The KPIs every UK director should track monthly are the small set of numbers that tell you, early and clearly, whether your business is building cash, protecting margin, and staying in control of risk. Total Books Accountants LTD supports directors with Virtual Finance Director services and business advisory, turning your management accounts into decision-ready insight so you can act faster, plan better, and avoid nasty surprises.

Key takeaways

- The right monthly KPIs are the ones that predict outcomes, not the ones that simply describe the past.

- Cash and working capital indicators deserve as much attention as sales and profit, because growth can still break a business.

- You should track a core set of metrics every month, then add a few that match your business model and sector.

- A KPI only works when it has an owner, a target, and a routine action that follows the result.

- Directors should align indicators to strategy, pricing, capacity, and risk so decisions stay consistent across the year.

- A Virtual Finance Director can build the dashboard, tighten the month-end process, and coach better decisions from the numbers.

Why monthly KPIs matter for UK directors

Monthly KPIs matter because they give you a regular, reliable way to spot issues before they hit your bank account, team morale, or customer base. UK businesses face fast-moving costs, shifting customer demand, and tighter expectations from lenders and suppliers. A monthly cadence is frequent enough to catch drift, but not so frequent that it turns into noise.

Monthly tracking also matters because statutory accounts are too slow for management. By the time annual accounts are filed, the story is old. Directors need a live view of performance to protect cash, defend profitability, and keep commitments to HMRC, staff, and stakeholders.

What makes a KPI useful rather than distracting

A useful KPI is one that triggers a decision, not a dashboard screenshot. If a number doesn’t change what you do next week, it is reporting, not management. You want indicators that help you choose: pricing, hiring, marketing spend, stock levels, credit control approach, and which customers to prioritise.

A useful KPI is also consistent and comparable. If the calculation changes every month, trends become meaningless. You want definitions written down, one version of the truth, and a simple routine for checking the data quality.

Learn more about our board reporting framework.

The KPI hierarchy every director should understand

The KPI hierarchy is led indicators at the top, operational drivers in the middle, and financial outcomes at the bottom. Outcomes include profit, net cash movement, and balance sheet strength. Drivers include conversion rates, utilisation, average order value, and debtor days. Led indicators include pipeline coverage, booking run-rate, renewal risk, and cost inflation signals.

This hierarchy matters because you can control drivers faster than outcomes. If profit is down this month, you can’t change last month’s sales. You can change pricing, lead quality, credit policy, staffing mix, and delivery efficiency.

The director’s monthly KPI pack

A director’s monthly KPI pack should fit on a few pages and be reviewed in under an hour. The goal is not to admire charts. The goal is to agree actions, assign owners, and set deadlines.

A practical pack usually includes a headline dashboard, a short commentary of what changed, a cash and working capital page, a revenue and margin page, and a risk page. If you have a board, this pack becomes a disciplined rhythm that reduces opinion-led debate and increases clarity.

The 12 core KPI groups to track monthly

The core KPI groups are cash, runway, profitability, gross margin, operating margin, working capital, sales performance, customer retention, pricing and unit economics, operational efficiency, people metrics, and risk/compliance. These groups cover how you make money, how you keep it, and how you avoid preventable shocks.

Not every business needs 50 metrics. Most businesses need 15–25 that are defined well and reviewed properly.

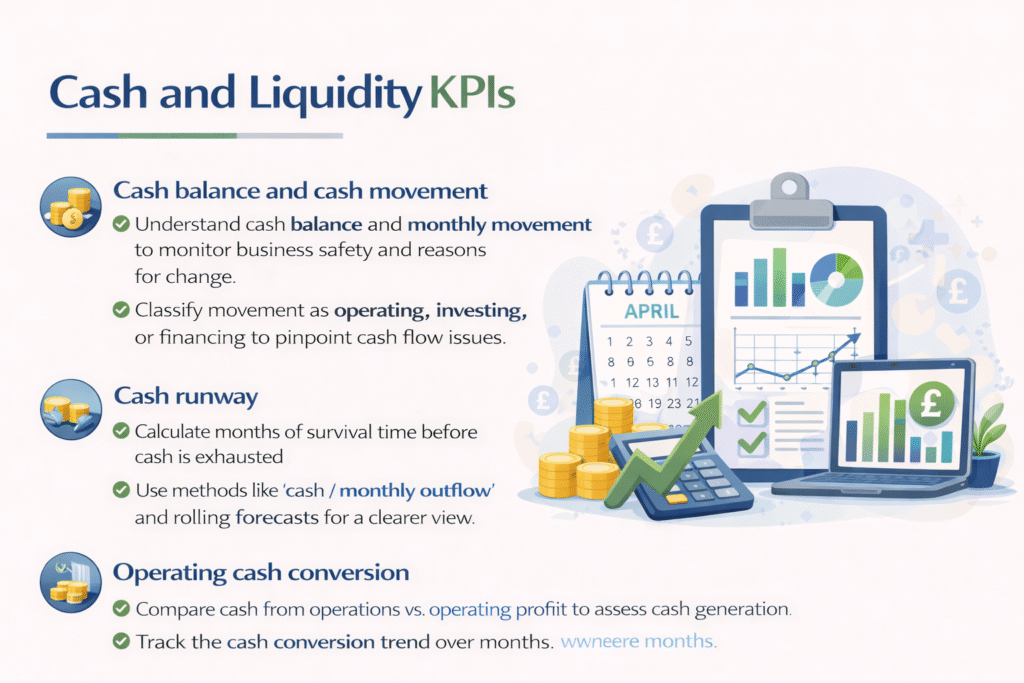

Cash and liquidity KPIs

1) Cash balance and cash movement

Your cash balance and monthly movement tell you whether the business is getting safer or more fragile. A director should know opening cash, closing cash, and the key reasons for the change. This is the most basic control number, and it prevents decisions being made on optimism alone.

A strong habit is to split movement into operating activity, investing, and financing. If cash fell, you should know whether it was because customers paid late, stock rose, VAT was due, or you invested in equipment.

2) Cash runway

Your runway tells you how many months the business can operate before cash hits a danger point. This is not just for startups. Any business with lumpy revenue, seasonal trade, or high fixed costs benefits from runway visibility.

A simple runway method is “cash in bank divided by average monthly net outflow” based on recent months and expected near-term costs. A better method is a rolling 13-week forecast, which we’ll cover later.

3) Operating cash conversion

Operating cash conversion tells you how well profit turns into real money. Profit can look healthy while cash declines if receivables climb, stock builds, or supplier terms tighten. A director should want to see whether the business is converting earnings into bank balance consistently.

A straightforward measure is cash generated from operations divided by operating profit, tracked over several months. The trend is more important than a single month.

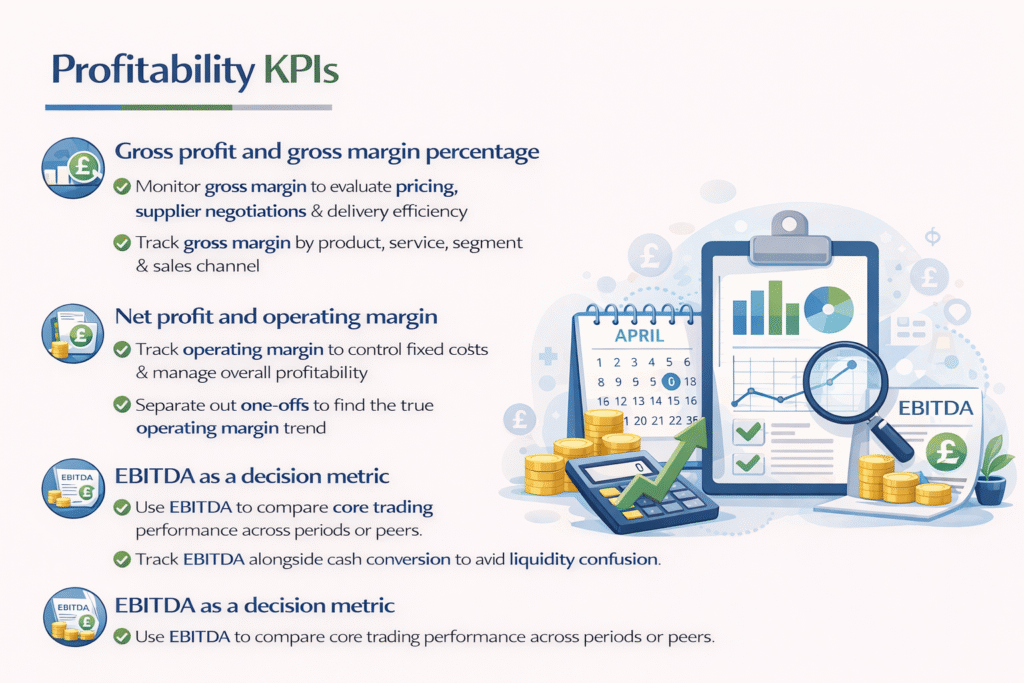

Profitability KPIs

4) Gross profit and gross margin percentage

Gross margin shows whether your pricing and direct costs are working. This is where many director-level decisions live: price rises, supplier negotiations, product mix changes, and delivery efficiency. If gross margin slides, your business can “grow” while becoming less viable.

Directors should track gross margin by product line, service type, customer segment, and channel where possible. The aggregate number can hide the real problem area.

5) Net profit and operating margin

Operating margin shows how much you keep after overheads, before non-trading items. This KPI matters because it reflects management control of fixed costs, team structure, and overhead discipline. A small margin business cannot absorb shocks the same way a high margin business can.

A clean monthly view separates one-offs and explains them. If a “one-off” happens every month, it’s not a one-off and should be planned for.

6) EBITDA as a decision metric

EBITDA helps you compare trading performance without noise from financing and non-cash charges. It can be useful for lender conversations and valuation discussions, especially in acquisition-minded sectors. It should not be treated as cash, but it can be a consistent operating performance marker.

If you track EBITDA, track it alongside cash conversion so you don’t confuse accounting performance with liquidity.

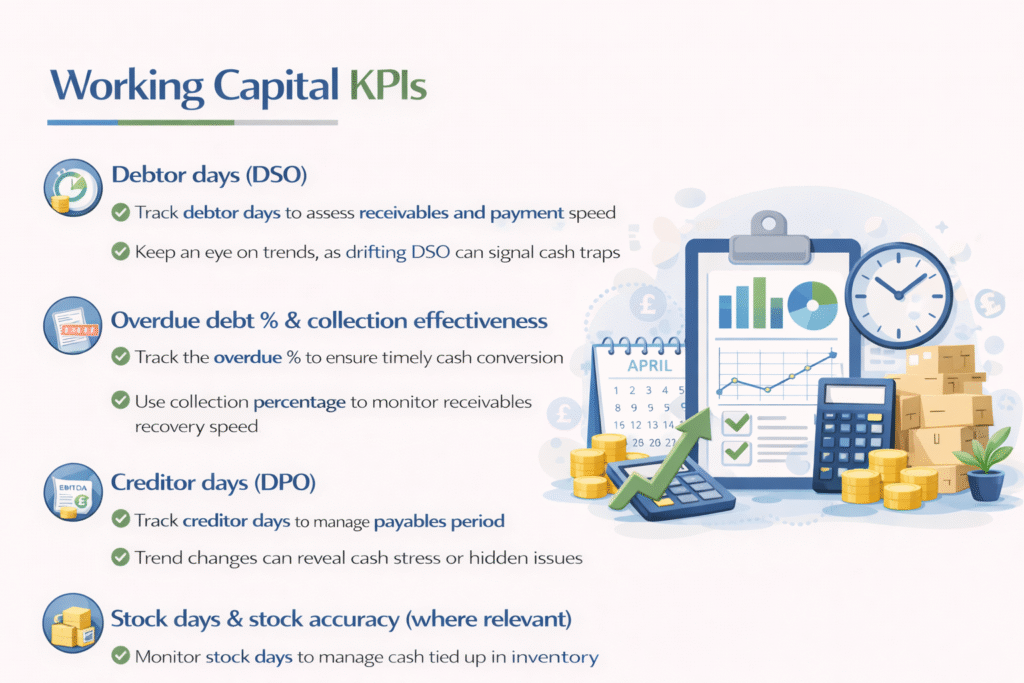

Working capital KPIs

7) Debtor days (DSO)

Debtor days tell you how quickly customers pay and how much cash is trapped in receivables. Late payments are one of the most common reasons profitable UK SMEs face stress. Directors should treat debtor days as a strategic lever, not a back-office detail.

A healthy target depends on your sector and contract terms, but the most important factor is whether the figure is drifting. A five-day slip can be a major cash hit at scale.

8) Overdue debt percentage and collection effectiveness

Overdue debt percentage tells you whether the sales you booked are becoming cash on time. This metric protects you from being fooled by revenue. If your aged receivables are growing, your risk is rising.

Collection effectiveness can be measured as “cash collected this month divided by invoices due this month” or similar. What matters is consistent measurement and fast follow-up.

9) Creditor days (DPO)

Creditor days tell you how long you take to pay suppliers. Paying too slowly can damage supply relationships and credit rating. Paying too quickly can squeeze cash and reduce flexibility. Directors should find the balance that protects cash without creating supplier risk.

A sudden rise in creditor days can also signal hidden stress. It may look like a positive cash move, but it can be a warning.

10) Stock days and stock accuracy (where relevant)

Stock days show how much cash is tied up in inventory. In trading businesses, stock is often the biggest cash absorber. Directors should track stock turnover and also track write-offs and obsolescence, because those are silent margin killers.

Stock accuracy matters because wrong stock data creates wrong purchasing decisions. A small improvement in forecasting and stock discipline can release significant cash.

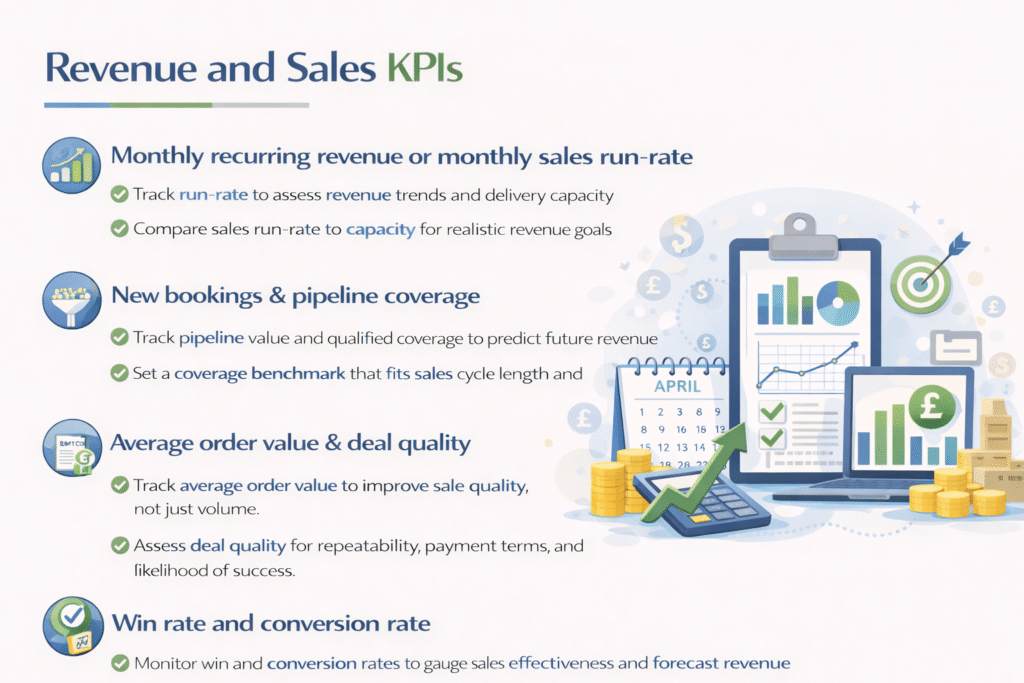

Revenue and sales KPIs

11) Monthly recurring revenue or monthly sales run-rate

Your run-rate tells you what the business is currently producing and whether it is trending up or down. For subscription businesses, recurring revenue is central. For project and trading businesses, monthly sales trends and order intake matter more.

A director should also compare run-rate to capacity. A sales spike that you can’t deliver will harm reputation and retention.

12) New bookings and pipeline coverage

Bookings measure the future, not the past. Pipeline coverage shows whether you have enough qualified opportunities to hit next month and next quarter targets. Directors should track pipeline value, stage weighting, and conversion assumptions, not just the “big number” in the CRM.

A practical coverage benchmark is having a multiple of target revenue in qualified pipeline. The right multiple depends on conversion rates and sales cycle length.

13) Average order value and deal quality

Average order value shows whether you’re improving the quality of sales, not just the quantity. Bigger is not always better if bigger deals come with tougher delivery, slower payments, or higher churn risk. The point is to understand the true contribution of different deal types.

Deal quality can include payment terms, implementation complexity, and likelihood of repeat business. Directors should want sales to be profitable sales.

14) Win rate and conversion rate

Win rate tells you whether your offer is landing and whether your sales process is effective. Conversion is a key driver KPI because it predicts revenue before revenue happens. If win rate drops, you want to know whether the issue is lead quality, pricing, competition, or sales execution.

Tracking win rate by channel and segment can reveal where marketing spend is wasted and where you should double down.

Customer KPIs

15) Retention and churn

Retention tells you whether customers stay and keep paying. Churn tells you where value is leaking. For many models, retaining and expanding existing customers is more profitable than constantly acquiring new ones.

Directors should track churn by cohort and by reason. If cancellations rise after onboarding, the issue is usually delivery and expectation setting, not marketing.

16) Customer concentration risk

Customer concentration risk shows how exposed you are to a single client or small group. If one customer represents 20% of revenue, one contract change can reshape the year. This isn’t to scare you. It’s to keep you honest about risk.

A director-level action is to build a plan to diversify or to harden the relationship with contractual protections and service resilience.

17) Customer satisfaction signals

Customer satisfaction signals show whether future revenue is safe. You can use Net Promoter Score, service ratings, complaint volumes, or renewal risk flags depending on your business. The best measure is the one you can collect reliably and act on.

A director should want a monthly view of key accounts at risk and a plan to rescue them before renewal dates.

Pricing and unit economics KPIs

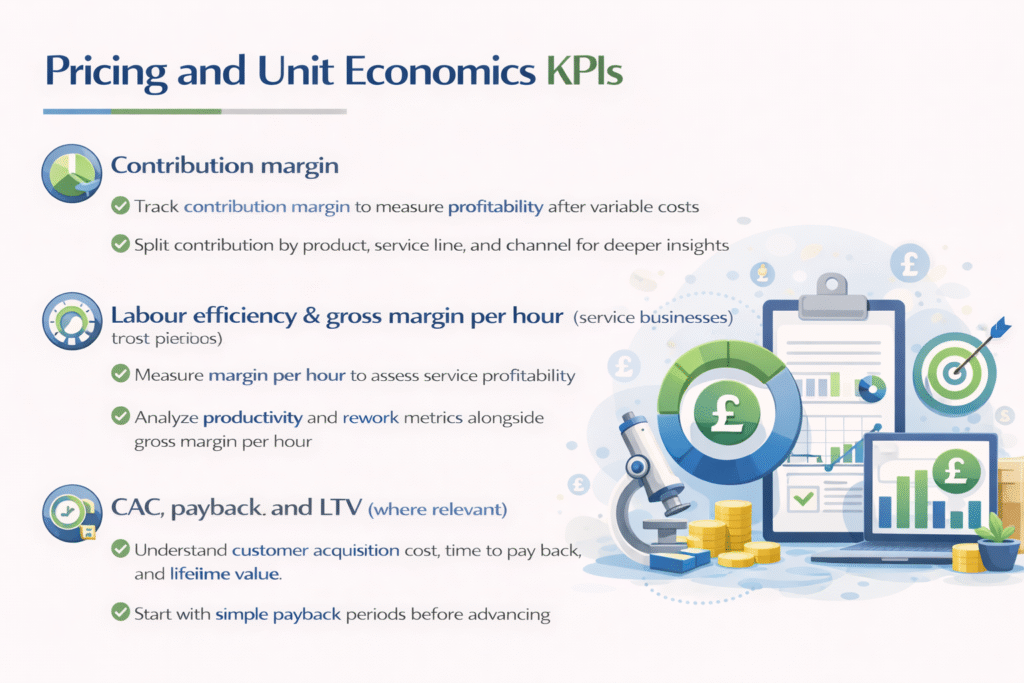

18) Contribution margin

Contribution margin shows what you make after direct variable costs, before overhead allocation. This KPI tells you whether each sale helps or hurts. Businesses with poor contribution can appear busy while losing money.

Tracking contribution by product, service line, and channel helps you price properly and stop subsidising low-value work.

19) Labour efficiency and gross margin per hour (service businesses)

Gross margin per hour shows whether your delivery engine is profitable. If you sell time, your pricing and your utilisation decide your outcome. A small improvement in delivery efficiency can do more than a big marketing push.

This KPI works best when combined with write-off and rework metrics. If you discount heavily after delivery issues, your margin is being destroyed quietly.

20) CAC, payback, and LTV (where relevant)

Customer acquisition cost and payback show whether growth is healthy. Lifetime value indicates how much a customer is worth over time. Not every SME needs complex unit economics, but any business investing heavily in marketing should know whether acquisition is paying back fast enough.

A director should focus on simple payback and trend first. Complexity can come later once basics are stable.

Operational KPIs

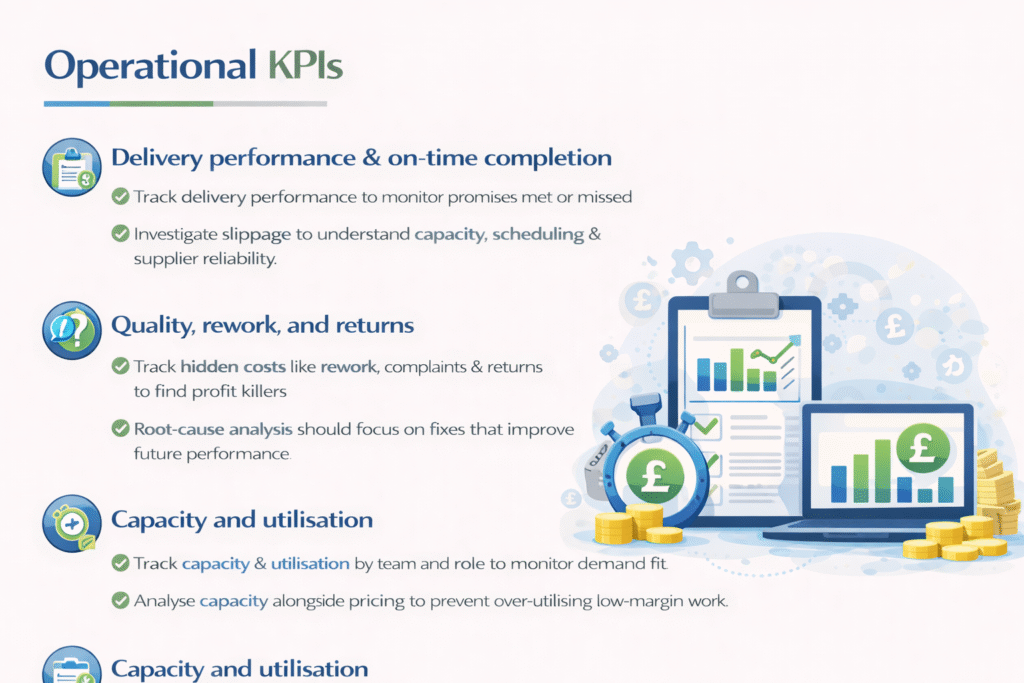

21) Delivery performance and on-time completion

Delivery performance tells you whether you are meeting promises. Late delivery triggers refunds, churn, complaints, and team burnout. This KPI is a leading indicator because it shows future reputation damage before it becomes visible in revenue.

If on-time completion drops, directors should check capacity, scheduling, scope control, and supplier reliability.

22) Quality, rework, and returns

Quality metrics show hidden cost. Rework is often the silent profit killer in service businesses. Returns and warranty claims play the same role in product businesses. Directors should want these numbers because they often explain why margins feel weaker than expected.

A monthly quality review should link to root causes and fixes, not blame.

23) Capacity and utilisation

Capacity and utilisation tell you whether you are staffed for current demand. Underutilisation burns cash and morale. Overutilisation burns quality and retention. Directors should track utilisation by team and by role, because one bottleneck can stall everything.

Utilisation should be paired with pricing. Selling more of low-margin work just to keep people busy is rarely a good long-term strategy.

People KPIs

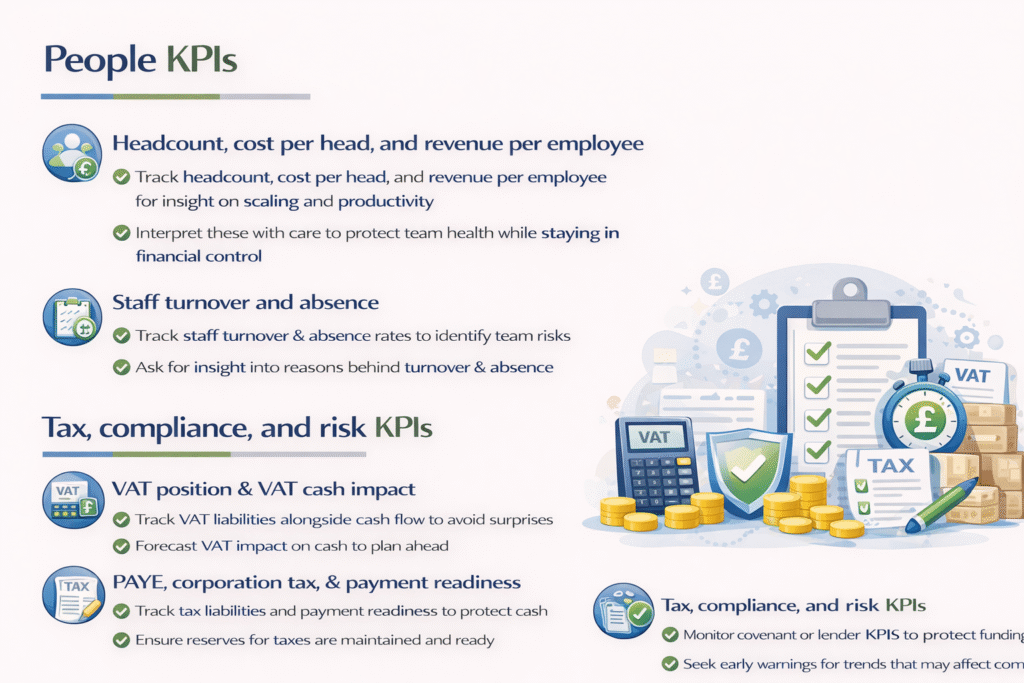

24) Headcount, cost per head, and revenue per employee

Revenue per employee gives a simple productivity signal. Cost per head shows whether your payroll model is sustainable. Headcount trend highlights whether you’re scaling deliberately or drifting.

These metrics should be used with care. You’re not running a spreadsheet. You’re running a business with people. The point is to protect team health while keeping financial control.

25) Staff turnover and absence

Turnover and absence show cultural and operational risk. If attrition rises, delivery quality can fall and recruitment costs increase. If absence rises, capacity assumptions fail and deadlines slip.

Directors should ask for monthly insight into why people leave and where workload or management issues are showing up.

Tax, compliance, and risk KPIs

26) VAT position and VAT cash impact

VAT visibility protects cash because VAT bills arrive whether customers paid you or not, depending on your VAT accounting basis. A director should know the expected VAT payable or reclaimable and whether it is moving as sales grow.

The action is to forecast VAT alongside cash, not to treat it as a surprise every quarter.

27) PAYE, corporation tax, and payment readiness

Tax payment readiness keeps you out of trouble and reduces panic. A director should know what has been accrued, what is due, and whether funds are reserved. This is especially important for growing companies where profits rise faster than cash.

The point is simple: stay ahead of liabilities so you can invest with confidence.

28) Covenant or lender KPI compliance (if applicable)

Lender KPI compliance protects funding. If you have covenants, you should track them monthly even if reporting is quarterly. A covenant breach rarely comes out of nowhere; it comes from ignored trends.

A director should want early warning and a plan, not a last-minute negotiation.

Forecasting KPIs that make the monthly numbers actionable

29) Rolling 13-week cash forecast accuracy

Forecast accuracy tells you whether your forecast can be trusted. A forecast that is always wrong is just theatre. A director should track predicted cash balance versus actual and improve the model each month.

A simple approach is to compare the forecasted closing cash for each week against the real number, then refine assumptions on receipts, payments, and timing.

30) Budget versus actual with variance drivers

Budget versus actual shows whether you’re on plan and why. The goal is not to punish teams. The goal is to learn quickly. Directors should demand variance explanations that are specific, such as price, volume, mix, timing, or cost inflation.

A good monthly variance review ends with 3–5 clear actions that update the plan.

31) Break-even point and margin of safety

Break-even tells you the minimum monthly revenue you need to cover fixed costs. Margin of safety tells you how far above break-even you currently operate. Directors should track these numbers because they change with payroll, rent, financing costs, and gross margin shifts.

This KPI is a strong discipline tool when deciding hires, office moves, and new fixed commitments.

Balance sheet KPIs directors often ignore (and shouldn’t)

32) Net assets and reserves

Net assets and reserves show whether the business has a buffer. Directors should keep an eye on retained earnings and balance sheet strength, especially if distributions are being considered. Weak reserves can limit funding options and create risk in downturns.

This KPI is also relevant for companies with substantial dividends. Paying out too much can destabilise the business.

33) Debt levels and interest cover

Debt levels show leverage. Interest cover shows ability to service borrowings from trading performance. Even if you’re not heavily geared, rates can move and refinancing can become expensive.

A director should also understand the difference between short-term liabilities and long-term debt, because that affects cash planning.

34) Aged payables and supplier risk

Aged payables show whether you are drifting into late payment behaviour. Supplier relationships matter for pricing, delivery reliability, and reputation. A sudden build-up of overdue supplier balances is a risk signal that should be addressed quickly.

This KPI also protects you from operational shock if a supplier cuts you off.

KPIs by business model (so you track what actually matters)

Service-based businesses

Service-based businesses should prioritise utilisation, delivery margin, write-offs, and cash collection. If you sell expertise, your time is your inventory. Tracking productive hours versus available hours, margin per engagement, and rework levels helps directors keep delivery profitable.

Service businesses should also track pipeline quality because the gap between selling and delivering can be the difference between growth and overload.

Product and trading businesses

Product businesses should prioritise gross margin by SKU or product line, stock turnover, returns, and supplier performance. Inventory ties up cash, and small mistakes in purchasing or pricing can compound quickly.

Trading businesses should also track landed cost changes and currency exposure where imports are involved, because margin can be wiped out by cost inflation.

Subscription and retainer models

Subscription models should prioritise recurring revenue trend, churn, expansion revenue, and cash collection reliability. A stable subscription base can still hide danger if churn rises or renewals become price-sensitive.

Subscription businesses should also track onboarding success because early customer experience often predicts future retention.

Project businesses

Project businesses should prioritise work-in-progress control, project margin, change requests, and billing milestones. Revenue can look healthy while profit collapses if scope creeps or teams are underpriced.

Project businesses should also track debtor ageing by project, because late payment often correlates with delivery disputes.

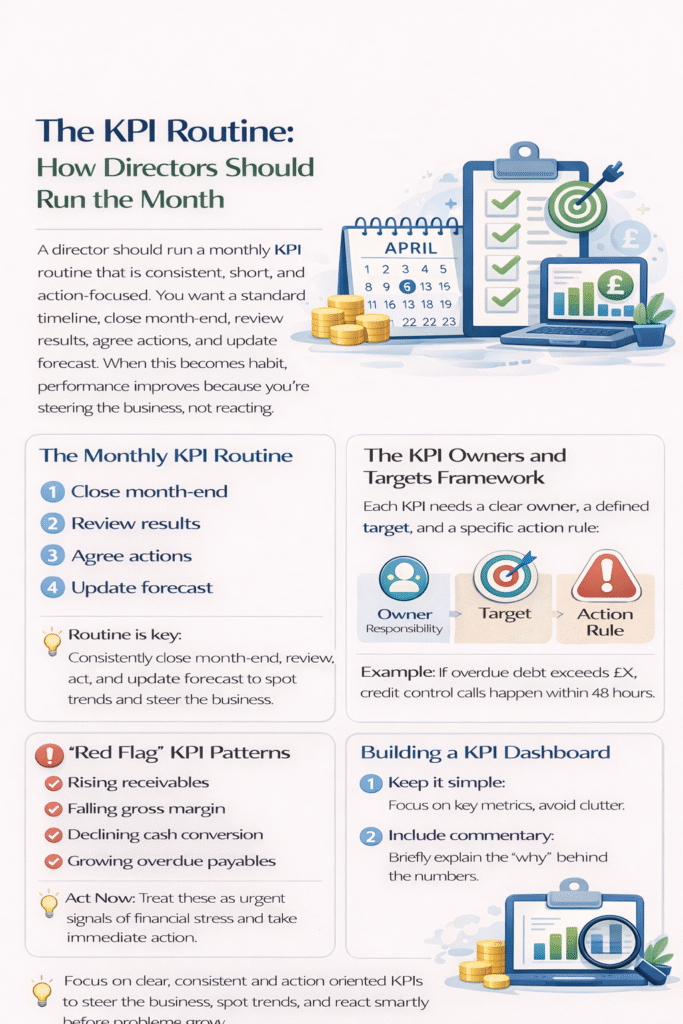

The KPI routine: how directors should run the month

A director should run a monthly KPI routine that is consistent, short, and action-focused. You want a standard timeline: close month-end, review results, agree actions, and update forecast. When this becomes habit, performance improves because you’re steering the business, not reacting.

A strong routine also avoids a common trap: changing the plan based on a single month. The goal is to spot patterns and act with judgement.

The KPI owners and targets framework

KPIs work when each one has an owner, a target, and an action rule. An owner ensures follow-through. A target gives meaning. An action rule stops debates and triggers movement.

An example action rule is simple: if overdue debt exceeds a threshold, credit control calls happen within 48 hours and new credit is paused for repeat offenders. Another example is: if margin drops below target, pricing review happens before next month’s quotes go out.

The “red flag” KPI patterns that deserve immediate attention

Red flag patterns are rising receivables, falling gross margin, declining cash conversion, and growing overdue payables. These patterns often show stress before profit drops. Directors should treat these as “act now” signals.

Another red flag is a growing gap between sales and cash. If revenue grows but the bank balance doesn’t, something is wrong with terms, collections, delivery disputes, or cost timing.

How to build a KPI dashboard that directors actually use

A dashboard should be simple enough that you look at it every month without dread. Too many charts create avoidance. Too few numbers create blind spots. The sweet spot is a clear layout with headlines first and detail second.

A usable dashboard also includes commentary. Directors need the “why”, not just the “what”. Commentary should explain drivers, not just list variances.

How Total Books’ Virtual Finance Director service helps directors

Our Virtual Finance Director service helps by putting structure around reporting, forecasting, and decision-making, so directors get clarity without needing an in-house finance team. Total Books Accountants LTD supports clients by tightening month-end, improving management accounts, creating KPI dashboards, and translating numbers into commercial actions.

A Virtual Finance Director approach is also valuable because it links finance to strategy. You can use KPIs to decide pricing, hiring, funding, product focus, and expansion in a way that protects cash and margin.

Total Books also supports wider business advisory needs, such as budgeting, forecasting, scenario planning, funding readiness, and performance improvement projects, so your KPI pack becomes a practical growth tool rather than a monthly chore.

A practical starting set of monthly KPIs for most UK SMEs

A practical starting set is closing cash, runway, gross margin, operating margin, debtor days, overdue debt percentage, sales run-rate, pipeline coverage, retention or repeat rate, utilisation or delivery performance, headcount cost trend, and tax liabilities readiness. This set usually gives enough control without overwhelming the team.

A sensible next step is to add 3–5 model-specific metrics, such as stock days for trading businesses or churn rate for subscription models.

What to do next if you want a KPI system that drives decisions

The next step is to define your 15–25 KPIs, write down definitions, set targets, and build a month-end timetable that produces consistent numbers. You then add an action rhythm: monthly review meeting, owners, and follow-ups.

If you want the fastest route, a Virtual Finance Director can implement the dashboard, improve the quality of management reporting, and coach your leadership team to make KPI-driven decisions without turning your business into bureaucracy.

FAQs

What are the most important monthly KPIs for a director who wants better cash control?

The most important monthly KPIs for cash control are closing cash, runway, debtor days, overdue receivables, and a simple operating cash conversion measure. These metrics show whether you are collecting money on time and whether trading performance is turning into bank balance. You should also track upcoming VAT and PAYE readiness so tax doesn’t become a surprise. If these numbers are stable, you can make growth decisions with far more confidence.

How many KPIs should a UK director track each month without drowning in data?

A UK director should usually track 15–25 KPIs each month because that range is detailed enough to cover cash, margin, sales, delivery, and risk without becoming noise. You should have a smaller “headline” set of 8–12 that you review first, then drill into supporting metrics only when something moves. If you track 50 metrics, you often end up acting on none of them, so the discipline is to keep the set tight and actionable.

What is the difference between management KPIs and statutory reporting?

Management KPIs are designed to drive decisions quickly, while statutory reporting is designed to meet legal and compliance requirements. Management information is typically monthly, focuses on operational drivers, and allows commentary and adjustments that help leadership understand what is happening now. Statutory accounts are annual, follow formal rules, and are too late to steer the business in real time. Directors need both, but they should not rely on annual accounts for monthly control.

How should directors set targets for KPIs when the business is growing or changing?

Directors should set KPI targets based on strategy, capacity, and cash resilience rather than copying generic benchmarks. A growing business may accept lower short-term margin if the payback is clear and the cash plan supports it, while a cash-tight business should prioritise collection, margin protection, and controlled overhead growth. Targets should also be reviewed quarterly because costs, pricing, and market conditions change. The key is to keep targets realistic, measurable, and tied to clear actions.

Why do profitable businesses still run out of cash, and which KPIs prevent that?

Profitable businesses can run out of cash because profit is not the same as liquidity, and cash gets trapped in receivables, inventory, and timing differences such as VAT. A business can also invest in growth, equipment, or staff ahead of receipts and create a cash squeeze. The KPIs that prevent this are debtor days, overdue debt percentage, stock days where relevant, operating cash conversion, and a rolling cash forecast accuracy check. These indicators show cash strain early so you can act before it becomes urgent.

How can a Virtual Finance Director help if we already have an accountant?

A Virtual Finance Director helps by focusing on decision support, forecasting, and performance management rather than only compliance. Many businesses have year-end accounts and tax returns handled well, but still lack monthly clarity on margin, cash, and operational drivers. A Virtual Finance Director can set up KPI dashboards, improve the month-end close, build forecasts, and run monthly review meetings that turn numbers into actions. This support often increases profitability, reduces surprises, and gives directors more confidence when hiring, pricing, or funding growth.

How quickly can a director improve KPI reporting without replacing systems?

A director can improve KPI reporting quickly by standardising definitions, tightening data capture, and setting a consistent month-end timetable. You do not always need a new software stack to get better insight; you need clean routines and a clear pack that is reviewed properly. A simple improvement is to reconcile sales, cash, and debtors monthly so the numbers are trusted. Once the basics are reliable, you can automate more and add deeper analysis, but the early win is consistency and discipline.