Total Books Accountants LTD supports UK dentists with day-to-day accounting, corporation tax planning, management accounts, and Virtual Finance Director level support for expansion, exit planning and valuation.

Key takeaways

- Get bookkeeping that reflects how a dental practice actually works, including associates, lab fees, materials, and plan income.

- Run payroll accurately for nurses, reception, practice managers and clinicians, with PAYE and auto enrolment handled calmly and consistently.

- Reduce nasty surprises with corporation tax forecasting and year-end planning built into your reporting rhythm.

- Use monthly management accounts and cash flow forecasts to plan staffing, equipment purchases and opening hours with confidence.

- Prepare early for growth, sale readiness and valuation, so you stay in control of timing and negotiating strength.

How does Total Books support dentists beyond compliance?

We support dentists by combining compliance, finance operations, and strategic support, so your practice has a clear financial rhythm rather than a once-a-year scramble.

Depending on your needs, we can provide:

- Outsourced bookkeeping with tidy month-end routines

- Payroll and auto enrolment support

- Limited company accounts and

- Tax planning and remuneration support for owners

- Management accounts with commentary and actions

- Virtual Finance Office support as your outsourced finance team

- Virtual Finance Director support for growth, performance improvement, and decision-making

We work digitally across the UK and can support locally where helpful, including Cardiff, Bristol and Newport, using consistent processes and cloud systems such as Xero.

Why do dentists often need a specialist accountant rather than a general one?

Dentists often need a specialist accountant because practice finances have unique moving parts that can distort profit if they are not recorded consistently. The mix of NHS and private income, associate arrangements, lab bills, patient plans, and large equipment spend creates complexity that generic bookkeeping setups do not handle well.

A dentist-friendly finance setup should make it easy to answer questions like:

- Which chairs and sessions are most profitable?

- Are associate arrangements performing as expected once lab and materials are included?

- Is profit rising, or is cash simply being recycled through stock and expenses?

- Can we afford another clinician, extended hours, or a refurb?

What accounting problems do dental practices most commonly face?

The most common accounting problems in dental practices are inconsistent coding, weak month-end routines, and a lack of reporting that separates clinical performance from overheads. This usually leads to decisions made on gut feel rather than evidence.

We frequently see:

- Expenses lumped into generic categories that hide real cost drivers

- Associate costs and lab charges recorded inconsistently, which distorts margin

- Bank reconciliations done late, so the numbers are not trusted

- Owner drawings mixed with expenses, creating confusion and risk

- Tax planning left until after the year ends, which removes options

How should bookkeeping be structured for a dental practice?

Dental practice bookkeeping should be structured around clear income streams and controllable cost lines, with rules that make month-end closure quick and repeatable. The goal is a set of numbers that match how you run the practice.

A practical structure usually includes:

- Clear income categories, such as plan income, private fees, and other clinical income streams

- Separate visibility of key cost types, including lab fees, materials and consumables, software subscriptions, marketing, and premises costs

- Consistent treatment of clinical costs linked to associates or clinicians

- Clean separation of personal and business transactions for owners and directors

- A month-end close checklist so reporting does not drift

We also focus on evidence and process, so your record keeping stands up to scrutiny from HMRC when needed.

How do associate arrangements affect dental practice accounts and reporting?

Associate arrangements affect reporting because income and costs can be split in ways that are easy to misunderstand if bookkeeping is not set up properly. If associates are generating strong top-line revenue but lab or materials costs are being recorded loosely, you can misread performance and overestimate profitability.

A good reporting setup helps you:

- Understand contribution by clinician or session where practical

- Track lab costs and materials in a way that supports pricing decisions

- Review chair utilisation and overhead coverage

- Spot where discounts, write-offs or refunds are creeping in

This is not about making reporting complicated. It is about making it truthful.

What should a dentist review each month to stay in control?

A dentist should review a short monthly pack that highlights profitability, cash movement, and the main drivers of change, not a thick bundle of printouts. The point is to spot issues early and make decisions while you still have time to act.

A useful monthly pack often includes:

- Profit and loss with comparisons to prior periods

- Key overhead lines with commentary on changes

- Staff costs and trends, including overtime or rota changes

- Cash position and a near-term cash outlook

- Basic balance sheet checks for accuracy and risk signals

When you are growing or preparing to sell, we usually add:

- A rolling forecast

- A KPI dashboard with consistent definitions

- A simple actions log that turns numbers into next steps

How should payroll work in a dental practice with mixed roles and rotas?

How should payroll work in a dental practice with mixed roles and rotas?

Payroll should run on a consistent timetable with clean approvals, because dental teams often include varied roles, variable hours, and frequent staffing changes. A reliable payroll process reduces errors, protects trust, and improves financial forecasting.

We typically help practices manage:

- PAYE submissions and payroll processing

- Starters, leavers, and role changes

- Statutory payments where applicable

- Auto enrolment administration and pension contributions, aligned with the Pensions Regulator expectations in practice

- Payroll reporting that makes staffing costs visible, not mysterious

How can dentists reduce tax surprises with proactive planning?

Dentists reduce tax surprises by forecasting tax early, then aligning pay decisions, investment plans, and year-end actions to a clear plan. Most tax pain comes from leaving decisions too late.

Proactive planning often covers:

- Director remuneration planning for practice owners operating through a limited company

- Timing decisions for major purchases and repairs

- Keeping director loan accounts tidy and monitored

- Aligning personal and business decisions so they do not conflict

We keep this practical, documented, and consistent with HMRC expectations, without overcomplicating it.

What does corporation tax planning look like for a dental practice limited company?

Corporation tax planning means understanding your expected taxable profit during the year, then making year-end decisions with time to act. For dental practices, the risk is usually poor visibility rather than lack of profitability.

A sensible rhythm includes:

- Monthly or quarterly profit tracking

- A pre-year-end review meeting with clear options and actions

- Clean reconciliations so your final accounts are not a scramble

- A tax forecast that feeds into cash flow planning

This also supports your statutory compliance with Companies House, because a clean story across reporting and filings reduces risk and rework.

How do equipment purchases and refurbishments affect a dental practice’s numbers?

Equipment purchases and refurbishments affect your accounts, tax, and cash flow in different ways, and misunderstanding this is a common cause of stress. Cash leaves the bank immediately, but the accounting and tax treatment can follow a different pattern.

We help dentists plan investment by:

- Forecasting cash impact alongside profit impact

- Building a simple affordability model before commitments are made

- Ensuring records and evidence are clean for year-end work

- Making sure reporting reflects what is truly happening, not what was hoped

When does VAT become a risk area for dentists?

VAT becomes a risk area when the practice has mixed activity, particularly where some services may not be treated the same way. Many dental services are treated differently depending on the nature of the work, so assumptions can be risky.

Our approach is simple:

- Identify whether the practice has any VAT exposure

- Put consistent coding and evidence rules in place

- Review quarterly so mistakes do not compound

We also ensure your record keeping supports Making Tax Digital requirements where relevant, using tools and workflows that keep the audit trail clean.

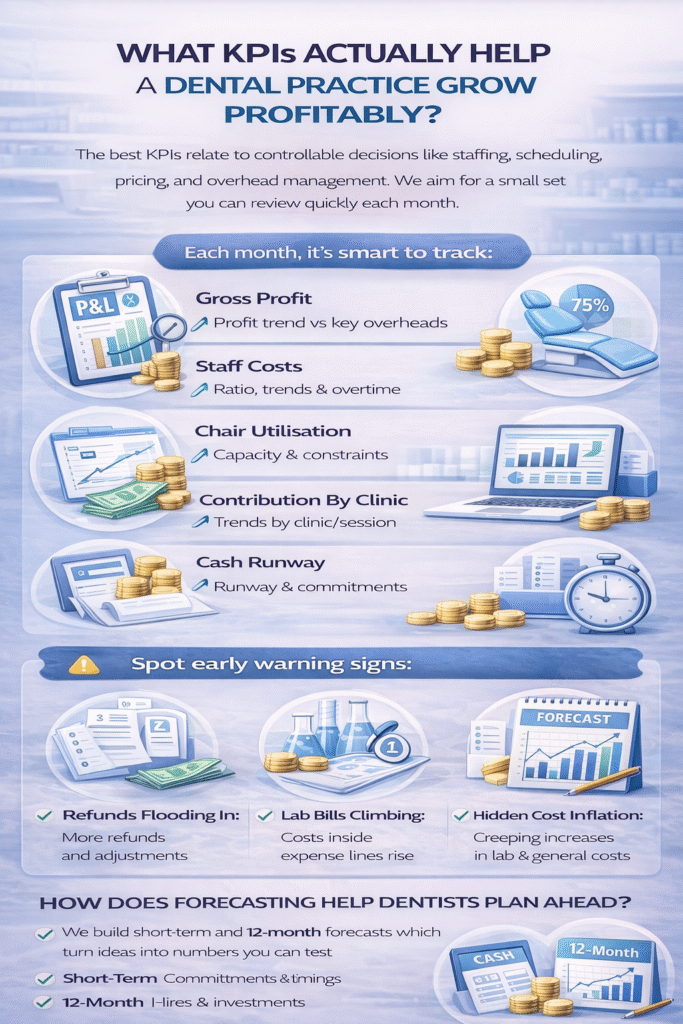

What KPIs actually help a dental practice grow profitably?

The best KPIs are the ones that connect to controllable decisions, such as staffing, scheduling, pricing, and overhead management. We aim for a small set you can review quickly each month.

Common KPI themes include:

- Gross profit and overhead coverage trend

- Staff cost ratio and overtime patterns

- Chair utilisation and capacity constraints

- Contribution trends by clinic or session where appropriate

- Cash runway and timing of major commitments

We also use reporting that helps you spot early warning signals, such as rising refunds, creeping lab costs, or cost inflation hidden inside general expense lines.

How can a dentist use forecasting to plan hiring, opening hours, or a second site?

Forecasting helps because it turns ideas into numbers you can test, so you can decide with confidence rather than hope. For most practices, two simple layers work well:

- A short-term cash forecast for timing and commitments

- A rolling 12-month forecast for hires, investment, and capacity changes

We also build scenarios, so you can answer:

- What if revenue holds steady but wages rise?

- What if a clinician reduces sessions?

- What if lab costs rise on a particular treatment mix?

What does exit planning look like for a dental practice owner?

Exit planning means making your practice easier to run, easier to value, and easier to sell, even if you are not selling this year. It is about reducing buyer risk and proving maintainable earnings.

Exit readiness typically involves:

- Consistent monthly reporting that supports the profit story

- Clear separation of owner benefits from business costs

- Clean processes that do not rely entirely on the owner

- A forecast that shows stability, not just ambition

- A tidy balance sheet and clear evidence trails

How is a dental practice valuation influenced by the numbers?

A valuation is influenced by maintainable earnings, confidence in the accounts, and how transferable the practice is without the owner. Buyers look for a credible story backed by consistent reporting.

We help you strengthen valuation drivers by:

- Producing management accounts that reconcile cleanly to year-end accounts

- Identifying and explaining one-off costs clearly

- Normalising owner costs in a way that supports maintainable earnings discussions

- Improving cash flow visibility so the practice looks professionally managed

We often frame valuation conversations around metrics like EBITDA and working capital movement, but always in plain English so the owner understands the levers.

How can a dental practice switch accountants without disruption?

A dental practice can switch accountants smoothly with a structured handover plan, clear cut-off dates, and a focus on quick wins that improve accuracy early. The goal is minimal disruption for the team and zero drama for the owner.

Our onboarding typically includes:

- Data access and workflow mapping

- A clean-up plan if records are behind

- A month-end close timetable and responsibilities

- A reporting pack design that fits how you make decisions

- A clear cadence for meetings and reviews

FAQs

Do I need a specialist accountant for my dental practice?

Yes—dentistry has unique income streams, associate arrangements, lab costs, and VAT considerations. A dental specialist helps you stay compliant and understand true profitability.

Can you manage bookkeeping for dentists and dental practices?

Yes. We run structured bookkeeping with monthly reconciliations and clean coding so your accounts are accurate, up to date, and ready for decision-making.

Do you provide payroll for dental practice staff?

Yes. We handle PAYE payroll for nurses, receptionists, managers and clinicians, including variable hours, statutory payments, and auto enrolment support.

How do you help reduce corporation tax surprises for dentists?

We track profit throughout the year and do pre-year-end planning so you know what to expect and can take action before the year closes.

Can you help me pay myself tax-efficiently as a dentist?

Yes. We help practice owners plan remuneration (salary/dividends and wider tax planning) based on your goals, cash needs, and compliance requirements.

Do you produce management accounts for dental practices?

Yes. We provide monthly management accounts that highlight profit drivers, overhead trends, staffing costs, and cash movement—so you can make faster decisions.

Can you help with cash flow forecasting for a dental practice?

Yes. We build practical cash flow forecasts so you can plan hiring, equipment purchases, refurbishments, and expansion without risking cash pressure.

Can you support associate payment reporting and margin analysis?

Yes. We structure reporting to reflect associate arrangements and key costs (like lab fees), helping you see contribution clearly and price with confidence.

Do dentists need VAT advice?

Sometimes. If your practice has mixed or changing services, VAT can become a risk area. We review your position and put consistent systems in place.

Can you help with dental practice exit planning and valuation?

Yes. We help you improve reporting, tidy records, normalise owner costs, and build a credible “numbers story” to support valuation and smoother due diligence.