Key takeaways

- Decision-first board packs keep directors focused on options, risks and actions, not just historic variances.

- A five-part core works best: executive summary, KPI dashboard, cash and runway, decision papers, action log.

- Clear commentary links movements to causes, owners and next steps within 30, 60 and 90 days.

- Consistent KPIs and visuals create one version of truth and faster debate across meetings.

- A Virtual Finance Office standardises data, automates production and facilitates decision forums with your board.

What does effective board reporting mean for UK medium businesses?

Effective board reporting gives directors an accurate, forward-looking view and a small set of decisions to make now. It translates numbers into a narrative of performance, risk and opportunity, then sets owners and deadlines. For a medium-sized company with multiple revenue streams, sites and teams, the board pack is the lens through which the board understands reality and exercises good governance.

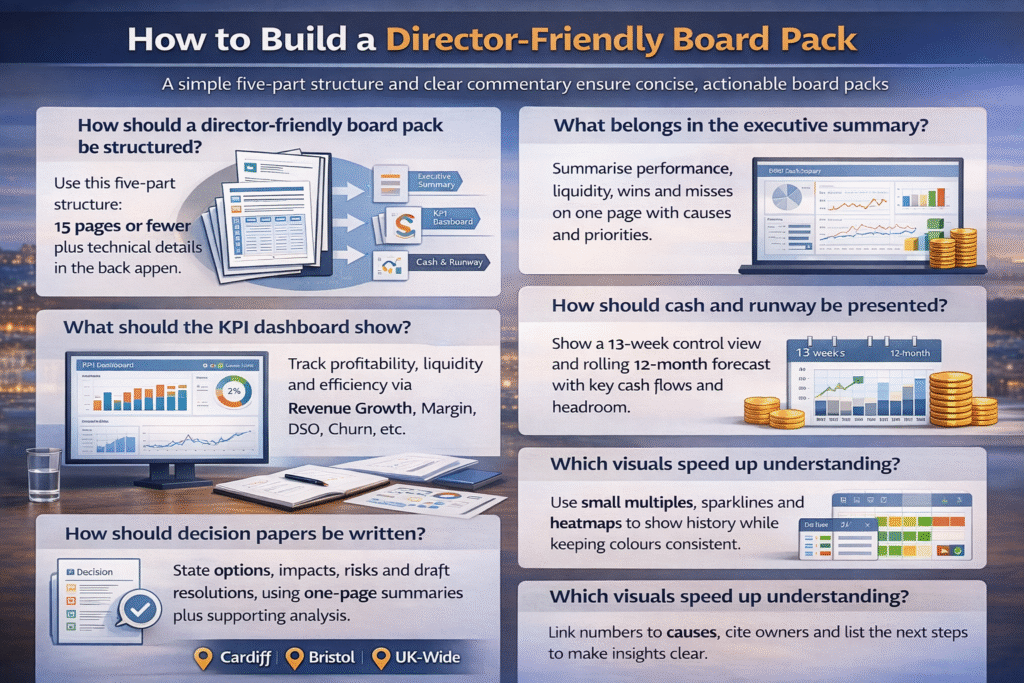

How should a director-friendly board pack be structured?

A simple five-part structure works in most sectors: an executive summary, a KPI dashboard, a cash and runway section, decision papers, and an action and risks log. Keep the core to 15 pages or fewer and put technical appendices at the back for those who want detail. Consistency across meetings is more valuable than novelty.

What belongs in the executive summary?

The executive summary gives an at a glance verdict on performance, liquidity and delivery against plan. It highlights wins, misses and three to five priorities for the next period. It should include a single page that shows year to date against budget, last year and rolling 12 months, with commentary that states cause and consequence before the board asks.

What should the KPI dashboard show?

The KPI dashboard shows profitability, liquidity and efficiency through a small set of standard metrics with targets. At minimum include revenue growth, gross margin, operating margin or EBITDA, cash conversion, DSO, stock turns where relevant, on time delivery and churn or retention if subscription based. Show three to six months history, a target band and a red amber green status.

How should cash and runway be presented?

Show a 13 week cash view for operational control and a rolling 12 month forecast for planning. Surface headroom to facilities, covenant headroom if applicable, and cash drivers such as receipts, payroll and capex. State the assumed payment and collection rhythms. Where there is risk of a dip, show mitigations and triggers ahead of time.

How should decision papers be written?

Each decision paper states the decision, options, quantified impacts, risks and a recommendation. Use one page summaries followed by two to four pages of analysis. If scenarios are used, keep to base, best and downside with clear triggers for switching. End with a draft resolution for the board to adopt or amend.

How do you keep commentary readable and useful?

Write commentary that links variance to causes, names owners and lists the next action. Keep sentences short. Avoid jargon. Avoid repeating the chart. Use the pattern: what moved, why it moved, whether it is temporary or structural, what you will do next and by when. State any support needed from the board.

Which visuals speed up understanding?

Use small multiples for trends, heatmaps for performance by product or site, and sparklines inside tables for compact history. Keep colours consistent across months. Use traffic lights sparingly so red really means attention. Always align decimals and units to remove cognitive friction.

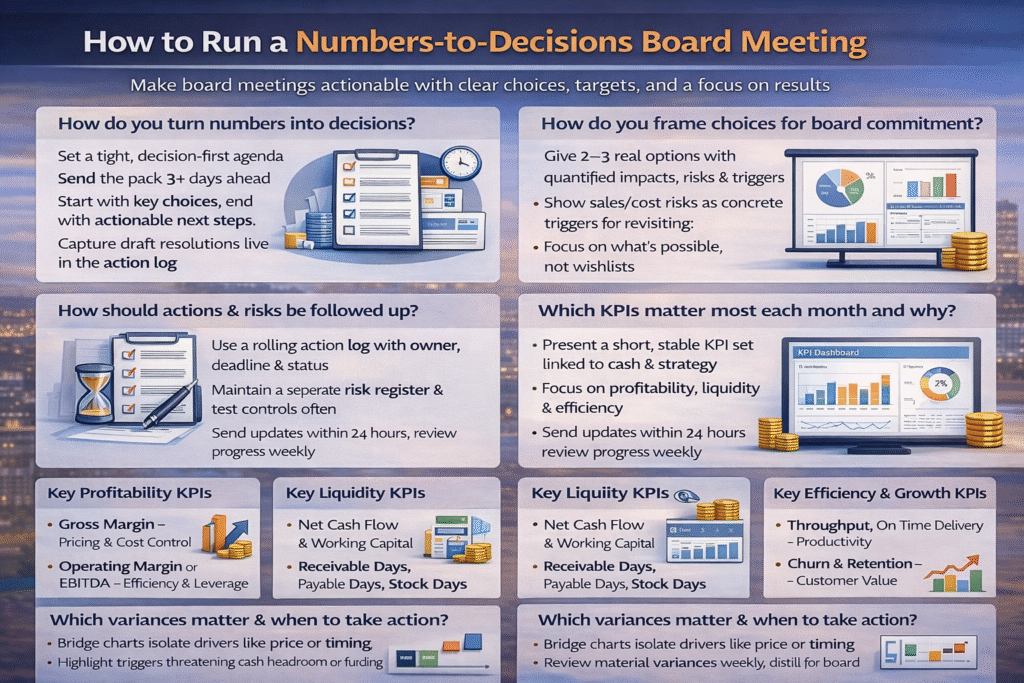

How do you run a meeting that turns numbers into decisions?

Set a tight agenda with time boxes, start with decisions and reserve the last 15 minutes for the action and risks log. Send the pack at least three clear days before the meeting and do not add last minute slides. During the meeting, move to a draft resolution as soon as options are clear and capture the wording live in the action log.

How do you frame choices so the board can commit?

Present two or three real options with quantified impacts and risks, not a menu of possibilities. Show sensitivity to the drivers that matter most. If the recommendation depends on hitting a sales or cost assumption, show the trigger that will cause a revisit.

How should actions be captured and followed up?

Use a rolling action log with fields for owner, due date, status and evidence. Review the previous log at the start, not the end, to close loops. Keep a separate register for strategic risks with controls and test dates. Publish both within 24 hours of the meeting and update progress weekly in management meetings.

Which KPIs matter most each month and why?

The board should see a short, stable list of KPIs that connect to strategy and cash. Profitability shows whether the model works, liquidity shows whether the business can continue paying commitments, and efficiency shows whether capacity is turning into value. Tie each KPI to an owner and target range, not a single point.

Which profitability KPIs should directors track?

Track gross margin to see pricing and cost discipline, operating margin or EBITDA to see overhead absorption and operating leverage, and profit per customer or per project for granular control. Where pricing power is strategic, add win rate and average selling price to the pack.

Which liquidity KPIs should directors track?

Track net cash movement, headroom to facilities and working capital components such as receivable days, payable days and stock days where relevant. Where lenders set covenants, include the covenant calculation and headroom. Trend lines are more informative than a single period.

Which efficiency and growth KPIs help boards steer?

Track throughput or utilisation in services, on time delivery and rework in operations, churn, retention and lifetime value in subscription models. Include pipeline quality if growth depends on capacity expansion. Keep definitions in a data dictionary so numbers remain comparable across months.

How should variance analysis lead to action rather than excuses?

Good variance analysis isolates drivers, quantifies their effect and names corrective actions. Use a bridge chart to show movement from budget or last year to actual, with blocks for price, volume, mix, timing and one off items. Close with a short plan that lists owner, action, expected impact and the date by which the board will see the effect.

What is the best cadence for reviewing variances?

Review material variances weekly in management meetings to avoid surprises and present the distilled view to the board monthly or quarterly. Where a variance threatens covenants or headroom, escalate outside the cycle.

Which risks and early warnings should the board see?

Boards need a short list of principal risks with early warning indicators and controls. Focus on solvency, concentration, compliance and operational continuity. Map each risk to a KPI or trigger. Where a trigger is crossed, show the pre agreed response and owner.

How do you connect risks to KPIs and cash?

Tie credit risk to receivable days and overdue bands, stock risk to stock turns and obsolete stock, and delivery risk to failed fulfilment or rework rates. For cash, track headroom, large single debtor exposures and the timing of tax and payroll. Use scenario tests to show resilience.

How do you show compliance without drowning the pack?

Keep a compact calendar of key filings and obligations with status against upcoming dates. Where changes such as Making Tax Digital alter processes, show the readiness plan and any residual risks. Reserve detailed evidence for the appendix.

What tools and systems make board reporting faster and more reliable?

Use a clean general ledger with bank feeds and reconciliations, a capture tool for invoices and receipts, and a reporting layer that pulls a single version of the truth into dashboards and packs. Automate data refreshes and template builds. Keep roles and permissions tight to protect integrity.

Which stack works well in practice?

A common stack is Xero for the ledger, Dext for capture and a BI or reporting tool for dashboards and packs. Use a controlled data model and a definitions library. Build templates once and reuse. This provides audit trails for tax and filings and reduces manual errors.

How does board reporting connect with compliance and external obligations?

Board reporting should surface the status of statutory accounts, filings and tax payments without turning the pack into a compliance report. Use a compact compliance status box with upcoming Companies House and HMRC due dates and confirm whether liabilities are provided for in forecasts. Where a change such as Making Tax Digital applies, include a one line readiness note.

What mistakes do SMEs make in board reporting and how do you fix them?

Common mistakes include overlong packs, moving targets for KPIs, commentary that repeats charts and last minute additions that nobody reads. Fix these by setting a standard pack and calendar, limiting core pages, locking definitions in a data dictionary and enforcing a three day rule before meetings. Keep a change log for any structural updates to preserve comparability.

How does a Virtual Finance Office or Virtual Finance Director deliver this in practice?

A Virtual FD runs the monthly close and reporting process, maintains templates and the data model, and facilitates decision forums. A VFD shapes the KPI set, leads scenario planning and frames decision papers with the executive team. Together they install a finance operating rhythm that integrates weekly cash, monthly board and quarterly strategy.

What does the monthly cycle look like with a VFO/VFD?

Close the books in five working days, publish the draft pack by day seven, meet the board in the second week and publish actions within 24 hours. Maintain a dashboard that updates daily for management and use the same definitions for the board. Run a quarterly strategy day to revisit targets and adjust the forecast.

What outcomes should you expect within 90 days?

Expect cleaner reconciliations, a stable core pack, clear commentary standards and a repeatable action log. Decisions will shift earlier in the agenda and the board will spend more time on options and less on interpreting numbers. Cash visibility will improve and surprise variances will reduce.

How can your business get started with Total Books?

Book a short strategy conversation to align goals and pain points. We review your current pack, close process, KPIs and tools. We agree a 90 day plan that standardises definitions, rebuilds the core pack and sets the governance rhythm. Delivery is fully digital UK-wide, with on site sessions in Cardiff, Bristol and Newport when useful.

Book your 15-minute Strategy Meeting today.

FAQs

How should a UK board pack be structured if we only meet quarterly?

Keep a stable core: executive summary, KPI dashboard, cash view, decision papers and action log. Add a rolling 12 month forecast and scenario highlights so choices span the longer gap between meetings.

What is the right number of KPIs for a board to track each month?

Aim for 10 to 15 that map to profitability, liquidity and efficiency. Tie each KPI to an owner and a target band so the discussion moves from direction to action.

How far ahead should cash runway be shown in board reporting?

Show 13 weeks for control and 12 months for planning. Include headroom to facilities and assumptions on receipts, payroll and capex so directors can judge resilience.

Which visuals help directors read faster without misinterpretation?

Use sparklines for trend, small multiples across products or sites, and consistent colours. Use traffic lights sparingly so red signals attention and green confirms in range.

How do we keep commentary consistent across departments?

Adopt a style guide. Start with what moved, why it moved, whether it is temporary or structural, and what action follows. Name the owner and date for review.

Should compliance dates appear in the board pack every month?

Include a compact compliance box with Companies House and HMRC due dates and status. Keep the evidence in an appendix and confirm liabilities are provided for in forecasts.

What agenda works for a two hour board meeting focused on decisions?

Start with decisions, then performance and risks, then the action log. Time box items and capture resolutions live. Circulate actions within 24 hours.

How can a VFD improve the quality of board decisions quickly?

A VFD frames options with quantified impacts, leads scenario planning and sets KPI targets. This accelerates choices while keeping the plan credible.

Which stack should we choose if we are on Xero already?

Use Xero for ledger, Dext for capture and a reporting layer for dashboards. Standardise definitions and automate templates so the board sees one version of truth.

When should we move a topic from monthly reporting to a formal decision paper?

When the spend, risk or strategic impact is material, or when choices differ meaningfully. Summarise options on one page and attach analysis, then seek a resolution.