Double Taxation Relief on foreign rental income is the UK tax mechanism that helps you avoid paying tax twice on the same overseas rental profit, and Total Books Accountants LTD can handle the UK reporting, the relief claim, and any disclosure work so you stay compliant and don’t overpay.

Total Books Accountants LTD operates from 3 offices in Cardiff, Bristol & Newport and offers UK nationwide services through digital onboarding and secured communication method, and Total Books is a Companies House and HMRC accredited accountancy firm led by Buhir Rafiq who has been in the UK accountancy for more than 30 years.

Key takeaways

- Double Taxation Relief usually works by giving you a credit for foreign tax paid against UK tax due on the same overseas rental profit.

- Relief is normally capped at the UK tax on that same slice of income, so you can still have UK tax to pay.

- You usually still need to report the overseas rental income on your UK Self Assessment even if you paid tax abroad.

- Your UK taxable profit is calculated using UK rules, not the foreign country’s rules, so the numbers rarely match your overseas return.

- Exchange rates, ownership splits, foreign tax timing, and evidence of foreign tax paid are the areas that most often cause mistakes.

- If you have missed years, you should fix it with the right disclosure route for your facts, not a rushed “one size fits all” submission.

Who this guide is for

This guide is for UK residents who rent out a property overseas and want a clear, practical understanding of how the UK taxes it and how relief for foreign tax usually works.

This guide is also for people who are internationally mobile, exposed to foreign tax, have dual ties, or have a complicated set-up like a joint ownership, an overseas mortgage, or an agent who withholds tax at source.

This guide is for landlords who want to get things right the first time, because a clean UK tax position is usually cheaper and less stressful than correcting it after HMRC asks questions.

What counts as foreign rental income for UK tax

Foreign rental income is rent and property-related receipts from land or buildings located outside the UK, reported to HMRC in pounds sterling.

Foreign rental income includes long-term lets, short lets, holiday lets, and rentals managed by an overseas agent, because the UK focuses on where the property sits rather than where you live or where the money lands.

Foreign rental income can include extra charges paid by tenants, like payments for utilities you recharge, cleaning fees in some short-let models, or payments for parking or storage, because HMRC looks at the wider rental business receipts, not just “monthly rent”.

Why the UK taxes foreign rental income at all

The UK taxes foreign rental income because UK residents are usually taxed on worldwide income, which includes overseas property profits.

The UK does not treat overseas property income as “someone else’s business” just because you filed abroad, because a foreign return and a UK return are separate compliance obligations.

The UK system expects you to declare the income and then claim the correct relief, rather than simply leaving the income off the return.

What Double Taxation Relief really means in practice

Double Taxation Relief means you can reduce the UK tax on your overseas rental profit by the foreign income tax you have already paid on that same profit.

Double Taxation Relief does not mean the UK ignores the income, because the normal route is to tax it under UK rules and then apply a credit for foreign tax paid.

Double Taxation Relief does not mean you can claim any overseas charge as a credit, because only certain types of foreign tax qualify and the relief is limited by UK tax rules.

The big rule landlords need to know: the cap

Double Taxation Relief is normally capped at the amount of UK tax due on the same overseas rental profit.

This cap matters because you can still pay UK tax if your UK tax rate is higher than the effective foreign tax rate.

This cap also matters when your UK taxable profit is higher than your overseas taxable profit, which happens often due to different expense rules and timing differences.

The two main routes to relief: treaty relief and unilateral relief

Relief is usually provided either under a double tax treaty or under unilateral relief rules when no treaty applies.

Treaty relief usually sets out which country can tax property income and how the UK should give relief, typically via a credit method.

Unilateral relief can still help when there is no treaty, because the UK may allow relief for foreign tax that is broadly comparable to UK income tax and genuinely charged on the same income.

Credit relief versus deduction: what’s the difference

Credit relief usually means you take the foreign tax paid and offset it against UK tax due on the same income, up to the UK cap.

Deduction treatment usually means you treat the foreign tax as an expense when calculating your UK taxable profit, which can sometimes help when a credit would be wasted.

You normally need to choose one method for the same item of income and apply it consistently, because mixing approaches on the same profit stream tends to create incorrect computations and weak audit trails.

Why your overseas tax return and your UK return don’t match

Your overseas tax return and your UK return don’t match because the UK uses UK tax rules for the profit calculation.

Your overseas tax system may allow deductions for depreciation or notional costs that the UK doesn’t allow in the same way.

Your overseas tax system may tax gross rent through withholding, while the UK expects a net profit computation with UK-allowable expenses.

Your overseas tax year may run on a calendar year basis, while the UK uses the tax year from 6 April to 5 April, which creates a timing split you have to manage properly.

How to calculate foreign rental profit under UK rules

Your UK foreign rental profit is your overseas rental income minus allowable expenses, converted into GBP.

Allowable expenses usually include agent fees, management fees, advertising, routine repairs, insurance, service charges you pay, cleaning costs in rental contexts, and other costs that are wholly and exclusively for the rental business.

Non-allowable items usually include capital improvements, the cost of buying the property, private travel, private use costs, and personal spending that isn’t genuinely for the rental business.

The key habit is to separate repairs from improvements, because repairs usually maintain the property’s existing condition while improvements add value or change the property.

Finance costs and overseas mortgages: why it can get tricky

Finance costs can be complex because UK tax rules for interest and related finance charges can operate differently from the overseas system.

Finance costs can affect the UK tax you pay, which then affects the relief cap, so a “small” mistake on interest treatment can create a “big” mistake in the relief calculation.

Finance costs can be different depending on whether you own the property personally, jointly, through a partnership, or through a company, so the structure matters.

The safe approach is to calculate the UK position first and then overlay the foreign tax credit, rather than guessing the credit and hoping the profit aligns.

Exchange rates and conversion: simple rules that prevent headaches

You must report foreign rental income and expenses in sterling, using a consistent conversion approach.

You should use a method that you can explain simply, such as converting individual transactions using the rate on the date paid or using a sensible average rate for the year and applying it consistently.

You should keep a small working paper that shows what rate you used and how you applied it, because that single page can save hours if HMRC ever asks.

You should avoid mixing conversion methods without a clear reason, because it makes reconciliations messy and creates numbers that don’t tie back to bank statements or agent statements.

Evidence: what you need to support a relief claim

You need evidence of rental income, expenses, and foreign tax suffered, because relief claims are only as strong as the supporting paperwork.

Good evidence usually includes letting agent statements, bank receipts, invoices for repairs and services, insurance documents, and official confirmation of foreign tax paid or withheld.

If foreign tax is withheld, you should keep withholding certificates, annual statements from the agent, or an official tax statement from the foreign authority.

If your documents are not in English, you don’t always need a formal translation for everything, but you do need a clear explanation of what the key documents show and how they tie to the numbers in your UK computation.

How the UK claim is recorded on Self Assessment

Foreign rental income is usually reported through the foreign income sections of your Self Assessment, with figures for income, allowable expenses, and foreign tax paid.

The UK return expects clarity, because HMRC wants to see what profit you calculated under UK rules and what foreign tax you are claiming as relief.

You should treat the return like a story that must make sense, because a return that reads cleanly reduces the chance of queries and reduces the time needed to respond if questions arise.

Worked example 1: foreign tax lower than UK tax

You pay UK top-up tax when the UK tax on the overseas rental profit is higher than the foreign tax paid.

Example: You have an overseas rental profit of £12,000 under UK rules. Your UK tax rate on that slice is 40%, so UK tax is £4,800. You paid foreign income tax of £1,500. Your credit is £1,500, so you still pay £3,300 to the UK on that profit.

The practical point is that you cannot “credit your way out” of UK tax if the foreign tax is genuinely lower, so the focus becomes correct expenses, correct ownership split, correct finance cost treatment, and a clean computation.

Worked example 2: foreign tax higher than UK tax

You usually cannot get a UK repayment just because the foreign tax was higher, because the credit is limited to the UK tax on the same income.

Example: Your overseas rental profit is £10,000 under UK rules. Your UK tax on that slice is 20%, so £2,000. You paid foreign tax of £3,500. Your relief is capped at £2,000, so the extra £1,500 is not typically recoverable through the UK relief claim.

The practical point is that if foreign tax looks unusually high, you may need foreign-side advice to check whether the tax was correctly charged, whether a reduced treaty rate should apply, or whether a reclaim is possible overseas.

Worked example 3: when a deduction approach can matter

Deduction treatment can be helpful when a credit would be wasted, because a credit cannot reduce UK tax below zero.

Example: Your overall UK position means your UK tax liability is already nil due to other losses and allowances, but you still have overseas rental profit and foreign tax paid. A credit may give you no immediate benefit. A deduction approach may reduce taxable income in a way that helps other parts of the calculation, depending on your full facts.

The practical point is that this is a modelling exercise, not a guess, because the better method depends on your whole-year UK position.

The situations landlords commonly face, with the best next step

Situation A: “I paid tax abroad so I assumed the UK doesn’t need it”

You still need to report overseas rental profit in the UK if you are taxable here, because the UK expects disclosure and then relief.

The next step is to build a UK-style profit computation and then match foreign tax to the same income period, so your relief claim is accurate and defendable.

The fastest fix is usually a structured review of income, expenses, and foreign tax evidence, rather than trying to mirror the overseas return.

Situation B: “My agent deducts tax from rent and I don’t understand it”

Withholding can still qualify as foreign tax suffered, but only if it’s a genuine income tax and you can evidence it.

The next step is to gather agent statements and any annual tax summary, then map withholding amounts to the UK tax year and the UK profit computation.

The best improvement you can make is to standardise your documentation, because withholding set-ups are notorious for scattered paperwork.

Situation C: “I own the property with my spouse or a family member”

Joint ownership means you usually report your share of the income and expenses, because UK reporting follows beneficial ownership.

The next step is to document the ownership split and ensure foreign tax is allocated in the same proportion, because relief is linked to the person who suffered the tax.

The biggest risk is claiming all the foreign tax on one return while splitting the income, because that tends to trigger incorrect relief figures.

Situation D: “The property is in my name but the rent goes into someone else’s account”

Income still belongs to the beneficial owner, not simply the bank account holder, so you need to reflect the legal and beneficial position.

The next step is to clarify ownership and control, then align bank flows and agent instructions with the correct tax reporting.

The practical fix often involves tidying the paper trail and making sure the rent route matches the ownership reality.

Situation E: “I’m not sure if I’m UK resident this year”

Residence is the first domino, because it affects whether the UK taxes worldwide income.

The next step is to analyse your travel days, ties, and where you actually live and work, then align that conclusion with how you file.

The worst approach is to assume you are non-resident without checking, because a wrong residence position can create multi-year compliance issues.

Situation F: “I missed years of overseas rental income”

Voluntary correction is usually safer than waiting, because HMRC can receive information from abroad and from financial institutions.

The next step is to identify which years are affected, reconstruct income and expenses, and choose the right disclosure route based on whether the issue is offshore income, UK income, or mixed.

The key is to act with control, because a well-prepared disclosure is generally cheaper and more predictable than a rushed response to an HMRC enquiry.

How disclosure fits when foreign rental income was not reported

A voluntary disclosure can be the right solution when you have undeclared overseas rental income, because it lets you correct past years in a structured way.

A disclosure strategy should match the type of income and where it arises, because offshore income issues can sit under different HMRC processes than onshore landlord disclosures.

A joined-up approach matters if you also have UK rental income, because you want one consistent story across all years and all properties.

What “good” looks like: a clean DTR claim in a simple pack

A good DTR claim is a UK profit computation that ties to evidence, plus a clear record of foreign tax paid that ties to the same profit period.

A good pack usually includes a one-page summary of the property, a rent schedule, an expense schedule, a foreign tax schedule, a currency conversion note, and copies of the key proof documents.

A good pack also includes explanations for differences, such as why your overseas tax return shows a different profit figure than the UK computation.

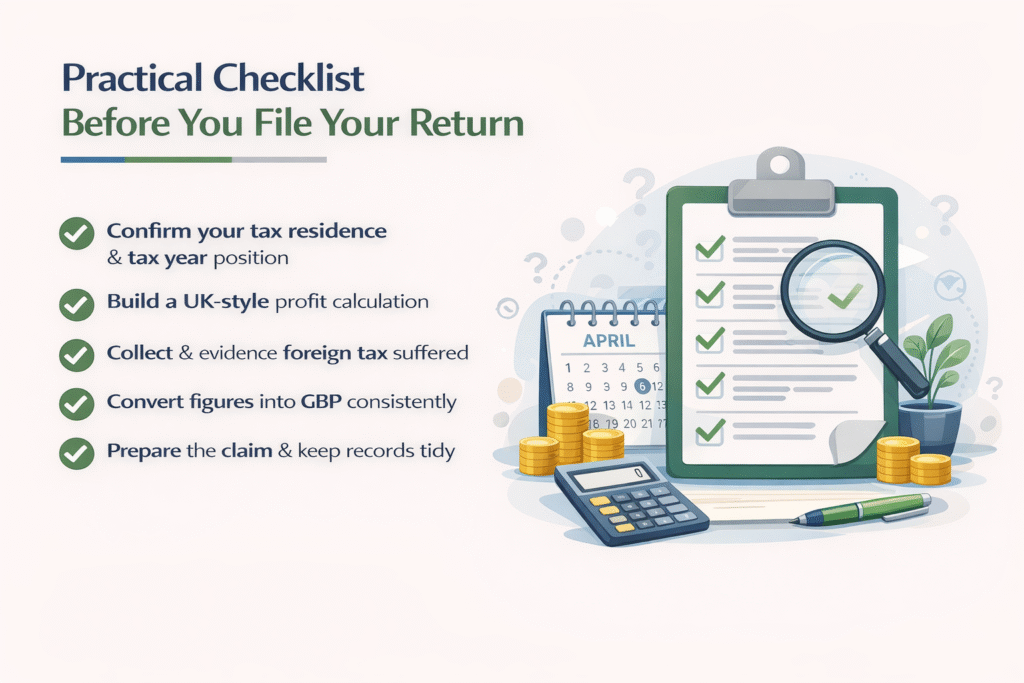

Practical checklist before you file your return

You should confirm your tax residence and the tax year position first, because it determines whether the income should be reported as taxable in the UK.

You should build a UK-style profit calculation second, because it sets the tax base that the UK uses.

You should collect and evidence foreign tax suffered third, because relief depends on what you can prove.

You should convert figures into GBP consistently fourth, because currency is where lots of hidden errors creep in.

You should prepare the claim and keep the pack tidy fifth, because future queries are easier when your records are clean.

Planning points that can reduce errors and tax leakage

You can reduce errors by keeping a monthly folder for the property, because a month-by-month system makes yearly totals easy and prevents missing invoices.

You can reduce tax leakage by ensuring you claim all UK-allowable expenses, because missing expenses inflates UK profit and can create unnecessary UK top-up tax.

You can reduce future stress by aligning agent statements and bank receipts, because mismatches are where HMRC questions tend to start.

You can reduce overpayment by reviewing whether the foreign tax was correctly charged and whether a reduced treaty rate should have applied, because an incorrect foreign withholding position can create wasted tax.

How Total Books Accountants LTD supports overseas landlords commercially

Total Books Accountants LTD supports overseas landlords by doing the end-to-end UK compliance work and making sure your Double Taxation Relief claim is correct, maximised, and defensible.

The typical value is saved time, reduced risk, and fewer surprises, because cross-border rental income has lots of moving parts that are easy to mis-handle if you’re doing it in the evenings with scattered statements.

The service is especially helpful when you have multiple years, multiple currencies, joint ownership, withholding taxes, or you’re unsure what you have already told HMRC, because those are the situations where small misunderstandings create large tax and penalty exposure.

FAQs

Do I still need to tell HMRC about foreign rental income if I pay tax overseas?

Yes, you normally still need to report foreign rental income on your UK return if you are within the UK tax net for that year, because the UK approach is usually to tax the income and then give relief for foreign tax suffered. The key is that reporting and relief are linked, so leaving the income off the return can remove your ability to claim relief properly and can create a compliance issue. A correct UK computation also matters because the UK profit figure often differs from the overseas taxable profit.

Will Double Taxation Relief always eliminate my UK tax on the overseas rent?

No, Double Taxation Relief does not always eliminate UK tax because relief is usually capped at the UK tax on the same slice of income and depends on the foreign tax suffered. If the foreign tax rate is lower than your UK tax rate, or if the UK profit calculation is higher than the foreign profit calculation, you can still pay UK top-up tax. The right focus is accurate UK profit, correct evidence of foreign tax, and correct allocation of income and tax between owners.

What if foreign tax is withheld from my rent and I never file a foreign tax return abroad?

Withholding tax can still be foreign tax suffered, but you need to prove it and you need to show it relates to your rental income. In many countries, withholding is a prepayment rather than the final tax, which means you may still need a foreign filing to finalise the position and get proper documentation. From a UK perspective, the best approach is to gather agent statements and any official withholding documentation and then map the amounts to the UK tax year and the UK profit computation.

Can I claim relief for overseas property taxes or municipal charges as well as income tax?

Not every overseas charge counts as foreign tax for UK relief, because the relief is usually aimed at income-type taxes rather than property ownership taxes or transaction-style charges. Some jurisdictions have charges that look like income tax and others that are more like local levies, and the label on the bill isn’t always decisive. The safe approach is to separate income taxes from other charges, claim credit relief only where it is properly admissible, and treat non-creditable amounts as expenses only if they meet UK deductibility rules.

My overseas accountant says my profit is one figure, but my UK accountant says it’s different. Which is right?

Both can be right in their own systems, because different countries have different rules on what counts as an allowable expense, how depreciation is treated, and how timing is recognised. The UK taxable profit for your UK return must be calculated using UK rules, and that figure is the one that drives your UK tax and the relief cap. The practical solution is to keep a clear bridge that shows how the overseas figures translate into the UK computation, so the differences are explainable and supported by evidence.

I’ve missed a few years of foreign rental income on my UK tax returns. Should I just amend the returns?

You should correct it in the right way for your situation, because sometimes amendments are appropriate and sometimes a formal disclosure route is more suitable depending on the years involved, the type of income, and whether there are other issues like UK property income or other offshore income. The safest approach is to first map out which years are affected, reconstruct the figures with evidence, and then choose a correction method that keeps your position consistent and minimises penalties. Doing it with a plan is usually cheaper than doing it in a panic.

Does joint ownership affect Double Taxation Relief?

Yes, joint ownership affects both the profit and the relief, because each owner generally reports their share of income and expenses and claims relief for the share of foreign tax they suffered. Problems often occur when one owner claims all the foreign tax while the income is split, or when the ownership split used overseas does not match the beneficial ownership position in the UK. The clean approach is to document ownership, allocate income and expenses consistently, and keep evidence that shows how foreign tax was paid or withheld in relation to each owner.

How do exchange rates affect my reported rental income and the relief claim?

Exchange rates affect everything because both income and expenses must be reported in sterling, and foreign tax paid also needs to be converted to pounds. If you convert rent using one method and expenses using another without a clear approach, your totals can become hard to reconcile and your claim can look unreliable. The practical answer is to pick a reasonable conversion method, apply it consistently, and keep a small conversion note that shows the rates used. That single step makes your UK reporting far more robust.

Can Double Taxation Relief apply if there is no tax treaty between the UK and the country where my property is located?

Relief can still be available in many cases even without a treaty, because the UK may allow relief under unilateral rules where the foreign tax is a genuine tax on income and relates to the same profit that the UK taxes. The detail matters, because the nature of the tax and the evidence you have will drive whether the claim is acceptable. If the country’s tax system is unusual, or the charge is not clearly an income tax, it is worth getting a professional review before you assume the relief works like a standard treaty credit.

What is the single biggest mistake landlords make with foreign rental income?

The biggest mistake is assuming that “tax paid abroad means nothing to do in the UK” and then leaving the income off the UK return, because that can create compliance risk and can also cause you to lose control over the relief position. The second biggest mistake is copying the overseas profit figure into the UK return without recalculating under UK rules, because that can overstate profit, understate expenses, and distort the credit relief cap. A structured UK computation with proper evidence is usually the simplest fix.