This page explains what pharmacy-specific accounting support should look like in the UK, covering bookkeeping and management accounts, payroll and pensions, corporation tax and proactive tax planning, plus growth, exit planning and valuation. Total Books Accountants LTD helps pharmacy owners turn day-to-day numbers into clear decisions, while keeping compliance tidy and predictable.

Key takeaways

- Get clean, pharmacy-ready bookkeeping so your reports reflect reality, not end-of-year surprises.

- Run payroll and auto enrolment accurately for dispensers, technicians, counter staff and managers, with controls that reduce errors.

- Use corporation tax planning and director remuneration strategy to reduce avoidable tax and protect cash.

- Build monthly management accounts and cash flow forecasts that help you plan staffing, stock, and investment.

- Prepare early for growth, exit planning and valuation, so you stay in control of timing and negotiating strength.

How does Total Books support pharmacies day to day?

We support pharmacies by combining compliance, day-to-day finance operations, and strategic planning, so you are not forced to choose between “accounts done” and “business run well”.

Depending on what you need, we can provide:

- Outsourced bookkeeping with clean month-end routines

- Payroll and auto enrolment support with a reliable timetable

- Year-end accounts and corporation tax compliance that aligns with your reporting

- Tax planning meetings that turn uncertainty into a plan

- Management accounts with commentary, not just numbers

- Virtual Finance Office support if you want a full outsourced finance function

- Virtual Finance Director input when you need board-level decision support for growth, confirming affordability, or exit readiness

We deliver this using structured workflows, clear responsibilities, and cloud systems that keep your numbers current and accessible.

What makes pharmacy accounting different from typical small business accounting?

Pharmacy accounting is different because the business model is operationally complex and margin sensitive, so small errors in coding, stock, or payroll can distort your true profitability.

A pharmacy’s performance often hinges on:

- Staff costs and rota patterns

- Stock levels, expiry, shrinkage, and supplier terms

- Mix of income streams and timing of receipts

- Tight operational compliance and evidence trails

- Owner objectives, including buying, expanding, or selling

How do pharmacy income and payment timings affect bookkeeping and cash flow?

They affect it because pharmacy revenue can look stable while cash moves unevenly, so you need bookkeeping that separates profitability from cash timing.

In practice, pharmacy owners often ask:

- “Why are we busy but cash is tight?”

- “Are we actually making margin, or just turning stock?”

- “Can we afford another dispenser or a second branch?”

A good accounting setup will:

- Track income categories clearly so you can see what is driving profit

- Reconcile bank activity routinely so you trust the numbers

- Produce a cash view that explains timing gaps, not just totals

What does “good” pharmacy bookkeeping look like in practice?

Good pharmacy bookkeeping is consistent, timely, and structured to show margin, staff cost, and cash in a way that supports decisions, not just filing.

That usually means:

- A chart of accounts designed for pharmacy reporting, not generic categories

- Weekly bank reconciliation routines and exception checks

- Clear rules for coding merchant fees, delivery costs, IT subscriptions, and locum spend

- Proper treatment of owner transactions, so director drawings do not muddy the view

- Clean supporting documents so your year-end accounts and tax work are faster

Many pharmacies come to us with:

- “Suspense” or “miscellaneous” categories that hide margin issues

- Stock-related costs spread across random headings

- Owner payments mixed with wages or supplier payments

- Backlogs that make decisions impossible

Which reports should a pharmacy owner review monthly?

A pharmacy owner should review a short monthly pack that shows profitability, margin movement, staff cost, and cash, with commentary that explains what changed and what to do next.

A practical monthly pack typically includes:

- Profit and loss with comparative periods

- Gross margin and key cost lines explained

- Staff cost summary, including overtime patterns

- Cash position and near-term cash outlook

- Balance sheet basics, especially working capital movement

If you are planning growth or a sale, you also want:

- A rolling forecast

- A KPI dashboard that stays consistent month to month

- A simple actions tracker

How should payroll be managed for a pharmacy team?

Payroll should be managed with strict accuracy and repeatable processes because pharmacies often have varied roles, variable hours, overtime, statutory payments, and frequent starters and leavers.

A strong pharmacy payroll process will cover:

- Correct PAYE setup and ongoing submissions

- Clean handling of overtime, sick pay, maternity or paternity pay where relevant

- Consistent cut-off dates so payroll aligns with your accounts and reporting

- Proper leaver and starter processes

- Auto enrolment administration and pension contributions where applicable, aligned with Pensions Regulator expectations (handled without drama)

Where payroll goes wrong, it usually comes down to:

- Missing data and late changes

- Manual workarounds that create errors

- No clear approval path for hours and overtime

- Pension settings not checked routinely

How can pharmacy owners use tax planning to protect cash and reduce surprises?

Tax planning helps by making tax predictable and legal rather than reactive, so you can keep more cash available for staffing, refurbishment, technology, or acquisition opportunities.

For many pharmacy owners, the real questions are:

- “How do I pay myself tax efficiently?”

- “How do I avoid a year-end tax shock?”

- “How do I build personal wealth without starving the business?”

Practical tax planning for pharmacy owners often includes:

- Director remuneration planning, balancing salary and dividends within your wider goals

- Timing of expenses and investment with the financial year-end in mind

- Pension contribution planning as part of an overall strategy

- Making sure director loan accounts are monitored and controlled

- Aligning personal tax and company tax decisions so they do not conflict

We keep this grounded in real numbers, with a clear plan and documentation, so you are not guessing.

What does corporation tax planning look like for a pharmacy limited company?

Corporation tax planning means understanding your taxable profit early, then making sensible year-end decisions with time to act, not weeks after the year closes.

For pharmacies, the biggest corporation tax problems are usually:

- Profit swings hidden by messy bookkeeping

- Owner decisions made without knowing the tax effect

- Poor cut-offs and reconciliations that distort profit

- Lack of a plan for investment, staff changes, or branch expansion

A practical corporation tax rhythm looks like:

- Monthly or quarterly profit tracking

- A mid-year check-in to test whether results match the plan

- A pre-year-end planning meeting with action points

- Clean year-end records so final accounts and the corporation tax return process are smooth

We also help you connect corporation tax planning to:

- Cash flow forecasting

- Growth plans, including funding or acquisition readiness

- Exit planning and valuation narratives

What VAT and digital record-keeping issues do pharmacies need to stay on top of?

Pharmacies need VAT and digital record-keeping handled carefully because errors and inconsistent treatment can cause costly corrections and management distraction.

What we do in practice is:

- Review whether VAT registration is relevant to the actual business model

- Put consistent rules in place for VAT coding, where applicable

- Ensure digital record keeping processes are robust and scalable

- Set up reporting that helps you spot mistakes early rather than after a quarter ends

If you are already VAT registered, we focus on:

- Clean audit trails for transactions

- Consistent treatment of common cost types

- A workflow that supports Making Tax Digital expectations without turning your pharmacy into an admin centre

How do stock, shrinkage, expiry and supplier terms show up in the numbers?

They show up as margin leakage and cash drain, and if your accounts are not set up to reveal that, you can be busy while profitability quietly erodes.

In pharmacy accounting, stock is not just “a cost”. It is:

- A working capital commitment

- A risk area for expiry and shrinkage

- A major driver of margin accuracy

- A factor in valuation and sale readiness

We typically support pharmacies by:

- Setting up bookkeeping categories so stock-related costs are not scattered

- Helping you understand how supplier terms and payment runs affect cash

- Building reporting that highlights margin movement over time

- Reviewing stock adjustments and cut-offs so year-end figures are credible

Which KPIs matter most for pharmacy growth decisions?

The most useful KPIs are the ones that connect directly to staffing, margin, and cash, because those are the levers that keep a pharmacy stable while it grows.

Common pharmacy KPI themes include:

- Gross margin trend and variance drivers

- Staff cost as a percentage of revenue, with overtime visibility

- Net profit trend

- Cash runway and near-term cash commitments

- Working capital movement, especially stock and payables

If you are expanding, you also want:

- Forecast accuracy and variance tracking

- Site level reporting for multi-branch operations

- A view of “owner time” and operational bottlenecks

How can a pharmacy use forecasting to plan staffing, refurbishment, or acquisition?

Forecasting helps because it turns big decisions into numbers you can test, so you can see whether the plan is affordable before you commit.

A practical approach for pharmacies is:

- A short-term cash forecast that focuses on timing and commitments

- A rolling 12-month forecast for planning hires, pay rises, refurbishments, or a new site

- Scenario planning for best case, base case, and cautious case

We keep it simple enough to use, but robust enough to trust.

What does exit planning mean for a pharmacy owner?

Exit planning means making your pharmacy easier to sell, easier to value, and less risky for a buyer, while also ensuring your personal goals are clear and costed.

In practice, exit readiness often includes:

- Clean monthly reporting and a credible profit story

- Evidence that margin is stable and repeatable

- Clear separation of personal and business costs

- Proper documentation for owner pay decisions

- Systems and workflows that do not rely entirely on the owner

Exit planning is not only for “selling soon”. It also helps if you want:

- To bring in a partner

- To pass the business to family

- To reduce your hours and keep profits stable

- To buy another site and later sell as a stronger group

How does pharmacy valuation work and what numbers influence it most?

Pharmacy valuation is shaped by maintainable earnings, confidence in the numbers, and how transferable the business is without the owner.

While valuation methods vary, buyers and advisers typically look for:

- Profitability that is consistent and well evidenced

- Clear explanations for one-off items

- Stable gross margin and controlled staff costs

- Clean balance sheet and sensible working capital management

- Forecasts that are realistic and supported by past performance

Our role is to help you build a valuation story that stands up to scrutiny:

- The bookkeeping and monthly reporting supports your narrative

- The numbers reconcile cleanly to year-end accounts

- The business looks operationally and financially “ready”

What tools and systems keep pharmacy finance accurate and low effort?

The right tools reduce manual admin and create a cleaner audit trail, but only if the setup matches how the pharmacy actually operates.

A typical “low effort, high control” setup includes:

- Cloud accounting, commonly Xero, configured for pharmacy reporting

- Digital receipt capture and approval workflows

- Clear user access controls and review points

- Standardised month-end procedures so reporting is repeatable

We focus less on fancy dashboards and more on:

- One version of truth

- Fast close

- Reliable numbers for decision-making

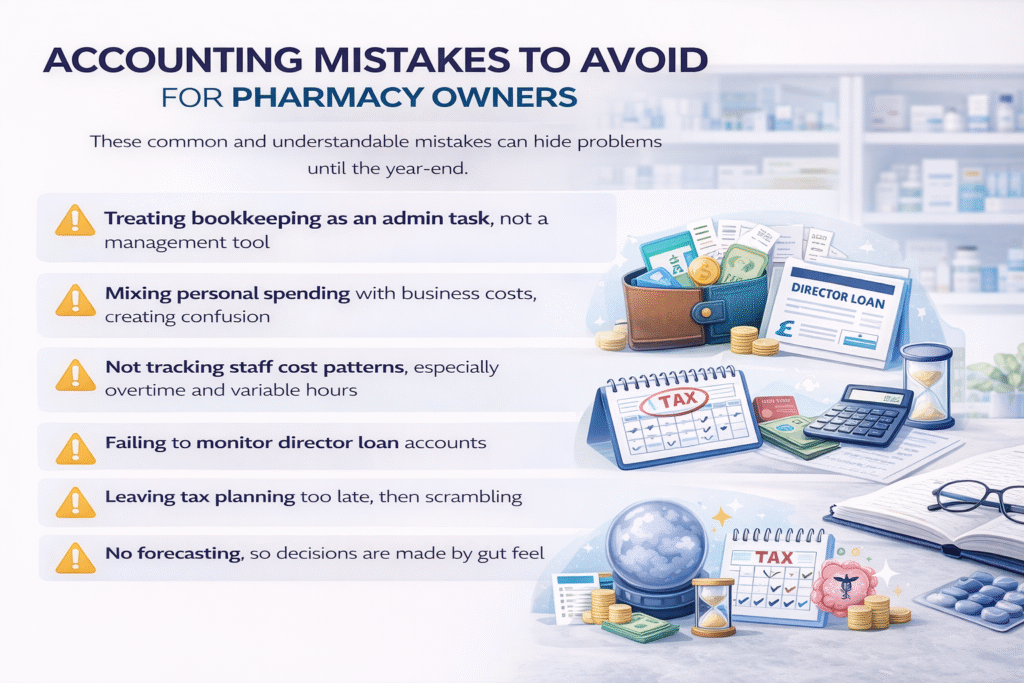

What mistakes do pharmacy owners commonly make with their accounts?

The most common mistakes are understandable, but costly, because they hide problems until the year-end.

We often see:

- Treating bookkeeping as an admin task, not a management tool

- Mixing personal spending with business costs, creating confusion

- Not tracking staff cost patterns, especially overtime and variable hours

- Failing to monitor director loan accounts

- Leaving tax planning too late, then scrambling

- No forecasting, so decisions are made by gut feel

How can an independent pharmacy scale without losing control?

An independent pharmacy can scale without losing control by making finance routines repeatable, then using monthly reporting and forecasting to guide staffing, stock, and investment.

Scaling safely often means:

- Standardising bookkeeping rules and reporting cadence

- Building a simple site-level reporting structure if you have more than one branch

- Introducing cash flow forecasting before you commit to hires or premises changes

- Turning tax planning into a scheduled part of the year, not an afterthought

How can a pharmacy get started with Total Books Accountants LTD?

You can get started by booking a free 15-minute strategy meeting, where we focus on your current setup, your pain points, and what “good” would look like for your pharmacy.

We typically cover:

- What you currently use for bookkeeping and payroll

- Whether reporting is timely enough to manage the business

- Where tax surprises are coming from, and how to prevent them

- Your growth or exit goals, and the numbers you need to track

- A clear scope for support, from compliance to Virtual Finance Director-level input

If you decide to move forward, we handle onboarding in a structured way so your pharmacy is not disrupted mid-month or mid-quarter.

FAQs

Do I need a specialist accountant for my pharmacy?

Yes—pharmacies have tight margins, stock complexity, and staff-heavy payroll. A pharmacy-focused accountant helps you stay compliant and get reporting you can actually use to run the business.

What accounting software do you support for UK pharmacies?

We support leading cloud systems (including Xero setups) and make sure the chart of accounts and reporting are tailored to pharmacy needs like margin tracking, staffing costs, and cash visibility.

Can you take over my pharmacy bookkeeping and month-end close?

Yes. We run a consistent bookkeeping rhythm (bank reconciliations, coding rules, and month-end checks) so your numbers are clean, timely, and ready for tax and management reporting.

Do you provide payroll for pharmacy teams (including variable hours)?

Yes. We run payroll with a clear timetable, accurate PAYE submissions, leavers/starters, statutory pay where applicable, and support for auto enrolment so payroll runs smoothly each month.

How do you help reduce corporation tax surprises?

We track results during the year and do proactive pre-year-end planning so you know what’s coming and can make informed decisions before the year closes—not after.

Can you help me pay myself tax-efficiently as a pharmacy owner?

Yes. We help you plan director remuneration (salary/dividends and wider tax planning considerations) based on your goals and cash needs, while keeping records clean and compliant.

Do you help with cash flow forecasting for pharmacies?

Yes. We build simple, practical cash flow forecasts so you can plan staffing, stock purchases, and investment with confidence—especially when cash timing doesn’t match workload.

Can you support me if I’m buying another pharmacy or opening a new branch?

Yes. We support growth planning with forecasting, scenario testing, and finance systems that scale, plus reporting that helps you compare performance across sites.

Can you help me prepare my pharmacy for sale (exit planning)?

Yes. We improve reporting quality, tidy owner costs, strengthen the “numbers story,” and help you get sale-ready well in advance so due diligence is smoother and negotiation is stronger.

Can you help with pharmacy valuation and understanding what my business is worth?

Yes. We help you understand the drivers of value (maintainable earnings, reliable reporting, and transferability) and present your figures in a way that supports a credible valuation.