inside wrappers (for example, high-yield investments) and which stay outside (for example, certain long-term growth assets, depending on your plans).

- Use spousal planning where appropriate so both partners’ allowances and lower bands are used.

The UK has over 20 million ISA holders and millions of workplace pension members, so using these standard tools well can make more difference over time than any single Budget change.

How should you approach pensions under the new environment?

With tweaks to how NIC advantages work for salary sacrifice and more IHT exposure for some pension pots:

- Salary sacrifice still has a role, but you may want to avoid automatically pushing every extra pound through it.

- Employer contributions from company profits remain powerful if your business can afford them.

- Pensions should be looked at alongside IHT planning, not separately.

What about IHT, trusts and property structures?

If you have significant assets in:

- Trusts,

- Family investment companies,

- Offshore structures, or

- High-value residential or agricultural property,

then this is a good time to:

- Review how those structures sit under the new relief rules and residence tests.

- Check that UK reporting and accounts are fully up to date – HMRC is clearly gearing up to use data and penalties more assertively.

- Coordinate personal, business and estate planning rather than letting them run on separate tracks.

Practical checklist: actions to consider after Autumn Budget 2025

Here’s a simple starting checklist you can use in conversations with us.

For business owners and directors

- Review how you pay yourself (salary, dividends, pensions, bonuses) for the next three to five years.

- Map out your capital spending plans and see whether timing changes could help.

- Tighten your digital bookkeeping, making sure Xero/QuickBooks/Sage and Dext are used properly and reconciled regularly.

- Refresh your tax calendar and internal systems so filings and payments are done comfortably ahead of deadlines.

- Revisit your exit and succession plan, especially if you were counting on very generous CGT reliefs.

For high net worth individuals and landlords

- Build or update a long-term personal financial plan that includes your tax position under the new rules.

- Check your use of ISAs, pensions and family allowances.

- Re-examine your IHT exposure, wills, trusts and property structures against the updated reliefs and thresholds.

- Plan for higher tax on dividend, savings and property income, so you aren’t surprised when future bills land.

FAQs

Has Income Tax actually gone up?

The main Income Tax rates haven’t gone up, but many people will feel like they’re paying more because tax thresholds are frozen and tax on dividends and savings is rising.

Is it still worth paying myself mainly in dividends?

Dividends can still be tax-efficient, but the gap is narrower. For many director-owners, a mix of salary, dividends and employer pension contributions tailored to their situation now beats one simple rule for everyone.

Are business sales still attractive with higher CGT?

Yes, a well-planned sale can still be very worthwhile. But you now need to think more carefully about timing, deal structure and which reliefs realistically apply, rather than assuming a very low fixed rate.

Do I need to change anything if I or my staff work from home?

You may do. Employees will no longer be able to rely on the old flat-rate homeworking relief in the same way, so employers need to decide whether and how to reimburse additional costs and ensure any director home-office arrangements are properly structured.

Should I wait for the next Budget before doing anything?

Probably not. The broad direction is clear: more tax from wealth and investment, more digital compliance, more use of penalties. A good plan now can usually absorb future tweaks better than doing nothing and hoping for cuts.

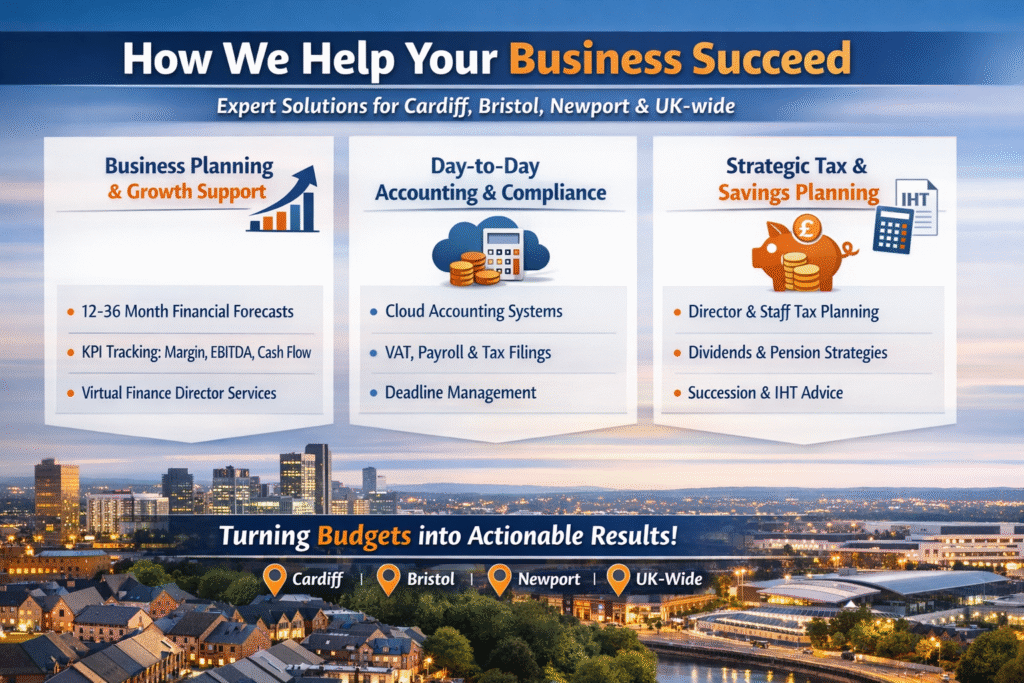

How Total Books helps with business planning, accounting and strategic tax planning

Autumn Budget 2025 underlines something we see daily at Total Books Accountants LTD:

It’s not the Budget itself that decides how well you do – it’s how you plan, respond and organise your finances around it.

Here’s how we help clients across Cardiff, Bristol, Newport and the wider UK turn these announcements into practical action.

Business planning and growth support

- We build 12–36 month financial forecasts so you can see how changes in tax, wages, interest rates and investment will affect cash and profit.

- We help set up and track key performance indicators (KPIs) such as gross margin, EBITDA, debtor days and working capital, so you can make decisions based on real numbers, not guesswork.

- Through our Virtual Finance Office and Virtual Finance Director services, we sit alongside you as part of the management team, not just as year-end accountants.

Day-to-day accounting and compliance

- We implement and maintain cloud accounting systems (Xero, QuickBooks, Sage) with tools like Dext to meet HMRC’s increasingly digital expectations.

- We manage VAT, payroll, Corporation Tax, CIS and Companies House filings, so deadlines are met and penalties are avoided.

- We design simple, robust finance processes so that even as you grow, your bookkeeping doesn’t fall behind.

Strategic tax and savings planning

- We carry out profit extraction reviews for directors, balancing salary, dividends and pensions under the latest rules.

- We support remuneration planning for key staff, helping you retain and motivate your team in a tax-aware way.

We work with you (and, where needed, your legal advisers) on company sales, succession planning, IHT exposure and long-term savings strategies, making sure the business, personal and family pieces fit together. Have a look at our Strategic Tax Planning service.

Accountants for Digital Marketing Agencies in The UK

Digital marketing agencies move fast, juggle retainers and project work, and often run on tight cash conversion cycles because payroll and freelancer costs land before client invoices are paid. This service page is for UK agency owners and directors who want clean bookkeeping, management accounts that actually explain performance, confident VAT and tax compliance, and a finance partner that helps you price profitably and scale without nasty surprises.

Accountants for Dentists in the UK

If you own or manage a dental practice, your numbers need to do more than tick a compliance box once a year. You need clean bookkeeping, reliable payroll, and tax planning that protects cash, plus reporting that helps you make decisions about associates, staffing, chair utilisation, equipment investment and future growth.

Accountants for Individual & Community Pharmacies in the UK

If you run an independent or community pharmacy, your accounting needs are not “standard SME”. You have regulated income streams, tight margins, staff-heavy operations, and decisions that can make or break cash flow month to month.

Accountants for High Net Worth Individuals in the UK

High net worth individuals in the UK are now firmly in HMRC’s sights, especially after the Autumn Budgets under the Labour government and the wider pressure on the UK’s public finances. Higher Capital Gains Tax (CGT) rates, frozen Inheritance Tax (IHT) thresholds and tighter rules around property and offshore structures all mean one thing: you need ongoing, joined-up tax planning – not just a yearly tax return.

Business Buy & Sell Consultancy | Total Books Accountants LTD

Buying or selling a UK business? Get expert valuation, financial and tax due diligence, SPA price mechanisms, VAT/TOGC planning and deal negotiation from Total Books (HMRC-authorised; Cardiff • Bristol • Newport). Book a free 15-minute consultation to start with.

Foreign Tax Consultancy for UK Residents | Total Books Accountants LTD

Overseas income, double tax relief, remittance basis, split-year rules or SRT? Speak to Buhir Rafiq MAAT (30+ years), HMRC-authorised agent at Total Books in Cardiff, Bristol & Newport. Book a free 15-minute consultation today.