Total Books, helping you declare rental income

Whether you’re a seasoned landlord or new to renting out properties, undeclared property income can quickly lead to issues. Lucky for you, at Total Books, we have a vast knowledge of property tax and landlord accounting. We’ll help bring you up to date with your property tax liabilities. With a guarantee to ensure a fully accepted disclosure, minimising tax penalties & taking away the worry of this tax burden.

If you owe tax on rental profits but have yet to disclose it to HMRC, we’ll help you make a voluntary disclosure before HMRC investigates your tax affairs. Contact us today to notify HMRC of undisclosed income.

Our Let Property Campaign Disclosure & Mitigation services

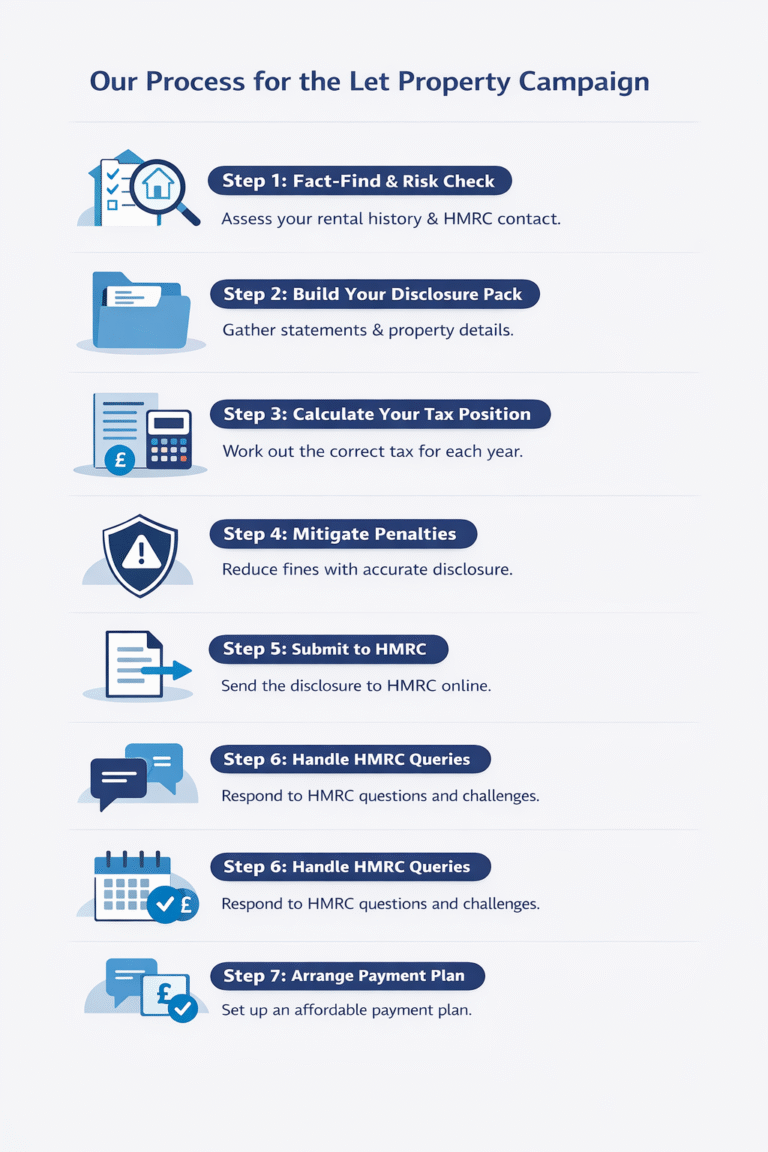

At Total Books, we make the Let Property Campaign feel straightforward and controlled — even if you’re worried, behind on paperwork, or already hearing from HMRC. Using the same structured timeline we follow in every disclosure, we take you from “not sure what to do next” to a completed, accepted outcome, with the right numbers, the right explanation, and a clear payment plan where needed.

Step 1: Fact-find and risk check

We start with a focused conversation to understand:

-

which properties are involved and when they were let

-

which tax years may be affected

-

whether HMRC have already contacted you (and how urgent it is)

Step 2: Build your disclosure pack

We help you get organised fast — even if records are incomplete — by working from:

-

bank statements and letting agent statements

-

tenancy dates and key property costs

-

anything already submitted (if you started a disclosure yourself)

Step 3: Accurate calculations for every year

We analyse each tax year properly (not just totals), calculate rental profit, and confirm the tax position — including situations where the final outcome may be lower than expected or even “nothing to pay” once the figures are correct.

Step 4: Penalty mitigation and disclosure wording

Penalties are not automatic at the same level — they depend on the circumstances. We prepare the disclosure explanation clearly and consistently, aiming to keep fines and penalties to a minimum while ensuring the disclosure remains fully honest and credible.

Step 5: Submit through HMRC’s Digital Disclosure Service

Once everything is checked and agreed with you, we prepare and submit the Let Property Campaign disclosure within the deadline window and manage HMRC communications throughout.

Step 6: Handle HMRC queries and disputes

If HMRC raise questions, challenge figures, or ask for further evidence, we respond on your behalf and manage the case through to acceptance and closure — keeping things calm, professional, and on track.

Step 7: Arrange a sensible payment plan

If tax is due and paying in full isn’t practical, we support you in putting a manageable payment arrangement in place, so the disclosure doesn’t become a financial burden.

We act as your representative LPC tax agents and deal with HMRC throughout, so you don’t have to. If you’ve made a mistake, received an HMRC letter, started a disclosure that’s gone quiet, or simply don’t know where to begin — we’ll guide you end-to-end and work with you until the matter is fully resolved.

Learn more on How do we can reduce your let property tax.

Not sure where you stand with the Let Property Campaign?

Most landlords contact us when uncertainty turns into pressure. Sometimes it starts with a quiet realisation. Sometimes it starts with an HMRC letter.

The right next step depends entirely on where you are right now. Find the closest match below and see how we help bring the situation under control.

1) “I’ve received a letter from HMRC about rental income”

This usually means HMRC already have data linking you to a let property. That could be from letting agents, Land Registry records, online platforms, or cross-checks through their CONNECT system. They are asking for an explanation or a tax return. This is known as a prompted disclosure.

What to do next

-

Do not ignore the letter. HMRC deadlines matter and missed responses increase penalties.

-

Do not guess or send partial replies. Inconsistent explanations can escalate the case.

-

Map the exposure quickly: which properties, which tax years, and how serious the risk is.

How Total Books helps

We act as your representative immediately. We review the letter, assess the exposure, and respond to HMRC with a clear plan. Correct handling at this stage can reduce penalties by up to 90%, which in many cases means tens of thousands avoided.

2) “I started a Let Property Campaign disclosure, but it isn’t finished”

This often happens when figures do not stack up, records are patchy, expenses are unclear, or the 90-day submission window is closing.

What to do next

-

Confirm exactly what has already been submitted and what has not.

-

Rebuild the numbers year by year. Rental profit is not the same as rental income.

-

Align the explanation with the facts so the disclosure stands up to scrutiny.

-

Request extra time if needed. HMRC can grant short extensions when handled correctly.

How Total Books helps

We take over the calculations, disclosure wording, and HMRC contact. The result is a complete, consistent submission that is more likely to be accepted without delays or repeated questions.

3) “I haven’t told HMRC yet, but I know I should have”

This is often the strongest position to be in. Voluntary disclosure usually means lower penalties and a smoother process.

What to do next

-

List all properties, including letting dates, empty periods, and ownership splits.

-

Identify the missing tax years and whether returns were ever filed.

-

Register properly and prepare before starting the disclosure clock.

How Total Books helps

We guide you from “where do I even start?” to a submitted disclosure, agreed figures, and a closed case, without unnecessary stress or guesswork.

4) “I’m not sure if I even need to disclose”

This applies more often than people think. HMRC can still check these situations through CONNECT.

Common examples include:

-

Lodgers or rent-a-room: tax relief applies up to a threshold, but income above it may still need reporting.

-

Airbnb, short-term or holiday lets: income is taxable and expense rules vary by setup.

-

Living abroad: non-resident landlords can still have UK tax obligations.

-

Letting agents or guaranteed rent: tax responsibility still sits with you.

How Total Books helps

We confirm whether disclosure is required, calculate the correct position, and make sure the right route is used so you do not overpay or disclose incorrectly.

5) “My records are incomplete”

This is common, especially when issues go back several years.

What to do next

-

Start with bank statements. They are often enough to rebuild income.

-

Use letting agent statements where available.

-

Reconstruct expenses sensibly using what can be supported, such as repairs, insurance, agent fees, service charges, and compliance costs.

How Total Books helps

We rebuild the figures in a way HMRC accept, using practical evidence and sensible estimates. We also make sure costs are claimed in the correct years to avoid common errors.

6) “I can’t afford to pay the tax in one go”

This worry stops many people acting. Delaying usually makes things worse.

What to do next

-

Do not delay disclosure purely because of payment concerns.

-

Confirm the true figure first. Many landlords overestimate what they owe.

-

Plan cashflow around a realistic repayment approach.

How Total Books helps

Once the disclosure is agreed, we support you in arranging a manageable payment plan so the outcome does not become financially overwhelming.

7) “I’m worried this could turn into something serious”

If letters have been ignored, multiple years are involved, or HMRC already have data, anxiety is a normal response.

What to do next

-

Get professional representation early. Timing, tone, and accuracy matter.

-

Keep everything consistent across years and properties.

-

Avoid partial disclosures. HMRC can look back up to 20 years.

How Total Books helps

We deal with HMRC directly, control the narrative, and keep the disclosure structured from day one so the situation does not spiral.

Ignoring undeclared rental income does not make HMRC go away.

What is the Let Property Campaign?

If you make a profit from renting out residential property, then you must tell HMRC. But what if you didn’t know how much tax you owed? Or what if you made a mistake? Well, that’s where the Let Property Campaign comes in.

HMRC created the Let Property Campaign as an amnesty to give landlords a chance to resolve unpaid tax. It allows you to disclose everything voluntarily in exchange for much lower penalties than if HMRC found out about the unreported income themselves. You can view the detailed HMRC guidance on the let property campaign here Let Property Campaign: your guide to making a disclosure – GOV.UK

Who does the Let Property Campaign benefit?

You might find the Let Property Campaign beneficial if you have previously failed to pay tax on property income. It provides a less stressful way for you to disclose your rental income and catch up on the tax you owe.

The LPC specifically supports:

-

- Residential property landlords

-

- Holiday lets & Air B&B Landlords

-

- Spare room rentals (that go over the tax-free threshold)

-

- UK landlords who live abroad

-

- Guaranteed rents paid through letting agents

Unsure if you fit into one of these categories? We’ll help you work out your tax liability and pay any tax you might have previously missed.

How does HMRC find out about undeclared rental income?

HMRC has access to numerous databases and can easily find out about undisclosed income from various sources, including your property rentals. They may spot patterns, like owning multiple properties, that could hint at earning rental income. Or, if they already suspect something isn’t quite right, they may start an investigation. This means cross-referencing data across different sources to determine if the house is let to a tenant where Let property Income Tax has not been paid.

This property information can come from many sources easily accessible to the UK tax authorities:

-

- HM Land Registry ( Landlord )

-

- Stamp Duty Land Tax ( Landlord )

-

- House Insurance & Mortgage ( Landlord )

-

- Electoral Register ( Tenant )

-

- Bank account details ( Tenant )

-

- Driving licence, Passport & Council Tax (Tenant )

-

- Complaints from ex-tenants

-

- Third parties (such as estate agents or property management companies)

How much is the HMRC penalty for the Let Property Campaign?

LPC penalties vary depending on why you failed to declare income. If it was an honest mistake, then you may face a lower penalty than if you intentionally chose not to pay tax.

At Total Books Accountants, we have successfully managed to bring over 80% of our cases down from a 100% tax & fines penalty to between 10% & 30%. Saving our clients upwards of £4,000 in fines & penalties per case. You can read more about the HMRC Failure to notify penalty guidance here Compliance checks — penalties for failure to notify — CC/FS11 – GOV.UK

Let Property Campaign disclosure

We’ll help you sign up and make a declaration under the LPC. It’s a relatively quick process, but you should bear in mind that once you have registered, the timeframe is tight! You only have 90 days to make a disclosure, so we always recommend coming prepared. Bring any documents you might need and contact us as soon as you’re ready to tell HMRC.

Our Let Property Campaign disclosure service starts with a conversation. We want to learn more about your rental properties and pinpoint where things might have gone wrong. We’re a friendly team offering judgment-free support – our only goal is to put you at ease and help you get back on track.

Once we understand your finances a little better, we’ll analyse your total rental income for the tax years you’ve missed, calculate any unpaid tax, and work out if you’re likely to face any penalties. Don’t worry -it is our job to keep these penalties to a minimum.

We’ll ensure you’re happy with the figures and then prepare your disclosure using HMRC’s Digital Disclosure Service. We’ll handle all of the paperwork and communicate with HMRC on your behalf to keep things running smoothly throughout the entire process.

We guarantee to work with the client until the case has been fully accepted and closed with the LPC disclosure office. In many cases we even ensure that a payment plan is arranged to suit the client. This means that a client can pay in monthly installments from one to five years, ensuring that taxes due do not become a burden and you can forget about this for the future.

Management of landlord tax affairs

Our service doesn’t just end there. Whether it’s tracking rental income or optimising your taxes to save more money, we provide ongoing support to keep you compliant long after the LPC disclosure. Our tax services ensure your property tax returns are accurate and on time and help you make the most of the tax reliefs available.

We embrace modern accounting practices and help our clients do the same. By utilising the latest accounting software Bright Manager & TaxCalc, we’ll help you ensure that missed tax payments are a thing of the past.

Ensure compliance and maximise your rental income with Total Books

If you’re a landlord struggling to keep on top of your taxes, don’t wait for a formal investigation to come knocking. Our Let Property Campaign services provide a straightforward and supportive way to bring your tax affairs up to date.

Get in touch today to make a full disclosure and start your journey to better tax management.

Frequently Asked Questions

When did the Let Property Campaign start?

What does a prompted HMRC letter about rental income mean?

A prompted letter means HMRC already believe you may have undeclared rental income. This often comes from data matching through letting agents, Land Registry records, banks, or online platforms. Deadlines in these letters matter and incorrect replies can escalate the case quickly.

What penalties apply under the Let Property Campaign?

Penalties depend on whether the disclosure is voluntary or prompted and how HMRC assess behaviour. They consider whether errors were careless, deliberate, or concealed. Clear disclosure wording and full cooperation can significantly reduce penalty percentages.

Can I submit a disclosure if my records are incomplete?

Yes, a Let Property Campaign disclosure can still be submitted with incomplete records. Bank statements, letting agent statements, and reasonable reconstructions are commonly used. The key is that figures are consistent, supportable, and explained clearly to HMRC.

What is the difference between rental income and rental profit?

Rental income is the total rent received before any costs are deducted. Rental profit is the figure HMRC tax after allowable expenses are taken off. Many disclosures fail because income is reported instead of profit, which overstates the tax due.

What expenses can I claim against rental income?

Allowable expenses include repairs, insurance, letting agent fees, service charges, and compliance costs such as safety certificates. Capital improvements are treated differently and are not deducted in the same way. Expenses must be allocated to the correct tax year to avoid challenges.

Do Airbnb and short-term lets need to be disclosed?

Yes, Airbnb and short-term letting income is usually taxable and may need to be disclosed. The tax treatment depends on whether the property qualifies as a furnished holiday let or standard rental. Even part-year or occasional letting can trigger reporting obligations.

Do lodgers or rent-a-room income need declaring?

Not always, but income above the Rent a Room threshold is taxable and may require disclosure. Once the threshold is exceeded, Self Assessment reporting can apply. Each tax year is assessed separately based on total receipts.

What is the 90-day disclosure window?

After notifying HMRC, you usually have 90 days to submit the full disclosure. Missing this deadline can increase penalties and trigger further HMRC action. Short extensions may be possible if requested correctly and early.

What happens after a Let Property Campaign submission?

HMRC review the figures, explanation, and supporting evidence once the disclosure is submitted. They may ask questions or request further clarification before acceptance. When HMRC confirm acceptance, the disclosure is closed.