Landlords and property investors often overpay on let property tax because they miss allowable expenses, misunderstand mortgage interest rules, or leave tax planning too late. This guide explains the most practical, legal ways to reduce your let property tax, including what you can claim, how ownership and structure change your bill, and how to limit penalties if you need to use the Let Property Campaign.

We will show how Total Books Accountants LTD supports landlords with accurate bookkeeping, property tax planning, and disclosure packs that stand up to scrutiny.

This guide keeps it simple. It explains legal ways to reduce let property tax and stay on the right side of HMRC.

What does “reducing let property tax” actually mean for UK landlords?

Reducing let property tax means lowering your taxable rental profit or your effective tax rate legally, while keeping your reporting accurate and defendable. It is rarely one single trick. It is usually a stack of smaller wins while you submit rental income during self-assessment.

In practice, landlords reduce campaign tax in four ways:

- Reduce taxable profit by claiming the right allowable expenses and reliefs.

- Avoid avoidable errors like misclassifying improvements as repairs.

- Use the right structure for your portfolio stage, risk level, and future plans.

- Reduce penalties and interest if past years are wrong and you need to disclose.

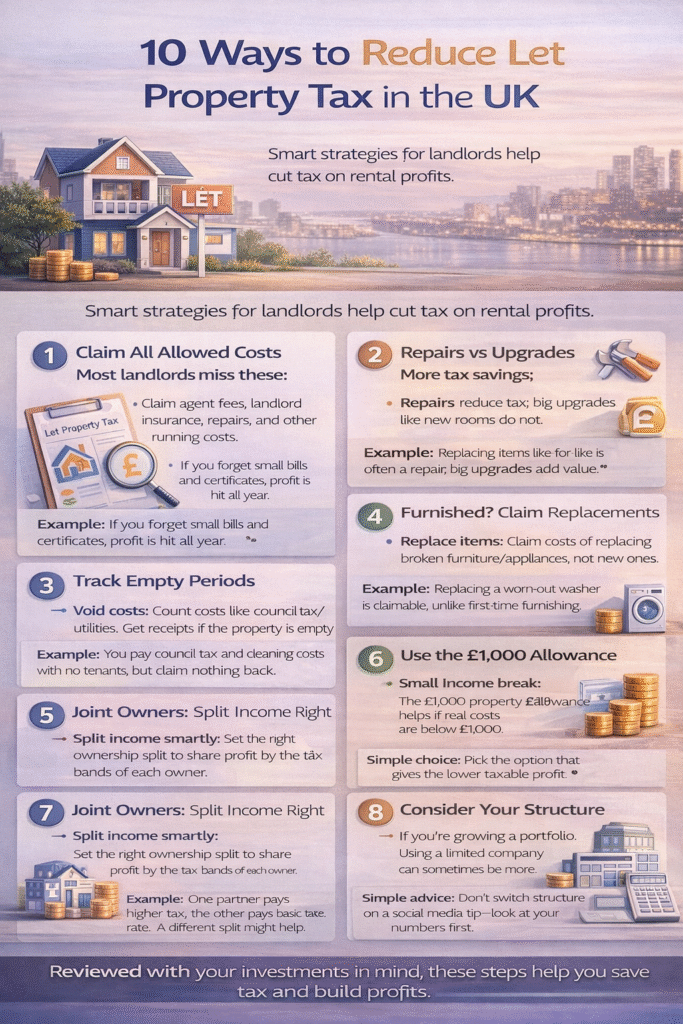

1) Claim all allowed costs (most landlords miss these)

These are costs you pay to run the rental.

Common allowed costs (easy wins)

- Letting agent fees (find tenant, management, renewals)

- Landlord insurance

- Safety and compliance costs you pay (checks, certificates)

- Repairs and maintenance (not upgrades—see next section)

- Service charges and ground rent (if you pay them)

- Cleaning and gardening (if it’s your cost)

- Advertising for tenants

- Phone calls or postage used for the property (keep it sensible and noted)

- Travel to the property only if it’s for management (keep a short log)

- Professional help cost for rental paperwork and tax forms

Example:

A landlord only records “big” bills. They forget small costs like certificates, minor call-outs, and agent renewals. Over a year, these can reduce profit by a lot.

Tip: Use one folder (paper or digital) for every receipt and invoice.

2) Repairs vs upgrades (this saves tax and avoids trouble)

This is a key area. It is also where landlords get caught out.

Repairs (usually reduce taxable profit)

A repair puts something back to how it was.

- fixing a leak

- replacing broken tiles

- repainting after damage

- repairing a boiler

Upgrades (usually do NOT reduce taxable profit)

An upgrade makes the property better than before.

- adding a new room

- major redesign of kitchen or bathroom

- big improvements that add value

Example:

You replace a damaged kitchen with a similar one. That is often treated like a repair.

But if you also add extra units and upgrade to luxury finishes, that part is an upgrade.

Simple rule:

If you are “restoring”, it’s a repair.

If you are “improving”, it’s an upgrade.

3) Track empty periods (voids) properly

When a property is empty, you may still pay costs like:

- council tax (depending on the property and local rules)

- utilities

- insurance

- repairs to get it ready

These costs can still count if they are for the rental business.

Example:

A landlord has a one-month gap between tenants. They pay for cleaning and small repairs. If recorded, this can lower taxable profit.

4) Furnished property: replacing items can reduce tax

If you rent furnished, you may replace items like:

- fridge or washing machine

- sofa or bed

- curtains or carpets (in some cases)

Some replacements can be claimed in a specific way.

The key is: it must be a replacement, not buying items for the first time.

Example:

You replace a broken washing machine with a new one. That is often claimable.

But furnishing an empty property for the first time is treated differently.

Tip: Keep the old item note (“replacement of old fridge”) and the receipt.

5) Don’t get surprised by mortgage interest rules

Many landlords think mortgage interest is a normal cost like repairs.

For many people renting residential property, it does not work that way.

This can cause taxable profit to look higher than the cash you keep.

What helps most:

- record interest and mortgage costs clearly

- do a simple forecast before the tax deadline

- avoid leaving it until January

Example:

A landlord feels “break-even” each month. But the tax calculation still shows profit. When they track all costs properly and plan ahead, the bill becomes more predictable.

6) Use the £1,000 property allowance only if it helps

If your rental income is small, the property allowance may apply.

But it’s not always best.

- If your real costs are more than £1,000, claiming actual costs usually saves more tax.

- If your costs are less than £1,000, the allowance may be easier.

Simple choice:

Pick the option that gives the lower taxable profit.

7) Joint owners: split income the right way

If two people own a property, the rental profit split matters.

Sometimes households overpay because:

- the split is not recorded properly

- everything goes through one bank account

- the tax return doesn’t match the real ownership

Example:

One partner is on a higher tax rate. The other is on a lower rate. If the ownership and paperwork support a different split, the household tax bill may reduce.

This needs to be done correctly. Paperwork matters.

8) Consider your structure if you’re growing a portfolio

Some landlords hold property personally. Some use a limited company.

A limited company can make sense if you:

- plan to grow

- want to reinvest profits

- want clear separation of money

But it may not help if you:

- need to take most of the money out each year

- already own properties personally and want to “move them in” (this can be costly)

Simple advice:

Don’t switch structure based on a social media tip. Look at your numbers and goals first.

9) If you missed rental income: reduce the damage the right way (Let Property Campaign)

If you have undeclared rental income, the key is to act calmly and get organised.

You reduce the final cost by:

- rebuilding income from bank and agent records

- claiming genuine allowed costs you missed

- keeping clear notes and proof

Example:

A landlord has several years of letting but poor paperwork. Using bank statements and agent statements, they rebuild the figures. They include real repair and compliance costs. The final bill becomes fairer and easier to manage.

10) The biggest tax saver: simple record keeping

Most landlords don’t overpay because of tax rates.

They overpay because of messy records.

Make it easy for yourself

- Use one bank account for property income and costs (if possible)

- Save every invoice and receipt (photo is fine)

- Write short notes like “boiler repair” or “new tenant clean”

- Check your numbers every month or quarter

This alone can cut your tax bill.

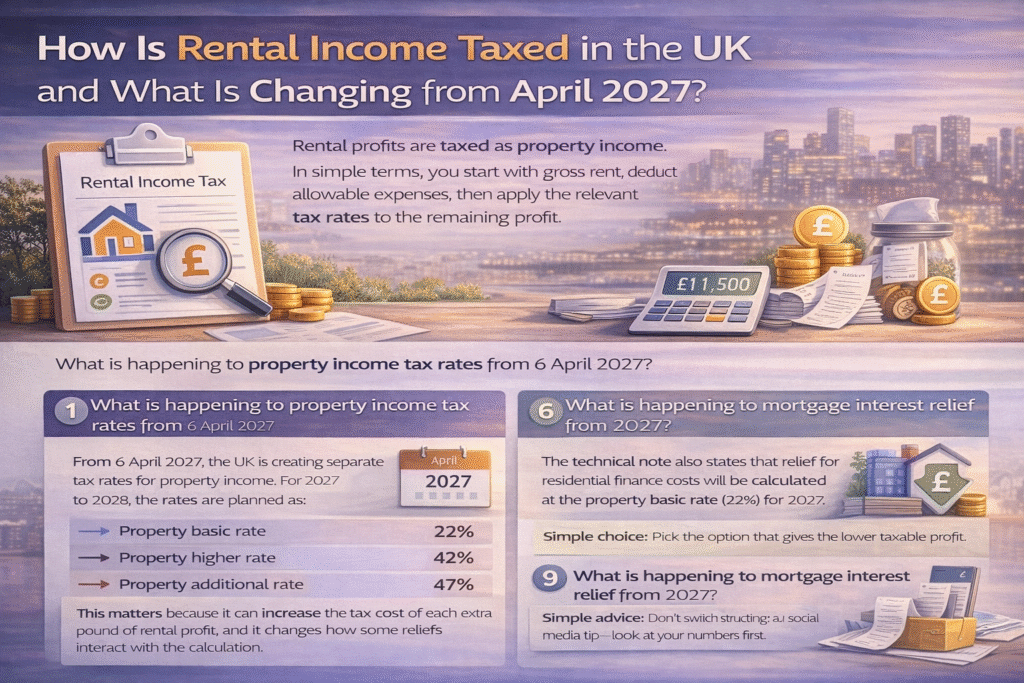

How is rental income taxed in the UK and what is changing from April 2027?

Rental profits are taxed as property income. In simple terms, you start with gross rent, deduct allowable expenses, then apply the relevant tax rates to the remaining profit.

Two changes matter for planning:

What is happening to property income tax rates from 6 April 2027?

From 6 April 2027, the UK is creating separate tax rates for property income. For 2027 to 2028, the rates are planned as:

- Property basic rate: 22%

- Property higher rate: 42%

- Property additional rate: 47%

This matters because it can increase the tax cost of each extra pound of rental profit, and it changes how some reliefs interact with the calculation.

What is happening to mortgage interest relief from 2027?

The technical note also states that relief for residential finance costs will be calculated at the property basic rate (22%) for 2027 to 2028.

So, planning around finance costs becomes even more important, especially for geared landlords.

Which allowable expenses can reduce your taxable rental profit immediately?

Allowable expenses are the day-to-day costs of running your property letting activity. If you do not claim them, you pay tax on money you never really kept.

Examples often include:

- Letting agent fees, management fees, tenant-find fees

- Insurance (buildings and relevant landlord insurance)

- Safety and compliance costs (for example checks you pay for)

- Repairs and maintenance that restore the property

- Service charges, ground rent, and similar running costs where you are responsible

- Certain professional fees connected to the letting activity

- Replacement of eligible items in furnished properties in the right way

- Costs you cover that would normally be the tenant’s, if the tenancy agreement makes you liable

HMRC’s rental income guidance is clear that maintenance and repairs are allowable, but capital improvements are not.

How do repairs, improvements and replacements affect your tax bill?

Repairs reduce taxable profit when they restore the property to its original condition. Improvements generally do not reduce rental profit because they are capital in nature.

What counts as a repair for rental property tax purposes?

A repair restores an asset to its previous condition, even if you use the nearest modern equivalent. HMRC provides examples like replacing roof tiles, replacing a broken boiler, and redecorating between tenants to restore the property.

What usually counts as an improvement?

An improvement is where you enhance the property beyond its original standard or create something new. These costs often matter later for capital gains calculations, but they are not normally deducted from rental profit.

When can you claim for replacements in furnished properties?

HMRC’s guidance notes that replacing furnishings is not a repair, but items may qualify for replacement of domestic items relief in relevant cases.

How does mortgage interest relief work now and how can you reduce the damage?

Many landlords expect mortgage interest to behave like a normal expense. For many individuals letting residential property, that is no longer how it works.

What is the core rule landlords keep missing?

The restriction means finance costs are not deducted from rental income in the normal way for many landlords, and instead relief is given at a basic-rate level through a tax reduction mechanism. HMRC’s guidance explains that the restriction was phased in and fully in place from April 2020. GOV.UK+1

What can you do to reduce the impact legally?

You cannot wish the rule away, but you can plan around it:

- Know your true marginal position: “profit on paper” can push you into a higher band even if cash feels tight.

- Forecast tax alongside cash flow: you need a monthly view, not an annual surprise.

- Consider structure changes cautiously: a company can treat interest differently, but incorporation has other taxes and costs.

- Use losses correctly: carried-forward property losses can offset future property profits, but only against property income.

When do the £1,000 property allowance and the Rent a Room Scheme reduce tax?

These are often confused, but they solve different problems.

When does the property allowance reduce rental tax?

The property allowance can provide up to £1,000 of tax-free allowance on property income in a tax year, but it has conditions and is not always the best choice if your actual expenses exceed £1,000.

For very small rental income streams, it can simplify things.

Micro-case: An accidental landlord renting out a former home for a short period had low gross rent and minimal costs. Using the allowance simplified reporting and avoided a messy “small expenses” debate.

When does Rent a Room relief help?

Rent a Room is about letting furnished accommodation in your main home, such as taking in a lodger. The threshold is £7,500 per year, or £3,750 if shared with another person.It does not automatically apply to a separate buy-to-let property.

How can joint ownership and income splitting reduce property tax legally?

Sharing income can reduce tax when one owner is in a lower tax band than the other, but it must reflect real ownership and beneficial entitlement.

What is the practical planning angle for couples?

If one spouse or civil partner is a basic-rate taxpayer and the other is higher-rate, shifting beneficial ownership can reduce the blended tax rate on profits. This is not a spreadsheet exercise. It involves:

- How the property is owned legally

- How beneficial ownership is documented

- How income is actually allocated and evidenced

- How mortgage lender terms and legal reality interact

Micro-case: A higher-rate taxpayer paid all property costs from their account, so they assumed all profit should be taxed on them. After a proper review, ownership and income allocation were aligned to the real beneficial position. The annual tax bill reduced and the records became easier to defend.

When does using a limited company or SPV reduce let property tax and when can it backfire?

A limited company can be powerful, but it is not a universal answer.

When can a company structure be helpful?

A company can suit landlords who:

- Intend to build a larger portfolio

- Want to reinvest profits rather than extract them personally

- Need clearer separation of risks

- Want a more scalable reporting workflow

It can also change how finance costs are treated inside the company computation, which can be significant for highly geared portfolios.

When can incorporation create new problems?

It can backfire when:

- You need to extract most profits personally each year

- You trigger taxes and costs on transferring an existing portfolio

- The admin burden and compliance costs outweigh the benefit

- You ignore the future exit plan, such as selling properties or extracting retained profits

How can timing, losses and forecasting reduce tax stress and improve cash flow?

Timing does not mean hiding income. It means planning expenditure, record-keeping, and decision points so you are not cornered.

How do property losses work?

Property losses carried forward are generally used only against future property profits, not against salary or other income. The Let Property Campaign guidance also highlights that losses can be complex and may need advice.

Why does forecasting matter more from 2027?

With the planned property rate changes from April 2027, the value of proactive forecasting increases.

The goal is to know your likely tax position early enough to act, not after the year ends.

How do the 2025 holiday let changes affect tax planning for short-term landlords?

If you run furnished holiday lets, the tax landscape changed. The government published measures to abolish the furnished holiday lettings tax regime from April 2025.

That means owners who relied on historic advantages should revisit structure, pricing, and exit planning.

How does Total Books help landlords reduce let property tax in practice?

We reduce landlord tax bills by combining tax planning with clean numbers, because the easiest way to overpay is to have messy records.

Our typical approach includes:

- A quick diagnostic of your rental income streams, ownership position, and reporting gaps

- A deduction and evidence review to ensure allowable expenses are claimed correctly

- A simple forecast so you can see likely tax before deadlines

- Xero-led workflows for landlords who want clean, digital reporting

- Let Property Campaign support, including notification, disclosure schedules, and an evidence-ready pack built from your records

If you want to reduce your property tax legally, or you are worried past returns are wrong, speak to Total Books Accountants LTD. A short strategy meeting can save you months of stress, and it often uncovers quick wins you can action immediately.

If you are a landlord, accidental landlord, or property investor, the biggest gains usually come from getting the basics right, then layering structure and forward planning on top. With property income tax rates set to change from April 2027 and digital reporting moving closer, now is the right time to get your rental numbers clean and your strategy clear.