Total Books Accountants LTD supports digital marketing agencies with outsourced bookkeeping, Xero cloud accounting, VAT returns, payroll, management reporting, and Virtual Finance Director support so you can see margin by client, control cash, and make better decisions month by month.

Key Takeaways

- Get clarity on true profitability with agency-specific reporting such as gross margin by client, utilisation, and delivery cost-to-serve.

- Reduce cash stress with a practical billing rhythm, WIP visibility, and a forecasting cadence that fits retainers and campaigns.

- Keep VAT and UK compliance tidy with cloud processes designed for fast-moving service businesses and recurring income.

- Build a scalable finance stack using Xero, receipt capture, and clean approval controls so growth does not create chaos.

- Use a Virtual Finance Office or Virtual Finance Director to turn “numbers” into pricing decisions, hiring plans, and profit improvement.

What does “accountants for digital marketing agencies” mean in practice?

It means your accountant understands how agencies actually make money and where margins disappear, then builds a finance setup that makes those drivers visible every month.

Many agencies look profitable on the surface because revenue is growing, but the real story sits in delivery costs, utilisation, scope creep, and timing differences between when you pay people and when clients pay you. A generic approach to accounting often misses the agency-specific patterns that matter, such as:

- Retainers billed monthly in advance or arrears

- Project milestones and change requests

- Contractor and freelancer-heavy delivery teams

- Ad spend and software subscriptions that blur into “overheads”

- Client concentration risk and pipeline volatility

- “Busy team, low profit” syndrome caused by poor pricing or delivery leakage

Why do digital marketing agencies need specialist bookkeeping and reporting?

Because agencies sell time, expertise, and outcomes, and that creates reporting needs that product businesses do not have.

For an agency, the most common “finance pain” is not a lack of data. It is data that does not answer the questions the director actually asks:

- Which clients are truly profitable after delivery time, freelancers, and tools?

- Are retainers priced properly for the work delivered?

- Are we hiring ahead of revenue or behind it?

- What is our runway if a top client churns?

- What costs are fixed, which are variable, and which are avoidable?

Specialist reporting focuses on the operational levers that drive profit, not just compliance.

How does Total Books support digital marketing agencies month to month?

We combine accurate day-to-day bookkeeping with a finance cadence that gives directors answers, not noise.

Total Books Accountants LTD supports agency clients through a blend of compliance, operational finance, and strategic support, depending on your stage.

You can expect coverage across:

- Outsourced bookkeeping: reconciliations, coding rules, clean ledgers

- Management accounts & reporting: monthly or quarterly reporting packs with commentary

- VAT and returns: registration support, VAT returns, process controls

- Payroll & Auto Enrolment: payslips, RTI workflow, ongoing admin

- Xero cloud accounting setup and optimisation: reporting structure built for agency KPIs

- Virtual Finance Office: a joined-up outsourced finance function

- Virtual Finance Director support: pricing, KPIs, cash strategy, hiring plans, scenario planning

We can work fully digitally across the UK, with support for clients in Cardiff, Bristol, Newport and beyond.

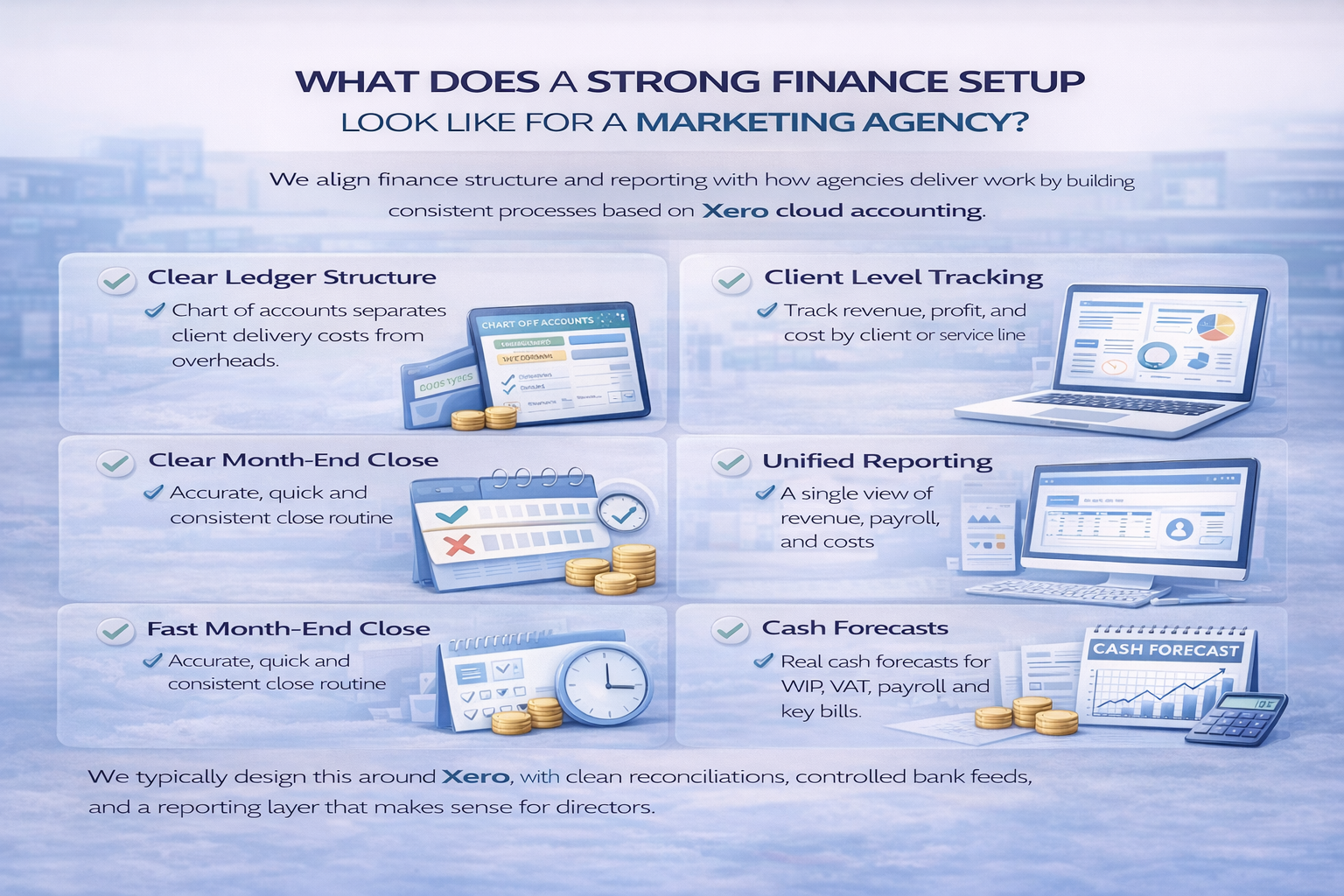

What does a strong finance setup look like for a marketing agency?

A strong setup is one where your ledger structure, processes, and reporting all align with how you deliver work.

For most agencies, “good finance” is not about complexity. It is about consistency and decision usefulness. That usually includes:

- A chart of accounts that separates delivery costs from overheads

- Tracking that allows you to view performance by client or service line

- Clear policies on what is rechargeable vs non-rechargeable

- A month-end close routine that does not drag into the middle of the next month

- A single version of truth for revenue, payroll, and costs

- Cash forecasting that ties to billing dates, payroll dates, and VAT timing

We typically design this around Xero, with clean reconciliations, controlled bank feeds, and a reporting layer that makes sense for directors.

How do we handle retainers, projects, and “messy” agency revenue?

We set up revenue categories and routines that reflect how you invoice, then ensure the reporting matches your commercial reality.

Agencies commonly have a mix of:

- Monthly retainers

- One-off projects

- Ongoing campaign management

- Set-up fees

- Performance incentives

- Recharges (software, travel, production costs)

The goal is to make sure your bookkeeping supports:

- Clear revenue recognition in management reporting

- Clean separation between delivery costs and overheads

- Visibility over WIP and unbilled work, where relevant

- Reliable client profitability views

We also help you build a rhythm where invoicing is predictable, debtors are monitored, and delivery teams are not “giving away” work without it showing up in the numbers.

Which agency KPIs should you expect your accountant to help you track?

Your accountant should help you track KPIs that connect finance to delivery, not just tax to filing.

The exact KPI set depends on your model, but common agency KPIs include:

- Gross margin (and gross margin by client where possible)

- Net profit margin and overhead ratio

- Utilisation and effective hourly rate signals (even if tracked outside the ledger)

- Monthly recurring revenue movement (new, expansion, churn)

- Debtor days and cash collection velocity

- Client concentration and top-client exposure

- Pipeline coverage vs capacity

- Cash runway and forecast variance

Management accounts should not be a pile of pages. It should be a director-friendly pack that tells you what changed and what to do next.

How do we improve cash flow for agencies without damaging client relationships?

We improve cash flow by tightening billing discipline, strengthening credit control tone, and using forecasting to prevent surprises.

Most agency cash stress comes from timing:

- Payroll and freelancer costs are predictable and frequent

- Client invoices can be slow, disputed, or delayed

- VAT can create a lumpier payment profile

- Growth adds payroll before revenue becomes stable

Cash improvements typically come from a few practical levers:

- Invoice promptly and consistently, aligned to retainer dates and milestones

- Reduce approval friction for billing and change requests

- Improve debtor follow-up with a calm, professional cadence

- Separate “recharge” costs so they are not silently absorbed

- Use a simple cash forecast that directors actually review

Where a Virtual Finance Office model is in place, we can also help you build an approval routine for payments and maintain cash visibility week by week.

How do VAT and compliance issues show up for marketing agencies?

They usually show up through inconsistent invoicing, poor record-keeping, or misunderstanding which costs are recharges vs overheads.

VAT can feel simple until an agency grows, adds international clients, or starts mixing services and recharges. The biggest risk is not “complex VAT theory”. It is process gaps, such as:

- Invoices raised late or with inconsistent descriptions

- VAT treatment not applied consistently across service lines

- Missing purchase evidence and weak expense capture

- Recharges not supported properly

- Multiple tools subscriptions booked inconsistently

We build routines that keep VAT reporting clean and supported by evidence. That includes digital record-keeping that supports Making Tax Digital expectations without creating admin overload. (MTD)

We also support year-end compliance and filings, including the deadlines and data flow between HMRC and Companies House, so your agency stays on top of obligations while you focus on delivery.

How should agencies account for freelancers, subcontractors, and payroll?

They should separate delivery labour from overheads, keep contracts and evidence tidy, and run payroll in a controlled, repeatable process.

Most agencies use a blend of:

- Employees on payroll

- Freelancers on invoices

- Specialist subcontractors for peaks or niche skills

From a reporting perspective, the key is clarity:

- Delivery team cost vs admin cost

- Direct client delivery costs vs general overheads

- Predictable payment routines that support cash forecasting

From a compliance and workflow perspective, payroll should be run with a consistent schedule, clear data inputs, and a tidy record of changes. Auto enrolment support should also be handled properly where applicable, with duties aligned to the Pensions Regulator.

What tools and systems support clean agency finance?

A small set of well-connected tools, used consistently, beats a complex stack that nobody follows.

For most agencies, the core building blocks are:

- Xero as the primary ledger

- Receipt capture and expense processing to keep evidence tidy

- A structured chart of accounts built for agency reporting

- Bank feeds with reconciliations done frequently, not “when we get time”

- A simple month-end close checklist so the same steps happen each month

- Management reporting outputs that directors can read in minutes

When appropriate, we also help agencies design roles and permissions so the right people can approve spend, raise invoices, and review key numbers without risking control gaps.

What mistakes do marketing agencies commonly make with accounting and tax?

They usually make the same few mistakes because the business is busy, not because the directors do not care.

Common agency pitfalls include:

- Treating revenue growth as profitability growth

- Not separating delivery costs from overheads, so gross margin is unclear

- Pricing without visibility of time cost and scope drift

- Invoicing late or inconsistently, causing cash flow pressure

- Leaving reconciliations until quarter-end, creating rework and errors

- Overloading “misc” and losing insight into where money is actually going

- Not building a regular finance rhythm, so decisions are made on gut feel

Total Books focuses on reducing these issues through cleaner workflows, clearer reporting, and a cadence that matches how agencies operate.

How does Total Books deliver this service in practice?

We follow a simple, structured process: get the numbers clean, make reporting useful, then support decisions with an ongoing cadence.

A typical engagement looks like this:

- Discovery and data access

We review your current bookkeeping, software, bank feeds, invoicing, and reporting needs. - Clean-up and structure

We tidy historic coding issues where needed and implement an agency-friendly ledger structure. - Monthly rhythm

We establish a timetable for reconciliations, invoicing checks, payroll inputs, and reporting outputs. - Management reporting and decision support

We deliver management accounts with commentary that highlights what changed and what it means. - Strategic support (optional)

For agencies scaling fast, a Virtual Finance Director layer helps with pricing, hiring plans, cash strategy, and scenario planning.

Who benefits most from working with Total Books as an agency accountant?

Agencies benefit most when they have momentum but feel strain in cash, reporting, or decision clarity.

This service is a strong fit if you are:

- A founder-led agency with recurring retainers and growing headcount

- A specialist performance agency with lots of software costs and contractor delivery

- A creative studio juggling project work and uneven billing milestones

- A multi-service agency that needs visibility by service line

- A director who wants faster month-end and less stress around tax deadlines

It is also a fit if you are planning a restructure, a hiring push, a new service line, or a push into bigger retainers and need confidence in margins.

How can a digital marketing agency get started with Total Books?

You can start with a short strategy call, then we map the quickest route to clean numbers and better decisions.

The simplest next step is to book a Free 15-Min Strategy Meeting. We will cover:

- What you sell and how you invoice

- What is working and what feels messy in finance

- Which reports you wish you had each month

- Whether you need bookkeeping clean-up, ongoing support, or a Virtual Finance layer

- The fastest path to clarity without disrupting delivery

If you are switching from another accountant, we keep it calm and structured so the handover does not derail your operations.

If you run a digital marketing agency and want clearer margins, calmer cash flow, and reporting you can act on, Total Books Accountants LTD can help you build a finance function that scales with your growth. Book a Free 15-Min Strategy Meeting and we will outline a practical plan to get your numbers clean, your reporting useful, and your decisions more confident.