Running a business without clear financial direction can leave you guessing. That’s why many UK business owners now use Virtual Finance Directors (VFDs) or Part-Time CFOs for guidance that goes beyond day-to-day accounting. At Total Books, our Virtual Finance Director service gives you senior-level financial support without the cost of hiring a full-time director.

If you’re growing fast, worried about cash flow, or planning for funding or exit, our fractional CFOs step in to guide you. We turn your financial data into simple actions — helping you forecast growth, track performance, plan ahead for tax, and make confident decisions whenever you need it, monthly or quarterly.

Unlike traditional accountants who focus only on past results, we work with you to shape your financial future.

Key Takeaways

- Work with an experienced Outsourced Finance Director without hiring full-time staff

- Get strategic reports, forecasts, and cash flow plans to support growth

- Improve funding readiness, tax efficiency, and business decision-making

- Seamlessly integrate with your bookkeeping and management accounts

- Flexible monthly, quarterly, or one-off packages available across the UK

Why Do Businesses Need a Virtual Finance Director?

Most UK small and medium-sized businesses (SMEs/SMBs) don’t have senior financial expertise in-house — yet they face tough financial decisions every month. That’s where a Virtual Finance Director (VFD) or Part-Time CFO adds real value.

Many business owners spend hours in spreadsheets, managing cash flow, chasing late payments, and trying to understand performance, all while running operations and serving customers. This pressure often causes gaps in strategy, pricing errors, and higher risks.

Research from ACCA UK (2024) shows that more than 60% of small businesses operate without strategic financial guidance, leaving them exposed to funding problems, unnecessary tax bills, and poor long-term decisions.

Common problems we see:

What Is a Virtual Finance Director?

A Virtual Finance Director (VFD), also known as a Fractional CFO, is a senior finance expert who gives your business strategic financial leadership on a part-time, flexible basis. Unlike hiring an in-house Finance Director on a six-figure salary, a Virtual FD provides the same high-level guidance without the overheads.

This service is ideal for growing businesses and small companies that need expert financial oversight, help with funding, or performance insights—but aren’t ready for a full-time finance director.

How does virtual FD work?

A Virtual FD works alongside your existing accountant or bookkeeper but focuses on forward-looking financial decisions. Here’s what’s typically included:

- Monthly or bi-weekly board-level meetings to review performance

- Rolling forecasts and scenario planning tied to your growth goals

- Funding strategy and capital planning (e.g. grants, investment, asset finance)

- Business model optimisation through pricing, margin, or structural advice

- Liaison with your accountant, internal team, and external stakeholders (e.g. lenders, investors)

- Owner support and strategic guidance during big decisions like exits, expansions, or restructures

Whether you need guidance once a month or ongoing CFO-level thinking every quarter, a VFD keeps you financially confident and growth-ready.

Core Responsibilities Our Outsourced Finance Director Handles:

Our Virtual Finance Director (VFD) and Fractional CFO services go beyond routine accounting. We help you interpret your financial data, turn numbers into decisions, and ensure your business runs with strategic clarity. Whether you’re a growing startup or a well-established SME, we tailor our expertise to your business model.

Strategic Financial Planning

We build forward-looking financial strategies so you can lead with confidence:

- Business forecasting using historical data and market trends

- Budgeting and multi-scenario planning for different growth paths

- Defining and tracking KPIs, OKRs, and financial milestones

Cashflow & Profitability Analysis

Understanding where your money goes is key to staying afloat—and scaling:

- In-depth cost breakdown and margin analysis

- Revenue stream evaluation and optimisation (e.g. service vs. product mix)

- Cashflow forecasting across seasonal cycles, tax months, and investment windows

Board-Level Reporting & Advisory

We support you with timely reports and insight that speak to investors, lenders, and stakeholders:

- Monthly management reports with commentary

- Flash reports and real-time dashboards via tools like Syft and Fathom

- Investor-ready presentations and finance packs for funding or sale

Tax and Compliance Oversight

Our outsourced finance director ensures tax doesn’t become a penalty trap:

- Corporation Tax forecasting aligned to profits and dividends

- Strategic dividend vs. salary planning for directors

- Business Asset Disposal Relief (BADR) and exit tax planning

When Do You Need an Outsourced Finance Director?

Not sure if it’s the right time to bring in a Virtual CFO or Outsourced Finance Director? These services become essential when financial complexity increases—yet your time and expertise are stretched thin.

Here’s when businesses typically turn to us:

- Profits are rising, but cash is tight

You’re making sales, but you can’t see where the money is going. A Fractional Finance Director will uncover cash leaks, adjust pricing, and improve cashflow timing.

- You’re applying for funding or loans

Banks and investors need clear, defensible forecasts. We build investor-ready financial packs and support due diligence.

- Considering a merger, exit, or succession

Whether it’s preparing for a partial sale or full exit, a Part-Time CFO helps maximise value and ensures tax-efficient structuring.

- Your business is growing fast—but cost control is unclear

Rapid growth without financial strategy can sink margins. We create performance dashboards and cost control frameworks.

- You need senior-level financial input—without hiring full-time

A CFO-as-a-Service brings board-level thinking to your business without the £100K+ salary.

Our Virtual FD Packages

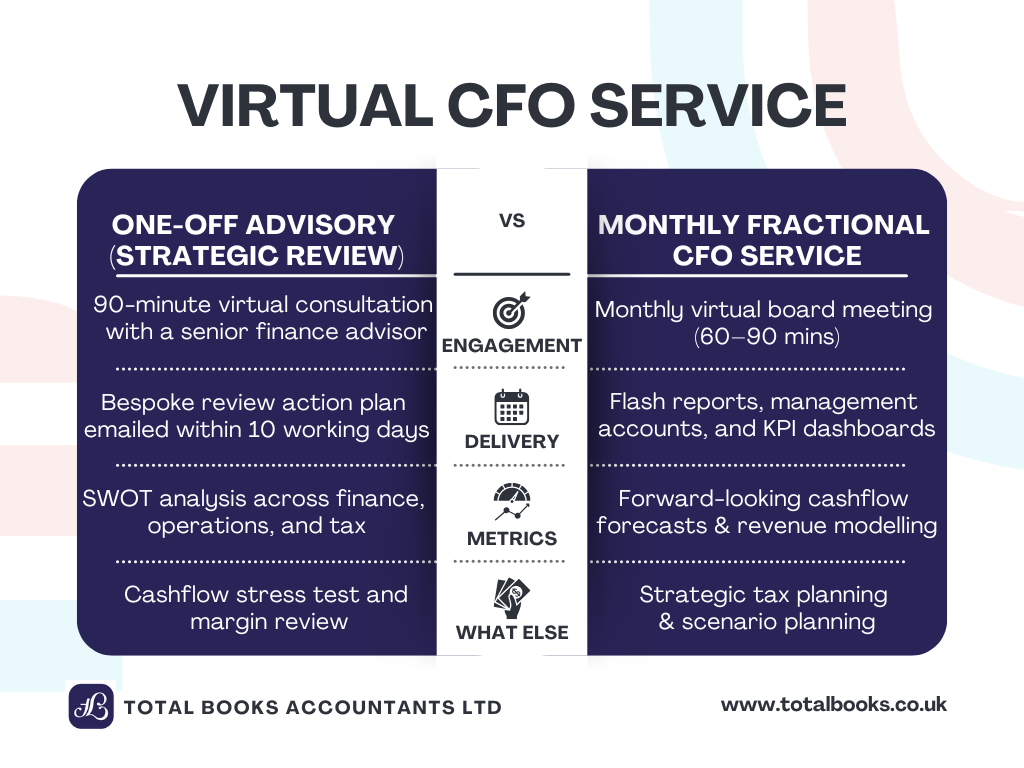

One-Off Advisory (Strategic Review)

Ideal for SMEs needing immediate clarity and action plan

- 90-minute virtual consultation with a senior finance advisor

- Bespoke action plan emailed within 10 working days

- SWOT analysis across finance, operations, and tax

- Cashflow stress test and margin review

- Short-term priority roadmap (cost savings, funding, planning)

Monthly Fractional CFO Service

For growing businesses seeking ongoing financial leadership

- Monthly virtual board meeting (60–90 mins)

- Flash reports, management accounts, and KPI dashboards

- Forward-looking cashflow forecasts and revenue modelling

- Strategic tax planning (Corporation Tax, Dividends, BADR)

- Scenario planning for funding, growth, or exit

- Access to WhatsApp/email support for urgent decisions

Integrated with Our Other Services

Fully managed finance function with strategic leadership

- All features of Fractional CFO +

- Weekly bookkeeping and bank reconciliations

- Xero-based financial reporting (customised dashboards)

- Monthly management accounts with commentary

- VAT and PAYE compliance, reviewed by your VFD

- Integrated cashflow management with alerts

Benefits of Hiring a Virtual CFO from Total Books

No Recruitment Hassle or Full-Time Overheads

Avoid the cost and commitment of hiring a full-time Finance Director. Our Virtual CFO service delivers high-level strategic guidance without long-term contracts, salaries, or recruitment delays.

Flexible Support Tailored to Your Business

Whether you need 2 hours a month or a full-day per week, our fractional finance director model lets you scale advisory input up or down based on growth, projects, or seasonality.

Nationwide Availability, Remote-First Delivery

We support businesses across the UK through digital platforms like Xero, Fathom, Syft, and Zoom. Get access to a Virtual Financial Director whether you’re in London, Bristol, Manchester, or Cardiff.

Expert-Led Guidance with Real Results

In 2024 alone, we helped SMEs:

- Avoid overpaying £28,000 in Corporation Tax

- Increase cashflow margins by 22% through better pricing strategy

- Recover £35,000 in working capital through debtor control

- Plan a profitable exit with a forecast-driven valuation uplift of £60,000+

Works Seamlessly with Bookkeeping & Accounts

Your Virtual CFO has visibility across all financial functions—from bookkeeping and payroll to VAT and budgeting—providing advice that’s grounded in accurate, real-time data.

Related Support We Offer

Virtual Finance Office

Full finance function without hiring in-house. Includes:

- Cloud bookkeeping

- Credit control and debtor tracking

- Payroll and VAT filing

- HMRC-ready digital records

Ideal for growing businesses needing finance outsourcing with day-to-day accuracy.

Monthly Management Accounts & Board Reporting

Get investor-ready financial packs with:

- P&L, cashflow, and balance sheet insights

- Custom dashboards via Xero, Fathom, or Syft

- KPIs tracked against strategic goals

Used by many of our fractional CFO clients for performance monitoring.

Business Valuation and Exit Planning

Prepare for sale, merger, or succession with:

- EBITDA and DCF-based valuation models

- Pre-sale tax planning (BADR, CGT)

- Value optimisation strategies

Often paired with Virtual Finance Director sessions for strategic timing.

Strategic Tax Planning

Maximise profit retention through:

- Dividends vs salary optimisation

- Corporation Tax forecasting

- R&D Tax Credits, Capital Allowances

- Year-end planning for owner-managed businesses

- Supports ongoing CFO decision-making with compliance-first insights.

Book a Free Consultation with an experienced CFO

Discover how our Part-Time Finance Director services can unlock smarter decisions.

Frequently Asked Questions

What’s the difference between a Virtual Finance Director and my regular accountant?

A Virtual Finance Director (VFD) focuses on forward-looking strategy — including forecasting, budgeting, risk management, and growth planning. Your accountant typically handles compliance tasks such as tax returns, year-end accounts, and bookkeeping. The VFD works alongside your accountant to guide key business decisions.

Can I hire a Virtual Finance Director on a part-time or project basis?

Yes. Our services include flexible options like one-off strategic reviews, quarterly advisory sessions, or a monthly fractional CFO plan. Whether you need ongoing support or help during key transitions (e.g. funding, exit planning), we adapt to your needs.

Will my VFD help me apply for funding or bank finance?

Absolutely. Your dedicated VFD will create investor-ready board packs, cashflow forecasts, and business plans aligned with lender expectations. We’ve helped clients secure six-figure investments with clear, data-driven reporting.

What industries do you support with Virtual CFO services?

We work with a wide range of UK SMEs, including service-based firms, trades, retail, professional services, eCommerce, and healthcare. Our VFD team has sector-specific experience and uses benchmarking data for informed decision-making.

How does Total Books deliver VFD support remotely?

We use cloud platforms like Xero, Syft, and Fathom to track your financials and provide virtual board meetings via Zoom or Teams. Our team is based in Cardiff and Bristol, but we support businesses UK-wide with full digital reporting and support.

Is there a minimum commitment?

Our strategic review package is a one-off with no commitment. Monthly or quarterly Virtual FD services are on flexible plans with clear scopes, so you stay in control of cost and time.

Can I combine the Virtual Finance Director service with bookkeeping and payroll?

Yes. Many clients choose our full Virtual Finance Office solution, which bundles bookkeeping, credit control, payroll, and management reports. This ensures the VFD always works with up-to-date figures, improving insight and agility.