Total Books treats pension planning as part of joined-up business tax planning. That means aligning your salary, dividends, pension contributions, profit targets, and exit goals, then working alongside a regulated pension expert when you need product or investment advice.

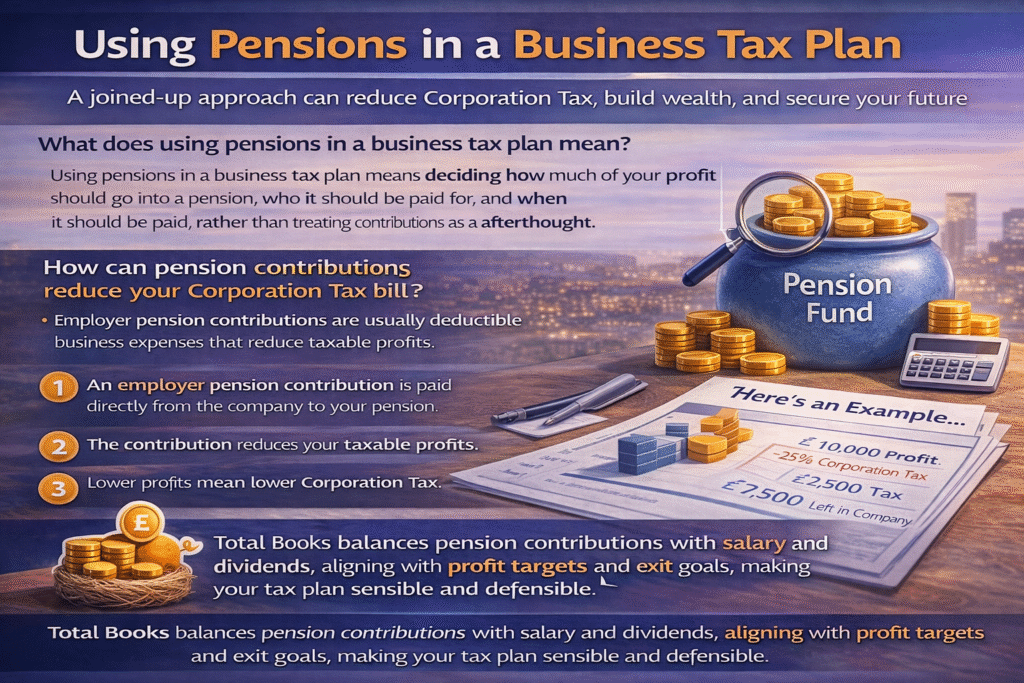

What does using pensions in a business tax plan actually mean?

Using pensions in a business tax plan means deciding how much of your profit should go into a pension, who it should be paid for, and when it should be paid, rather than treating contributions as an afterthought.

In practice, that usually involves:

- Deciding how much profit you want to keep in the company versus ring-fence in your pension.

- Using employer pension contributions from the company instead of (or alongside) bonuses and dividends.

- Planning contributions around your Corporation Tax position and cash flow.

- Coordinating with a pension specialist so the money is invested in the right kind of pension for your goals.

At Total Books, that starts with your accounts and forecasts, not a product brochure. The pension wrapper is then used as one of several tools to move profits to you tax-efficiently.

How can pension contributions reduce your Corporation Tax bill?

Pension contributions can reduce your Corporation Tax bill because genuine employer pension contributions are usually a deductible business expense, as long as they are “wholly and exclusively” for the purposes of the trade and reasonable for your role and company size.

In a typical limited company:

- An employer pension contribution is paid directly from the company to your pension.

- The contribution reduces your taxable profits.

- Lower taxable profits mean lower Corporation Tax.

For example, suppose a company has £10,000 of profit that sits above the owner’s normal drawings.

- Without a pension contribution, those profits might be taxed at 25% Corporation Tax, so £2,500 goes in tax and £7,500 remains in the company.

- With an employer pension contribution of £10,000, the company’s taxable profit falls by £10,000 and the Corporation Tax bill falls by £2,500. The full £10,000 goes into the pension instead of being taxed first.

You still need to check that contribution levels are appropriate for your role, salary, and overall profit levels. This is exactly where an accountant-led review from Total Books helps keep things sensible and defensible.

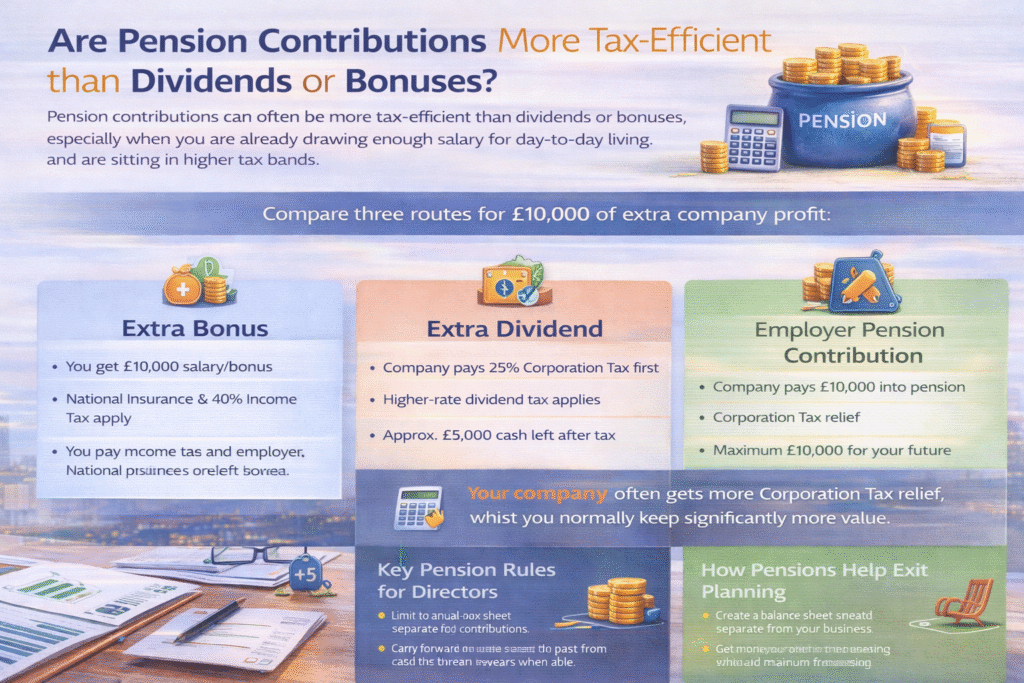

Are pension contributions more tax-efficient than dividends or bonuses?

Pension contributions can often be more tax-efficient than dividends or bonuses, especially when you are already drawing enough salary for day-to-day living and are sitting in higher tax bands.

Compare three routes for £10,000 of extra company profit:

1. Extra bonus

- The company pays you an extra £10,000 as salary/bonus.

- The company pays employer National Insurance on that amount.

- You pay Income Tax and employee National Insurance on the bonus.

- Corporation Tax relief is given, but the combined tax and NIC drag is usually heavy.

2. Extra dividend

- The company pays Corporation Tax first.

- Using a simple example at 25% Corporation Tax, the company pays £2,500 tax and has £7,500 left to distribute.

- A higher-rate shareholder could then face dividend tax at a higher-rate dividend band.

- After dividend tax, the personal cash left might be a little under £5,000.

3. Employer pension contribution

- The company pays £10,000 straight into your pension.

- The company gets Corporation Tax relief (in the example above, that relief is worth £2,500).

- You do not pay Income Tax or National Insurance on that contribution at the point it is made.

You end up with £10,000 invested for your future rather than around £5,000 in your hand today after tax. You trade liquidity today for more efficient long-term wealth. Total Books often models these options side by side, so you can see the impact in clear numbers before choosing your mix of salary, dividends, and pension contributions.

What pension allowances and rules should directors keep in mind?

Pension planning must sit within your allowances, because tax advantages rely on staying inside the rules.

Key concepts to understand:

- Annual pension allowance

There is a limit on how much can be contributed into pensions each tax year while still receiving tax advantages. This includes employer and personal contributions. The standard allowance can be reduced for very high earners through “tapering”. - Carry forward

Unused annual allowance from the previous three tax years may sometimes be used in the current year, as long as conditions are met. This offers opportunities for larger one-off contributions from the company when profits are strong. - Earnings and personal contributions

Personal contributions normally link to your relevant earnings. Employer contributions have different constraints, which is why many directors lean on company contributions rather than large personal payments. - Access ages and rules

Pension money is locked away until at least the minimum pension age, with a portion usually available tax-free and the rest taxed as income when drawn. That is why your short-term cash needs must be planned in parallel with your pension strategy.

Total Books will normally outline the numerical limits and then bring in a regulated pension expert to confirm what is suitable for you in product terms.

How can pensions support long-term business and exit planning?

Pensions can support long-term business and exit planning by acting as your “personal balance sheet”, separate from the company, that grows as you trade.

Strong pension planning can:

- Give you an asset base that is not tied to the future sale of the business.

- Provide a tax-efficient way to move profits out of the company during its lifetime.

- Support phased retirement, where you reduce your role in the business while drawing from other assets.

For some owners, specialist pension structures (like certain occupational schemes or self-invested arrangements) can even hold business-related assets such as commercial property. You might, for example, house your trading premises in a pension and let the company pay rent into the pension instead of to a third-party landlord.

The suitability and structure of those arrangements always need specialist, regulated input. Total Books focuses on the tax and business planning side, then coordinates with a pension expert so those ideas are put into practice safely and correctly.

Case Study: Saving tax using pensions effectively!

Marta The client came to us and we provided ongoing tax planning on incorporating her existing self assessment trade as a Psychotherapist. Alongside this Pensions tax planning was advised from the offset. The client has nearly completed three years of accounting & tax with ourselves and is in a really happy place knowing her taxes have come down considerably and that she is saving for the future. Below are some of the benefits from the ongoing pensions planning and investments strategy.

- £1k monthly pension contribution (I believe she pays 20% corp tax rate so therefore around £2,400 annualised corp tax saving) around £4,320 div tax savings, assuming higher rate div. Saving from 2026 tax year 35.75% plus 20% = 55.75% annualised tax saving on annualised pension contributions. £6,690 in total.

- Previously Marta did not have a pension and will have over half a million in pension in 20 years due to planning. Potentially more.

- Income protection and life insurance – ensuring if client was to become unwell or in the event of death, money would be available for her family as she has a young son who is dependent on her.

How might a pension strategy work in a hypothetical business?

A simple hypothetical scenario can show how pension planning fits alongside other decisions, without using personal names or a real case.

Imagine a profitable limited company where the director already:

- Draws a sensible salary up to the optimal level for National Insurance.

- Takes regular dividends that cover personal living costs.

- Has an extra £30,000 of profit left in the company after that.

Several routes exist:

- Pay higher dividends on the extra £30,000, increasing personal dividend tax.

- Leave the profit in the company, increasing future Corporation Tax exposure and business risk.

- Pay some or all of the £30,000 as an employer pension contribution.

If £20,000 goes into a pension as an employer contribution:

- The company’s taxable profit falls by £20,000.

- Corporation Tax reduces accordingly.

- The director’s pension receives £20,000 without extra Income Tax or National Insurance at that point.

- The remaining £10,000 profit can still be used for dividends, reserves, or reinvestment.

Total Books would model several versions of this scenario, showing how changing the contribution from £10,000 to £20,000 to £30,000 affects taxes today and projected pension values tomorrow. A pension expert would then help select or adjust the pension product to match the director’s attitude to risk and retirement timeline.

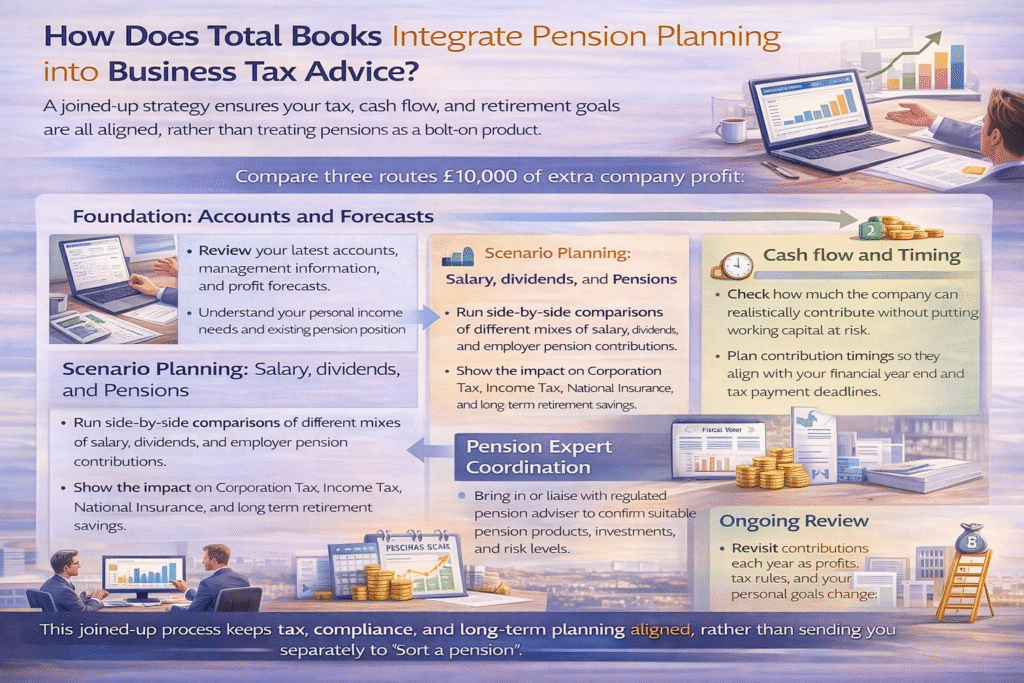

How does Total Books integrate pension planning into business tax advice?

Total Books integrates pension planning into business tax advice by treating it as one of several levers in your overall strategy, not a bolt-on product.

A typical approach looks like this:

- Foundation: Accounts and forecasts

- Review your latest accounts, management information, and profit forecasts.

- Understand your personal income needs and existing pension position.

- Review your latest accounts, management information, and profit forecasts.

- Scenario planning: Salary, dividends, and pensions

- Run side-by-side comparisons of different mixes of salary, dividends, and employer pension contributions.

- Show the impact on Corporation Tax, Income Tax, National Insurance, and long-term retirement savings.

- Run side-by-side comparisons of different mixes of salary, dividends, and employer pension contributions.

- Cash flow and timing

- Check how much the company can realistically contribute without putting working capital at risk.

- Plan contribution timings so they align with your financial year end and tax payment deadlines.

- Check how much the company can realistically contribute without putting working capital at risk.

- Pension expert coordination

- Bring in or liaise with a regulated pension adviser to confirm suitable pension products, investments, and risk levels.

- Ensure that the pension structure matches the tax strategy agreed with you.

- Bring in or liaise with a regulated pension adviser to confirm suitable pension products, investments, and risk levels.

- Ongoing review

- Revisit contributions each year as profits, tax rules, and your personal goals change.

- Adjust the plan ahead of any major events such as business sale, property purchase, or planned retirement.

- Revisit contributions each year as profits, tax rules, and your personal goals change.

This joined-up process keeps tax, compliance, and long-term planning aligned, rather than sending you separately to “sort a pension”.

What practical steps should you take before making company pension contributions?

Practical steps before making company pension contributions include both tax and personal planning checks.

Useful actions are:

- Review your current drawings

Make sure your basic salary and dividend level already meet your short-term living costs and personal commitments. Pension contributions should not push you into a cash-flow problem. - Check current profit and projections

Understand your likely profit for the current and next tax year, including any expected changes in trade, big contracts or investments. Contributions should be set at a level that remains comfortable. - Clarify your retirement and exit goals

Decide the age range when you would like to access pension benefits and how that sits alongside keeping, selling, or scaling the business. A clear goal helps decide contribution size and investment approach. - Confirm your allowances and carry forward position

Ask your accountant to map out your pension allowance usage over the last few years. This checks whether larger contributions are available through carry forward and highlights any risk of breaching limits. - Engage a pension expert alongside your accountant

Use your accountant for structure, numbers, and tax planning. Use a regulated pension expert for advice on specific pension products and investment choices. Total Books works in partnership with pension specialists so you get both angles aligned.

Final thoughts: Why treat pensions as a core tax planning tool?

Pensions deserve a central place in your business tax plan because they allow you to:

- Extract value from your company in a tax-efficient way.

- Build independent, long-term wealth separate from your trading risk.

- Take advantage of current reliefs while they are available.

When you work with Total Books, pension planning is not just a checkbox. It becomes part of a wider conversation about how you, your business, and your future retirement all fit together.

If you want to explore how employer pension contributions could work alongside your salary and dividends, the next step is a structured review of your numbers, followed by a joined-up discussion with a pension expert who can shape the product side around the tax plan we build with you.